1. What Happened? Hanshin E&C Wins $320M Complex Tunnel Project

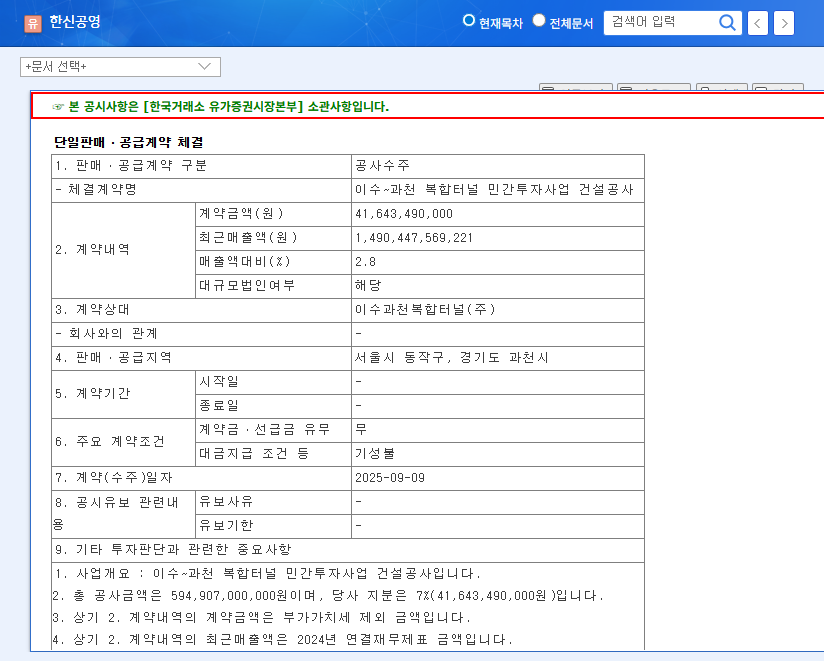

Hanshin E&C (004960) announced on September 10, 2025, that it has been awarded the construction contract for the Iseu-Gwacheon Complex Tunnel private investment project. The contract value is approximately $320 million, representing 2.8% of Hanshin E&C’s consolidated revenue in 2024.

2. Why Does It Matter? Strengthening Fundamentals and Growth Momentum

This contract represents more than just a single win; it’s expected to play a crucial role in strengthening Hanshin E&C’s fundamentals and securing future growth drivers.

- Revenue and Profit Growth: The $320 million contract is projected to contribute directly to increased revenue and operating profit.

- Business Diversification: The complex tunnel project will diversify Hanshin E&C’s portfolio and provide valuable experience in large-scale national projects.

- Positive Investment Sentiment: Securing this major contract sends a positive signal to investors about the company’s growth potential.

3. What’s Next? Focus on Long-Term Growth, Not Short-Term Gains

While this contract is expected to positively impact Hanshin E&C’s long-term growth, it’s important to monitor project progress and macroeconomic indicators rather than anticipating immediate stock price surges. The construction industry is particularly sensitive to interest rate fluctuations and raw material prices, requiring careful attention to these factors.

4. Investor Action Plan: Careful Analysis and Continuous Monitoring

Investors should consider both the positive aspects and potential risks associated with this contract. Careful analysis of factors like the progress of unstarted projects and changes in the macroeconomic environment is essential, along with a long-term investment strategy.

Frequently Asked Questions (FAQ)

Will this contract immediately impact Hanshin E&C’s stock price?

It’s advisable to approach this from a long-term growth perspective rather than expecting immediate stock price increases. Continuous monitoring of market conditions and company performance is crucial.

Is Hanshin E&C’s financial status stable?

While the company shows a healthy financial status as of 2024, ongoing observation is necessary as the construction industry is inherently vulnerable to external environmental changes.

What precautions should investors take?

Investors should be mindful of fluctuations in interest rates and raw material prices, as the construction industry is susceptible to these factors. Monitoring the progress of unstarted projects is also crucial.