1. What Happened with Shinhan Alpha REIT in August?

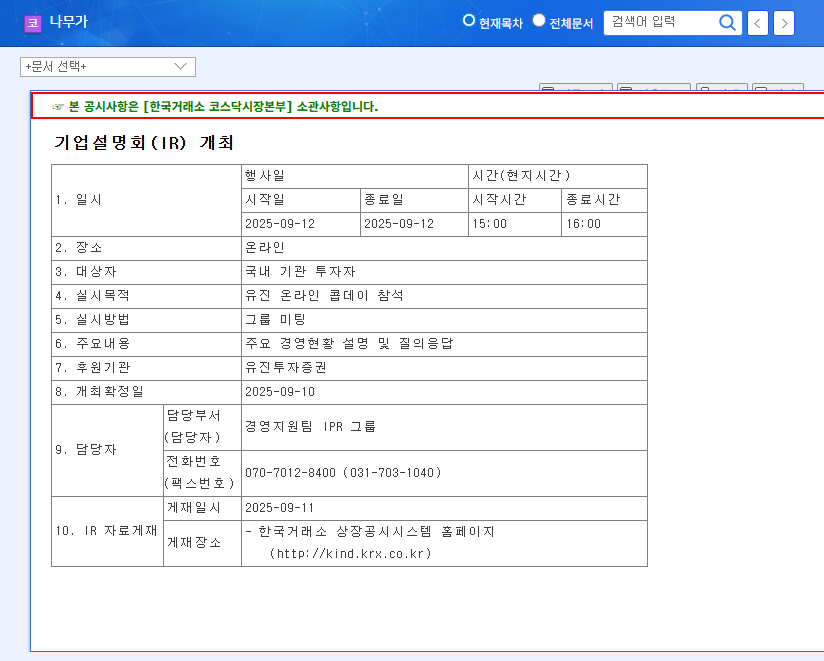

Shinhan Alpha REIT released its monthly report for August 2025 on September 10, 2025. This report provides investors with the latest information on the company’s recent performance and financial status. It is particularly important as it can address concerns about the increased financial burden revealed in the semi-annual report.

2. Why is it Important?

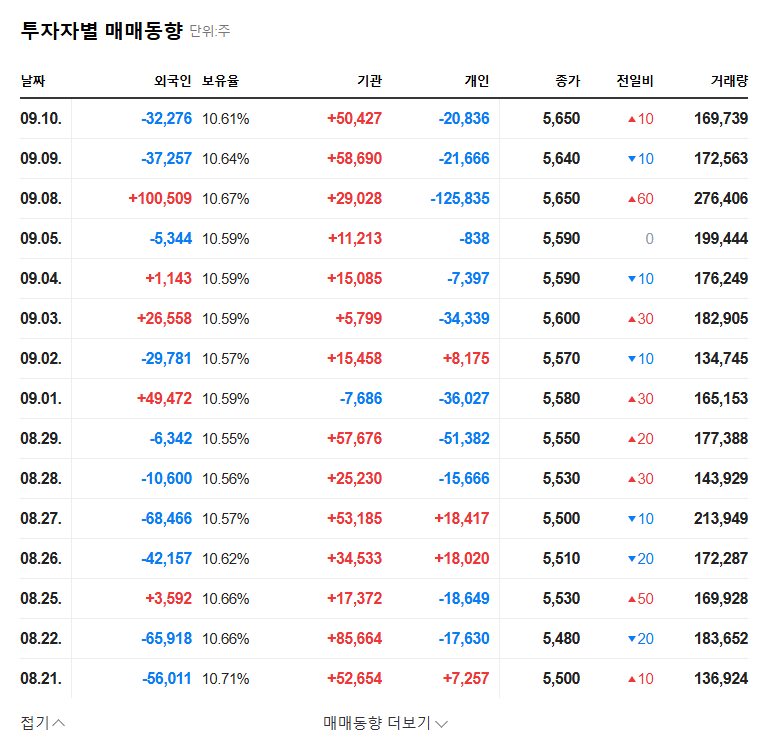

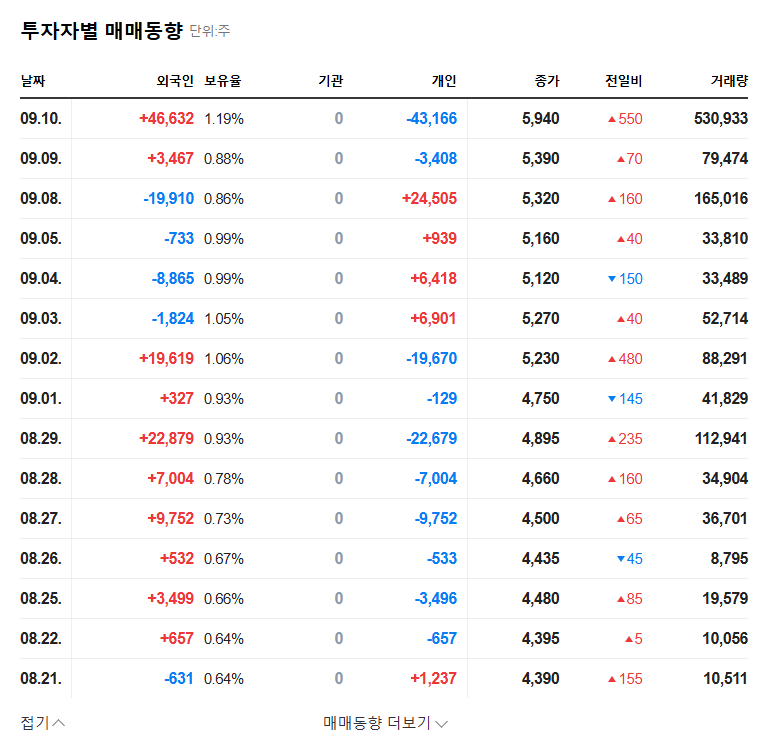

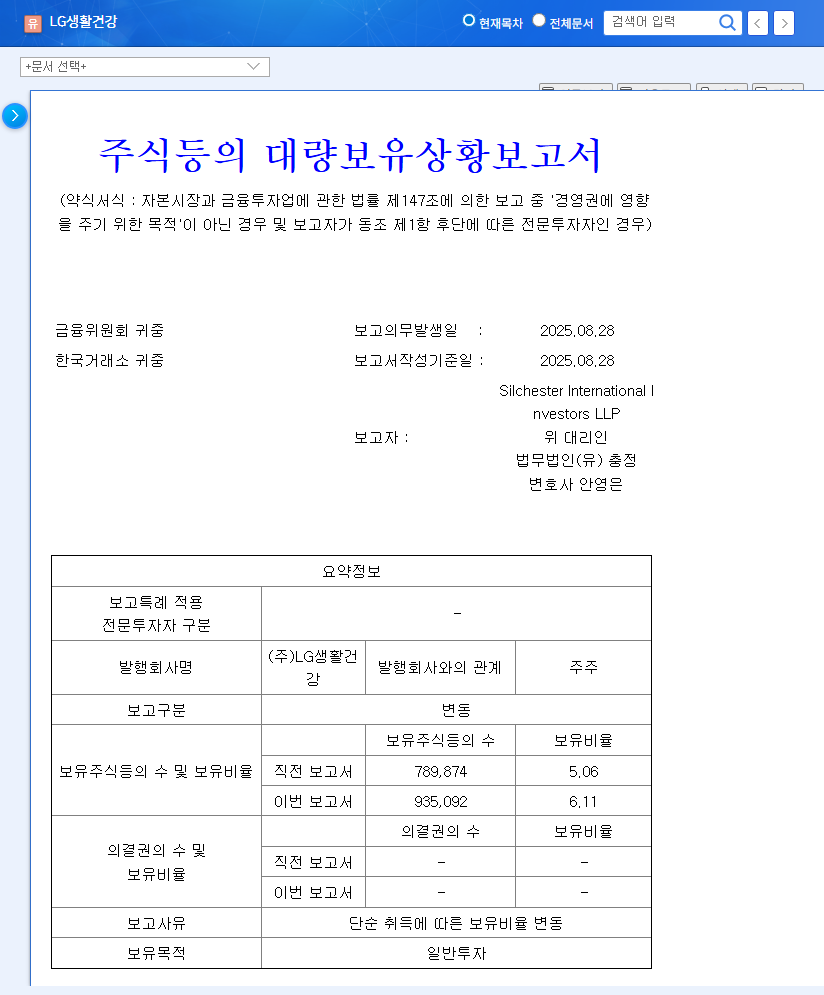

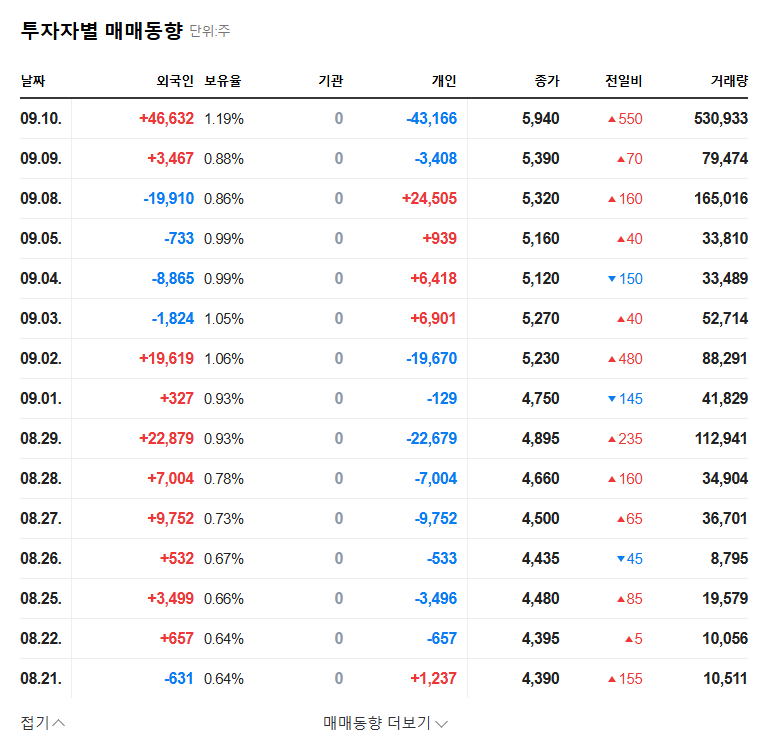

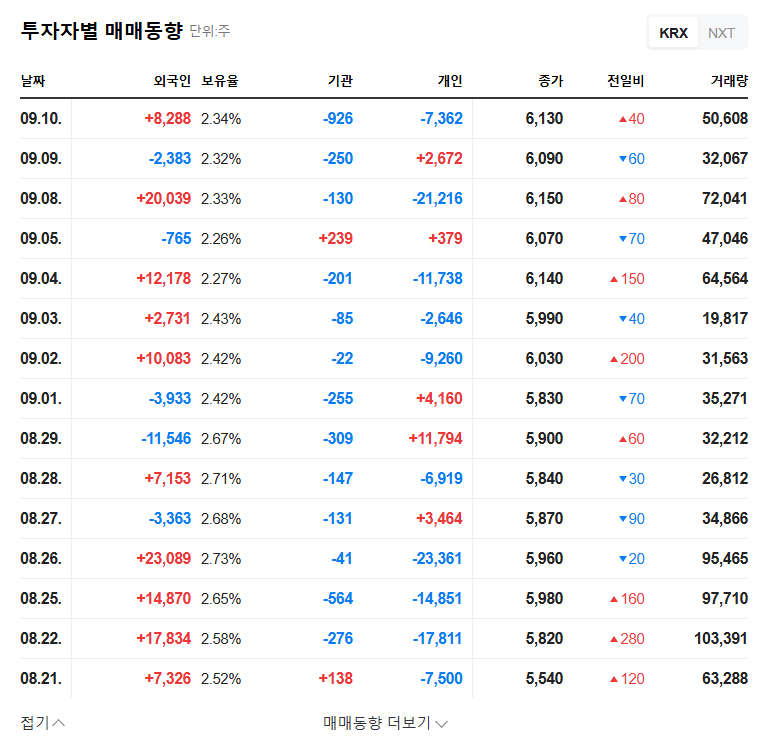

Shinhan Alpha REIT has expanded its portfolio through aggressive investments such as GS Seocho Tower and BNK Tower. While securing long-term growth momentum, this approach has raised concerns about financial soundness, including rising debt ratios and accumulated deficit in retained earnings. Therefore, it’s crucial to thoroughly analyze the August monthly report, focusing on occupancy rates, vacancy rates, and financing details, to accurately assess the company’s performance and financial health.

3. Dissecting the August Report

- Check Key Metrics: Analyze changes in August occupancy and vacancy rates, particularly focusing on the leasing market conditions of key assets such as those in the Bundang area. Carefully review financing amounts and conditions, as well as information regarding retained earnings and dividends.

- Positive Scenario: Positive indicators like increased occupancy rates, decreased vacancy rates, and reduced financing costs could drive stock price momentum.

- Negative Scenario: Conversely, negative indicators such as a deteriorating leasing market and continued difficulties in raising capital could put downward pressure on the stock price.

4. Action Plan for Investors

Instead of being swayed by short-term stock price volatility, investors should establish investment strategies from a long-term perspective. Along with analyzing the monthly report, it’s essential to monitor macroeconomic indicators such as interest rate fluctuations and real estate market forecasts, while also evaluating the company’s ability to manage its financial soundness.

FAQ

Where can I find Shinhan Alpha REIT’s August monthly report?

It’s available in the IR 자료실 (Investor Relations section) on Shinhan Alpha REIT’s official website.

What are the key takeaways from the August report?

It provides information on occupancy rates, vacancy rates, and financing status as of the end of August, allowing investors to assess the company’s recent performance.

What precautions should investors take?

Avoid being influenced by short-term price fluctuations and analyze the company’s fundamentals and the macroeconomic environment from a long-term perspective.