The latest HYUNDAI DEPARTMENT STORE earnings report for Q3 2025 has sent ripples through the market, revealing a performance that fell short of analyst expectations. For investors, this moment presents a critical juncture: is this a temporary stumble for a retail giant, or a sign of deeper structural challenges? This comprehensive HYUNDAI DEPARTMENT STORE financial analysis will dissect the numbers, explore the underlying causes, and provide a forward-looking perspective to help you navigate the crisis and identify potential opportunities.

As a cornerstone of South Korea’s retail landscape, the performance of HYUNDAI DEPARTMENT STORE CO.,LTD is often seen as a barometer for consumer health. The Q3 2025 results, with misses on both revenue and profit, demand a closer look at the company’s strategy, its resilience against macroeconomic headwinds, and its roadmap for future growth.

Unpacking the Q3 2025 Earnings Report

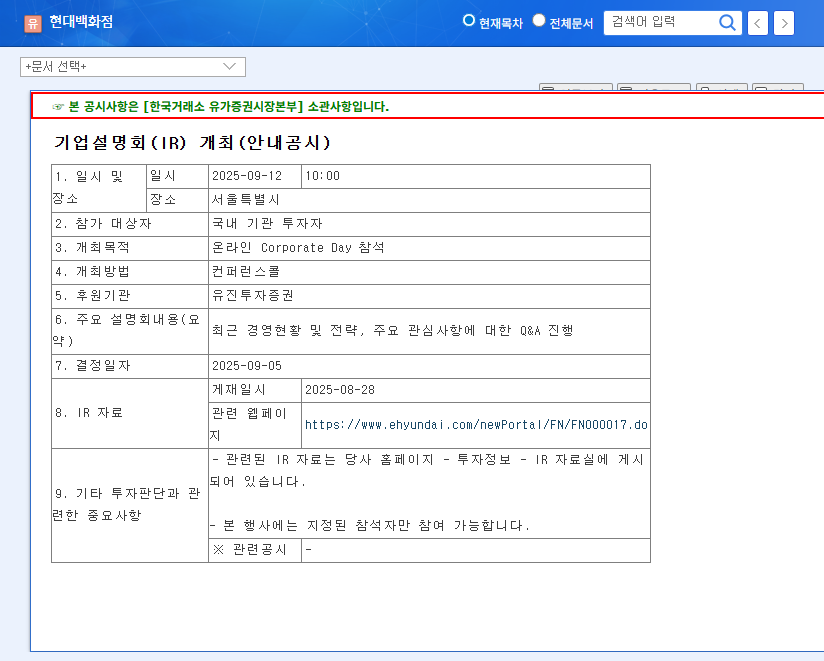

The provisional results for Q3 2025 painted a concerning picture, with key metrics failing to meet the market consensus. Let’s break down the official figures to understand the scale of the challenge. For a detailed breakdown, investors can consult the Official Disclosure (DART).

Key Financial Metrics vs. Expectations

- •Revenue: Reported KRW 1,010.3 billion, missing the market’s expectation of KRW 1,016.9 billion. This represents a 2.5% decrease year-over-year and continues a downward trend seen throughout 2025.

- •Operating Profit: Came in at KRW 72.6 billion, a significant 7% below the consensus of KRW 78.4 billion. While up 12.4% from the prior year, the operating profit margin has worryingly declined from its Q1 peak.

- •Net Profit: At KRW 45.2 billion, it missed expectations by 3% and showed a sharp decline from the previous two quarters, highlighting pressure from non-operating factors.

The persistent revenue decline since the start of the year, culminating in a year-over-year drop in Q3, signals a fundamental weakening in consumer spending and raises questions about the long-term growth trajectory of traditional department store channels.

Forces Behind the Slump: Macro Pressures and Sector Challenges

The disappointing HYUNDAI DEPARTMENT STORE earnings are not occurring in a vacuum. A combination of broad economic headwinds and industry-specific challenges are contributing to the decline. As reported by sources like Reuters, global inflation and interest rate policies are squeezing consumer disposable income worldwide.

Weakening Consumer Sentiment and Fierce Competition

The core department store division is facing a perfect storm. Rising interest rates and inflation are forcing households to cut back on discretionary spending, which directly impacts luxury and high-end retail. Simultaneously, the relentless growth of e-commerce continues to erode market share from brick-and-mortar establishments. To learn more, you can read our analysis of South Korea’s retail sector trends. This dual pressure makes it difficult to sustain revenue growth without significant innovation in customer experience and online integration.

Adverse Macroeconomic Environment

- •Currency Fluctuations: A rising KRW/USD exchange rate negatively impacts divisions with overseas operations, such as the ZINUS furniture segment, by increasing import costs for raw materials and affecting sales conversion.

- •Interest Rate Burden: While benchmark rates have stabilized, elevated government bond yields can increase borrowing costs for future investments and expansion projects, adding a layer of financial risk.

- •High Debt Ratio: A projected debt-to-equity ratio of 114.65% is a significant concern, especially in a rising rate environment, as it can strain financial flexibility and amplify risks.

Investor Outlook: Strategy and Key Recommendations

Given the challenges, the path forward for HYUNDAI DEPARTMENT STORE requires bold, decisive action. For investors, the key is to monitor whether the company’s strategic responses can effectively counteract the negative trends and unlock value in its diverse portfolio.

Pathways to Recovery and Growth

To enhance shareholder value and secure a sustainable future, management should focus on several key areas. The performance of the HYUNDAI DEPARTMENT STORE stock will likely depend on successful execution in these domains:

- •Core Business Innovation: The department store division must evolve. This means strengthening its online-to-offline (O2O) strategy, creating unique experiential retail content, and curating merchandise that resonates with modern consumer lifestyles.

- •Profitability and Efficiency: With revenue under pressure, a rigorous focus on cost efficiency is paramount. This includes reducing fixed costs, optimizing the supply chain, and improving capital structure to mitigate financial risks.

- •Diversified Growth Engines: The positive momentum in the Duty-Free and ZINUS divisions must be nurtured. Successful new store openings (e.g., The Hyundai Gwangju) will also be crucial for reigniting growth.

- •Transparent Communication: Restoring investor confidence requires clear and proactive communication about the turnaround strategy and measurable milestones for its implementation.

In conclusion, the Q3 2025 HYUNDAI DEPARTMENT STORE earnings serve as a critical wake-up call. While significant headwinds exist, the company possesses strong assets and potential growth drivers. Investors should closely watch for signs of strategic execution and fundamental improvements in the quarters to come.