The recent Yulho major shareholder lock-up disclosure has sent ripples through the investment community, placing Yulho Co., LTD. at a critical crossroads. This official announcement presents a complex scenario: on one hand, it signals a commitment from new leadership; on the other, it carries the significant risk of a potential ‘Investment Alert Status’ designation. For investors, this raises a crucial question: is this a warning sign to heed, or a strategic move paving the way for aggressive growth? This comprehensive analysis will dissect the disclosure, evaluate Yulho’s ambitious business diversification, and provide a clear roadmap for navigating the short-term risks and long-term potential of Yulho stock.

Decoding the Yulho Major Shareholder Lock-up Disclosure

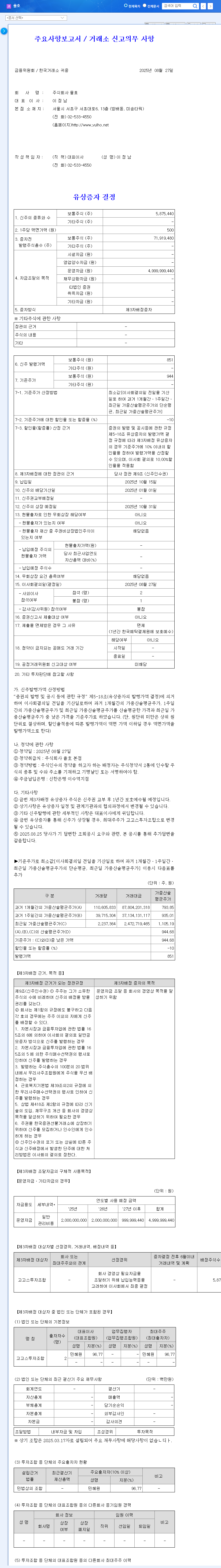

At the heart of the matter is a regulatory requirement. Following a recent change in ownership, Yulho’s new major shareholder is mandated by KOSDAQ listing rules to hold 6,064,690 newly issued shares for a period of one year. This lock-up period is standard practice, designed to ensure management stability and align shareholder interests with the company’s long-term health. However, the disclosure’s critical detail lies in its warning: failure to finalize this lock-up before an additional listing could trigger a designation as an ‘Investment Alert Status‘ stock. This potential penalty is the primary source of investor anxiety and a key factor to monitor. For official details, you can view the Official Disclosure on DART.

Company Profile: Yulho’s Ambitious Pivot

Yulho is undergoing a dramatic transformation, moving beyond its foundational IT infrastructure business into several high-growth, high-risk sectors. Understanding this strategic pivot is essential to any Yulho stock analysis.

From Stable IT to High-Growth Ventures

- •Legacy IT Business: As a Dell Technologies partner, this division provides a stable, albeit modest, revenue stream.

- •Secondary Batteries: A key pillar of its growth strategy, Yulho has invested in pre-treatment facilities and technology licensing. This positions them to capitalize on the global EV boom, but faces challenges in securing waste batteries and navigating raw material price swings.

- •Mining & Mineral Resources: By securing exploration rights for a nickel mine in Tanzania, Yulho is betting on the long-term demand for key battery metals. This venture requires significant upfront capital and is exposed to geopolitical and market volatility.

- •AI & Waste Treatment: These ventures represent further diversification, aiming for stable revenue from waste management and high-growth potential from AI, though both require substantial initial investment.

Financial Health Under Pressure

This aggressive expansion has come at a cost. While H1 2025 revenue saw a 36% YoY increase to KRW 38.9 billion, the company posted an operating loss of KRW 1.78 billion. The debt-to-equity ratio has climbed to 167.6%, and operating cash flow remains negative. This financial picture highlights a company in a high-stakes investment phase, funding its future growth through debt and convertible bonds. For more on financial metrics, investors can review resources from institutions like Bloomberg.

Yulho’s strategy is a classic high-risk, high-reward play. The success of its business diversification hinges on flawless execution and a favorable market, while its financials are stretched thin. The shareholder lock-up adds another layer of complexity to this delicate balance.

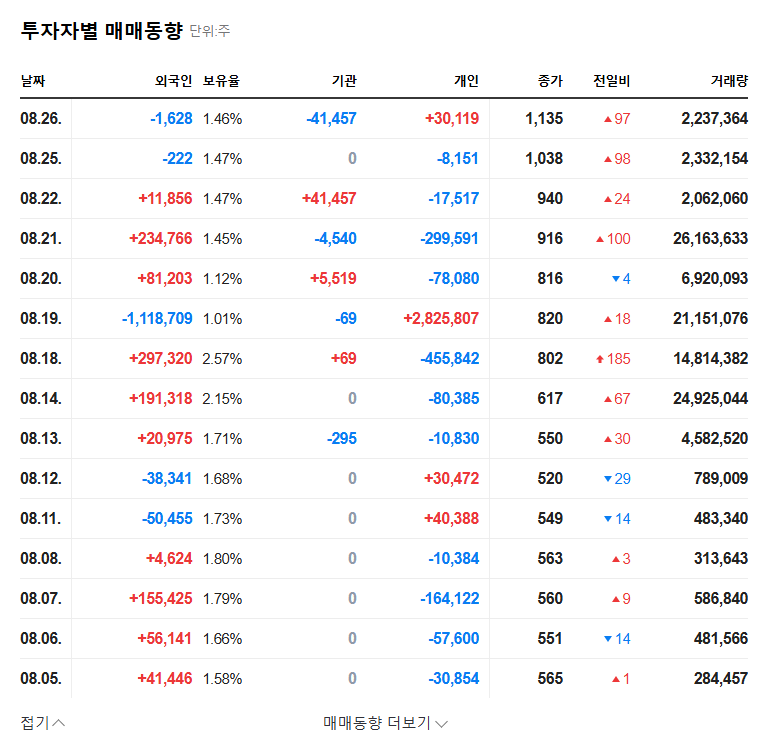

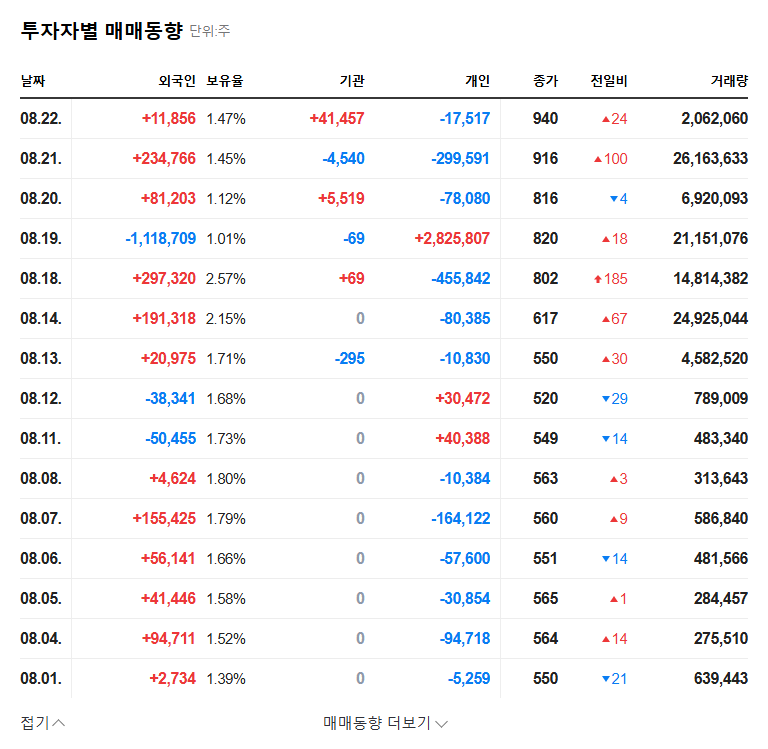

Market Impact and Investor Strategy

Short-Term Risk: The ‘Yulho Investment Alert’ Threat

The most immediate threat is the potential ‘Yulho investment alert’ designation. If triggered, this would likely damage investor sentiment, leading to increased stock price volatility and potential panic selling. It creates an overhang of uncertainty that could overshadow any positive operational developments in the short term. Cautious investors should prioritize monitoring the completion of the lock-up obligation. Understanding the specifics of these designations is crucial; you can learn more in our guide to KOSDAQ market regulations.

Mid-to-Long-Term Outlook: A Tug-of-War

Looking beyond the immediate noise, Yulho’s long-term success depends entirely on the tangible results from its new ventures. The Yulho major shareholder lock-up, if completed smoothly, can be seen as a vote of confidence in this very strategy. Investors should focus on key performance indicators:

- •New Business Revenue: Are the secondary battery and mineral ventures beginning to contribute meaningfully to the top line?

- •Financial Improvement: Are there clear efforts to reduce the debt ratio and move towards positive operating cash flow?

- •Project Milestones: Is the company hitting its publicly stated targets for facility construction and resource exploration?

Frequently Asked Questions (FAQ)

What is the core issue with the Yulho major shareholder lock-up?

The core issue is the attached warning. While the one-year lock-up of 6,064,690 shares is a standard regulatory step, the risk is that failure to complete it could lead to Yulho being designated an ‘Investment Alert Status’ stock, which negatively impacts investor confidence.

What does an ‘Investment Alert Status’ mean for Yulho stock?

This designation acts as a public warning to investors, often leading to a sharp decline in stock price. It raises concerns about the company’s management stability and financial liquidity, which can trigger significant selling pressure and make it harder for the company to raise capital in the future.

Is Yulho’s business diversification strategy viable?

The strategy is ambitious and targets high-growth sectors like secondary batteries and minerals. Its viability depends on execution. The potential rewards are high, but so are the risks, including high capital expenditure, market volatility, and a long timeline before seeing profitability.