1. What Happened?

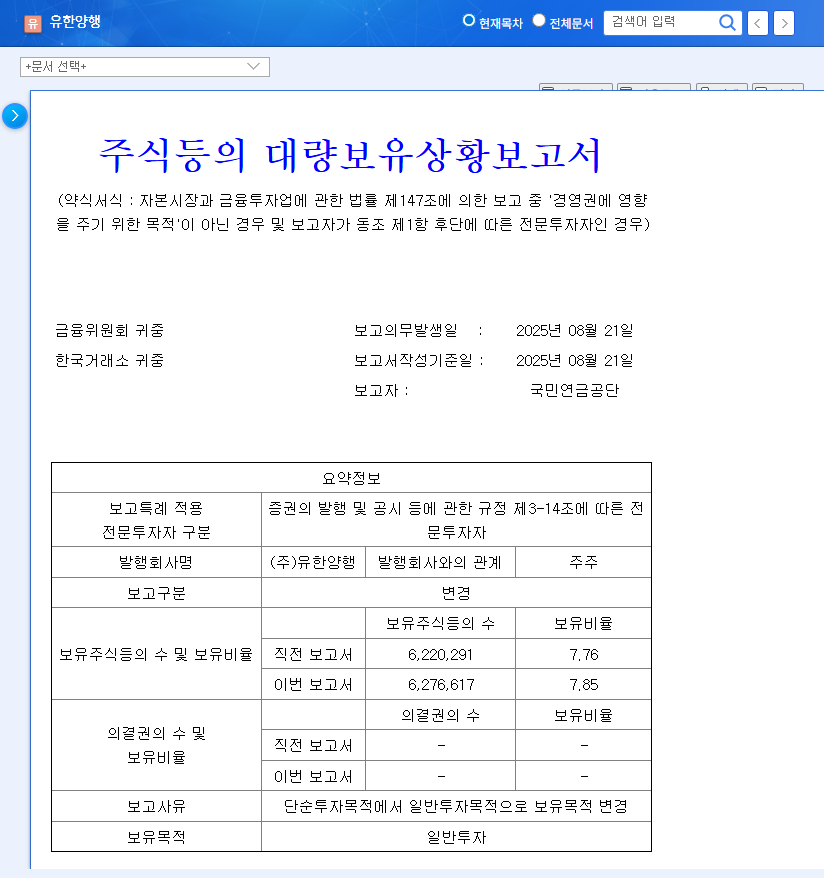

On August 27, 2025, the NPS increased its stake in Yuhan Corporation from 7.76% to 7.85%, a 0.09%p increase, and changed its investment objective from simple investment to general investment. General investment is interpreted as a more proactive investment approach compared to simple investment.

2. Why Does It Matter?

The NPS is a major player in the Korean stock market. Therefore, its investment decisions can be a significant signal to other investors. In particular, the change in investment objective and the increase in stake suggest a positive outlook by the NPS on Yuhan’s future growth potential. Yuhan is showing solid performance based on the successful domestic and international expansion of Leclaza and a robust R&D pipeline. This fundamental improvement is likely to have influenced the NPS’s investment decision.

3. What’s Next?

The NPS investment could provide a short-term boost to investor sentiment and upward momentum for the stock price. In the long term, it is expected to contribute to enhancing corporate value. However, continuous monitoring of macroeconomic variables such as exchange rates and interest rate fluctuations, and changes in the pharmaceutical market environment is necessary.

4. Investor Action Plan

- Monitor the stake changes of institutional investors, including the NPS.

- Check the progress of Yuhan’s new drug pipeline and earnings announcements.

- Analyze the impact of changes in macroeconomic indicators and reflect them in your investment strategy.

Why is the NPS stake change significant?

The NPS is a major player in the Korean stock market, so their investment decisions can act as an important signal to other investors. This change in investment objective and increased stake suggests a positive outlook on Yuhan’s future growth potential.

What is the outlook for Yuhan Corporation’s stock price?

The NPS investment could provide short-term upward momentum for the stock price and contribute to enhancing corporate value in the long term. However, continuous monitoring of macroeconomic variables like exchange rates and interest rates, and changes in the pharmaceutical market, is essential.

What should investors keep in mind?

Investors should analyze the stake changes of institutional investors including the NPS, Yuhan’s new drug pipeline progress, and the impact of macroeconomic indicator changes, and reflect these factors in their investment strategy.