INVENI Share Buyback: Key Analysis

INVENI (formerly Yesco Holdings) announced a share buyback of 300,000 shares (KRW 18.6 billion) on September 22, 2025, scheduled for completion on September 25th. This buyback is part of the shareholder value enhancement policy previously hinted at in the revised business report, raising investor expectations.

Why is the Buyback Decision Important?

- Shareholder Value Enhancement: Expected improvement in EPS (Earnings Per Share) and ROE (Return on Equity).

- Strengthened Investment Holding Company Strategy: Synergy between investment sector growth and shareholder return policy.

- Positive Market Signal: Conveys a positive message about the company’s financial soundness and future growth potential.

How Should Investors Strategize?

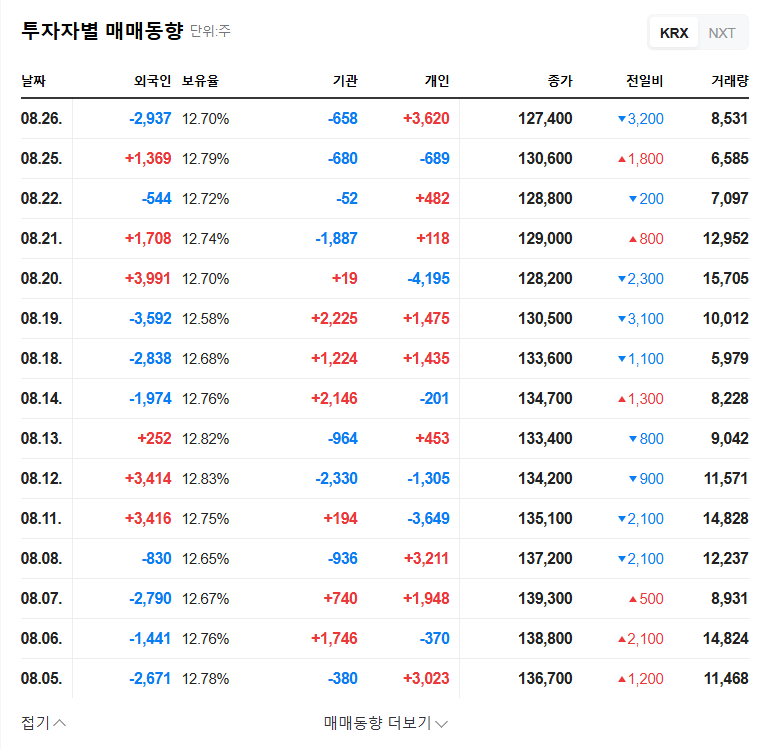

- Monitor Stock Price Trends: Be mindful of price volatility around the buyback date.

- Watch for Future Shareholder Return Policies: Consider the possibility of dividend increases and further share repurchases.

- Analyze Macroeconomic Indicators: Factor in external factors such as interest rates, exchange rates, and oil prices.

- Examine Fundamentals: Assess the growth of the investment sector and the stability of the city gas business.

Is INVENI’s Future Positive?

This share buyback is a significant signal of INVENI’s shareholder-friendly policies and growth potential. However, investment always requires caution. Carefully analyze market conditions and the company’s fundamentals to make informed investment decisions.

Frequently Asked Questions

What is a share buyback?

A share buyback is when a company buys back its own shares from the market, reducing the number of outstanding shares and potentially increasing the value of each remaining share.

Why is INVENI’s share buyback important?

It demonstrates a commitment to enhancing shareholder value and may lead to improved EPS and ROE.

What should investors consider?

Investors should consider potential stock price volatility around the buyback date, future shareholder return policies, and broader macroeconomic factors.