KAON Group’s Self-Stock Disposal: Unpacking the ₩5.6 Billion Decision

The recent announcement of the KAON Group self-stock disposal has sent ripples through the investment community. On November 10, 2025, the company disclosed its plan to dispose of 1,349,258 treasury shares, valued at approximately 5.6 billion KRW. This move, representing 7.48% of total issued shares, is not for raising capital but for a specific purpose: a ‘gratuitous contribution to the KAON Employee Welfare Foundation’. But what does this strategic decision truly mean for the KAON Group stock price and its long-term corporate value? This in-depth analysis will provide clear, actionable insights for current and potential investors.

We will delve into the fundamentals driving this decision, assess the potential impacts on shareholder value, and outline a strategic action plan for investors navigating this development. The official details of this transaction can be reviewed in the Official Disclosure on DART.

Understanding the Mechanism: What Are Treasury Shares?

Before analyzing the impact, it’s crucial to understand the asset in question. Treasury shares, or self-stock, are shares that a company has repurchased from the open market. Companies hold these shares for various reasons, such as to fund employee stock option plans, use in acquisitions, or to reduce the number of outstanding shares and boost earnings per share. For a more detailed explanation, you can refer to resources from authoritative sites like Investopedia.

KAON Group’s disposal is unique because its stated purpose is to enhance employee welfare via its foundation, distinguishing it from typical capital-raising or stock cancellation strategies. This signals a focus on internal human capital as a long-term growth driver.

A Fundamental Analysis of KAON Group

The decision for this self-stock disposal did not occur in a vacuum. It is deeply connected to the company’s current financial health, strategic initiatives, and market position. A balanced view reveals both significant strengths and notable challenges.

Positive Factors Fueling Growth

- •Diversified Business Foundation: The company maintains a strong foothold in OTT and network solutions, with a significant portion of its revenue generated from overseas exports, providing geographic diversification.

- •Future-Forward Investments: KAON Group is actively pursuing next-generation growth engines, including robotics, XR (Extended Reality), and ESS (Energy Storage Systems) for secondary batteries. Tangible results, like AR content and XR device launches, are beginning to emerge.

- •Improved Financial Health: Despite market headwinds, the company achieved a consolidated operating profit of 1.9 billion KRW in the first half of 2025, demonstrating a successful turnaround and strengthening its financial posture.

- •Commitment to ESG: With the issuance of its first Sustainability Report and joining the UNGC, KAON Group is bolstering its commitment to ESG principles, which is increasingly important to institutional investors. For more on their strategy, you might read our previous analysis of KAON’s ESG report.

Potential Risks and Headwinds

- •Profitability Concerns: The OTT business unit’s operating loss of 3.5 billion KRW highlights a critical area needing strategic improvement to enhance overall profitability.

- •Operational Inefficiencies: A low utilization rate at its Brazilian production facility and a high reliance on outsourcing pose challenges to cost control and operational efficiency.

- •Macroeconomic Sensitivity: With a high percentage of foreign currency transactions, the company is vulnerable to exchange rate volatility. A 10% fluctuation could significantly impact net income.

- •Credit Rating Pressure: A recent credit rating downgrade from BB+ to BB may increase borrowing costs and signal underlying financial risks to creditors and investors.

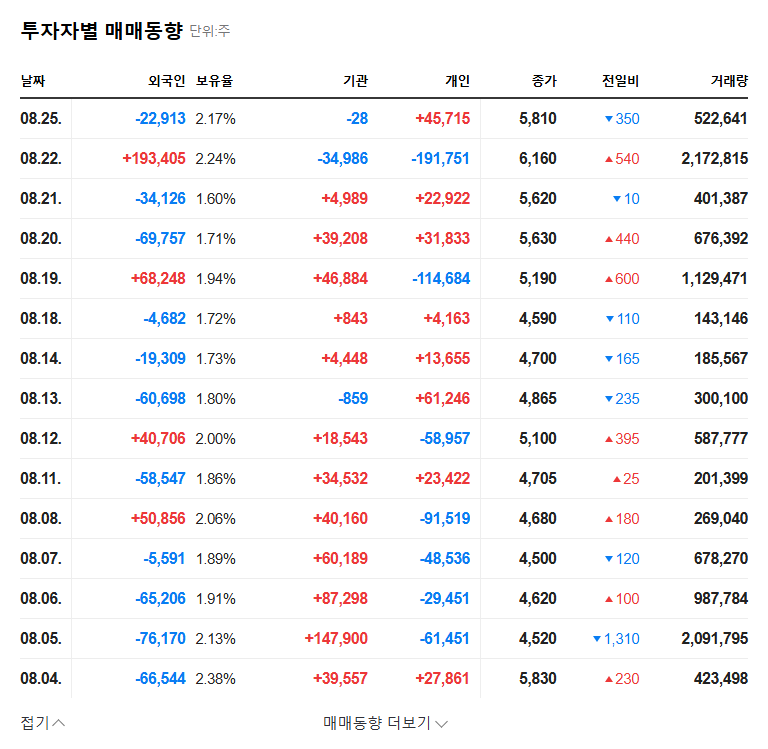

Impact on Stock Price and Corporate Value

The effect of the KAON Group self-stock disposal is multifaceted. In the short term, the market reaction will likely be muted. Since the disposal isn’t flooding the market with new shares for capital, it avoids the typical dilutive effect. However, investors will closely watch the disposal price. A significant discount to the market price could create temporary selling pressure. Conversely, the market may interpret the investment in employee welfare as a positive signal of long-term thinking.

In the mid-to-long term, the impact hinges on execution. If enhanced employee morale and retention lead to higher productivity, innovation, and talent acquisition, this 5.6 billion KRW investment could generate a substantial return in corporate value. However, the immediate effect is a reduction in net assets. If the benefits of improved welfare do not materialize in financial performance, the market may view this as a simple depletion of company assets.

Action Plan for KAON Group Investors

Given this complex situation, investors should adopt a proactive and analytical approach. Rather than reacting to short-term price movements, focus on the following key areas:

- •Demand Transparency: Monitor company communications for details on the disposal price and the specific utilization plans for the funds within the welfare foundation.

- •Track Fundamental Progress: Keep a close watch on quarterly reports for signs of profitability improvement in the OTT segment and tangible revenue from new ventures in XR, robotics, and ESS.

- •Assess Risk Management: Evaluate the company’s strategies for mitigating exchange rate risks and its plans to improve its credit rating.

- •Maintain a Long-Term View: This self-stock disposal is a long-term play on human capital. Base investment decisions on the company’s intrinsic value and its ability to execute its growth strategy over the next several years.