The recent WSI Co., Ltd. share sale by Life Asset Management, a major institutional investor, has sent ripples through the market, raising critical questions for current and potential investors. This disclosure, detailing a significant reduction in their holdings of WSI (299170), warrants a thorough WSI stock analysis. Why would an institution divest from a company with promising revenue growth? What does this move signal about WSI’s underlying financial health and future prospects? This article provides a comprehensive breakdown of the event, its potential impact, and a strategic roadmap for navigating the resulting market volatility.

We will dissect WSI’s fundamentals—both the impressive growth story and the concerning profitability challenges—within the context of a volatile macroeconomic environment. By understanding all facets of this situation, investors can make more informed decisions about their position in WSI Co., Ltd.

The Catalyst: Life Asset Management’s Divestment

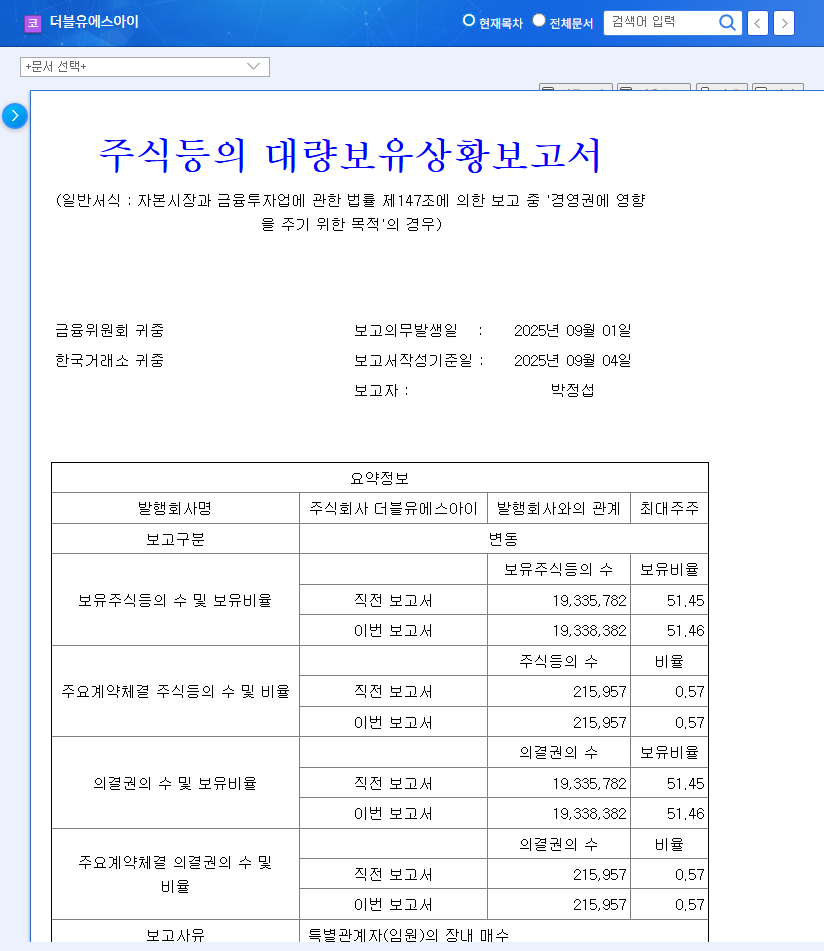

On November 7, 2025, the market took note of an important filing concerning WSI Co., Ltd. (299170). The ‘Report on the Status of Large Shareholdings (Simplified)’ revealed that Life Asset Management sold approximately 1.03 million shares of WSI. This transaction reduced their significant stake from 16.59% down to 13.18%. For investors, a large-scale sale by a sophisticated institutional player initially holding for ‘simple investment’ purposes is a significant red flag that demands closer inspection. You can view the Official Disclosure here.

Institutional sell-offs are often interpreted by the market as a leading indicator of underlying issues or a shift in confidence regarding a company’s short-term growth trajectory.

Analyzing the ‘Why’: WSI’s Financial Landscape

To understand the rationale behind the WSI Co., Ltd. share sale, we must look at the company’s dual narrative of rapid expansion clashing with profitability pressures and macroeconomic headwinds.

The Bull Case: Impressive Growth and Diversification

On the surface, WSI’s growth story is compelling. The company is actively and successfully diversifying its business model beyond its core distribution services.

- •Strategic Expansion: WSI is making calculated moves into high-growth areas like pharmaceutical manufacturing (via the IntroBiopharma acquisition) and medical robotics with its ‘U-Bot’ technology. This signals a strong focus on securing future revenue streams.

- •Robust Revenue Growth: A staggering 60% year-on-year revenue increase in Q1 2025 to KRW 25.808 billion is a testament to the success of these expansion efforts, particularly the integration of IntroBiopharma.

The Bear Case: Profitability and Financial Health Concerns

However, beneath the impressive top-line growth, signs of strain are emerging, which likely contributed to Life Asset Management’s decision.

- •Margin Compression: Operating profit grew by only 16.7%, lagging far behind the 60% revenue growth. This indicates that the cost of expansion and rising financial costs (KRW 4.195 billion from convertible bonds) are eating into profits.

- •Net Loss & Weak Cash Flow: The company posted a net loss of KRW 2.438 billion and saw its operating cash flow turn negative. This is a critical concern, as it suggests WSI is burning through cash despite higher sales. For more on this, see our guide to analyzing cash flow statements.

- •Macroeconomic Pressures: A rising USD/KRW exchange rate, sustained high interest rates, and volatile oil prices create a challenging operating environment, increasing import, logistics, and borrowing costs.

Future Outlook: Navigating Short-Term Turbulence

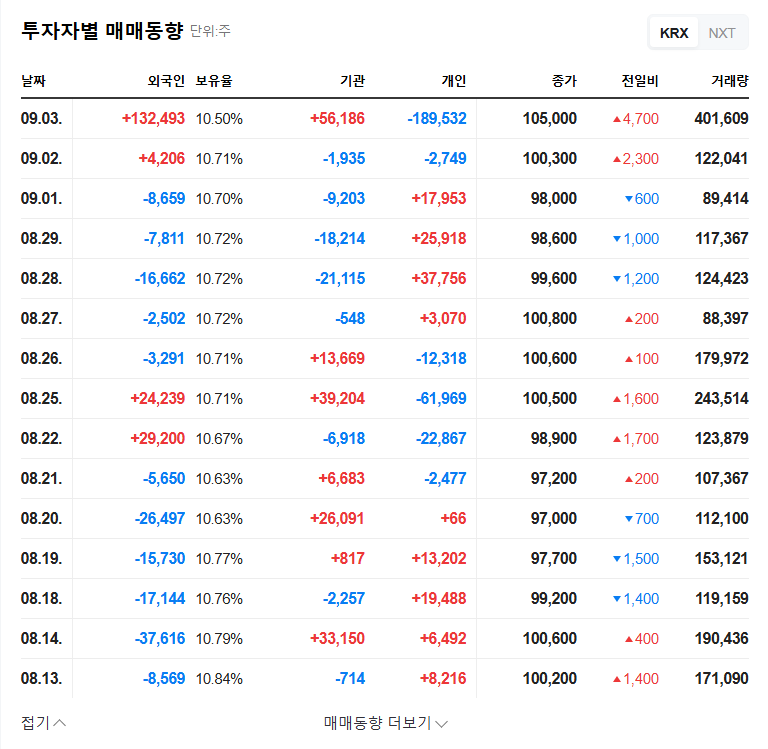

The immediate consequence of the WSI Co., Ltd. share sale is likely to be negative investor sentiment for WSI. The market may interpret Life Asset Management’s move as a vote of no confidence in WSI’s ability to manage its short-term financial burdens, overshadowing its long-term growth narrative.

This could lead to increased downward pressure on the WSI 299170 stock price as other investors may follow suit or adopt a wait-and-see approach. The risk of further sales from the remaining 13.18% stake held by Life Asset Management creates an overhang on the stock. Understanding institutional investor behavior is key; you can learn more from authoritative sources like Investopedia’s analysis of institutional selling.

Investor Action Plan & Key Monitorables

Given the heightened uncertainty, a cautious and disciplined approach is warranted. Before making any investment decisions regarding WSI 299170, investors should closely monitor the following key areas:

- •Continued Institutional Flow: Keep a close watch on any further disclosures from Life Asset Management or other major shareholders. Continued selling could signal deeper issues.

- •Upcoming Earnings Reports: The next quarterly report is crucial. Look for tangible evidence of improved profitability, better cost controls, and a return to positive operating cash flow.

- •Business Plan Execution: Monitor progress reports on the integration of IntroBiopharma and the market adoption of the ‘U-Bot’ system. Real-world success in these new ventures is key to justifying the company’s long-term value.

In conclusion, while the WSI Co., Ltd. share sale by a major institution is a significant headwind causing short-term concern, the company’s long-term growth initiatives remain intact. The path to stock price recovery will depend on WSI’s ability to translate its revenue growth into sustainable profit and manage its financial health effectively in a challenging economic climate.