1. What Happened? : Synergy IB Investment Acquires WITZ Convertible Bonds

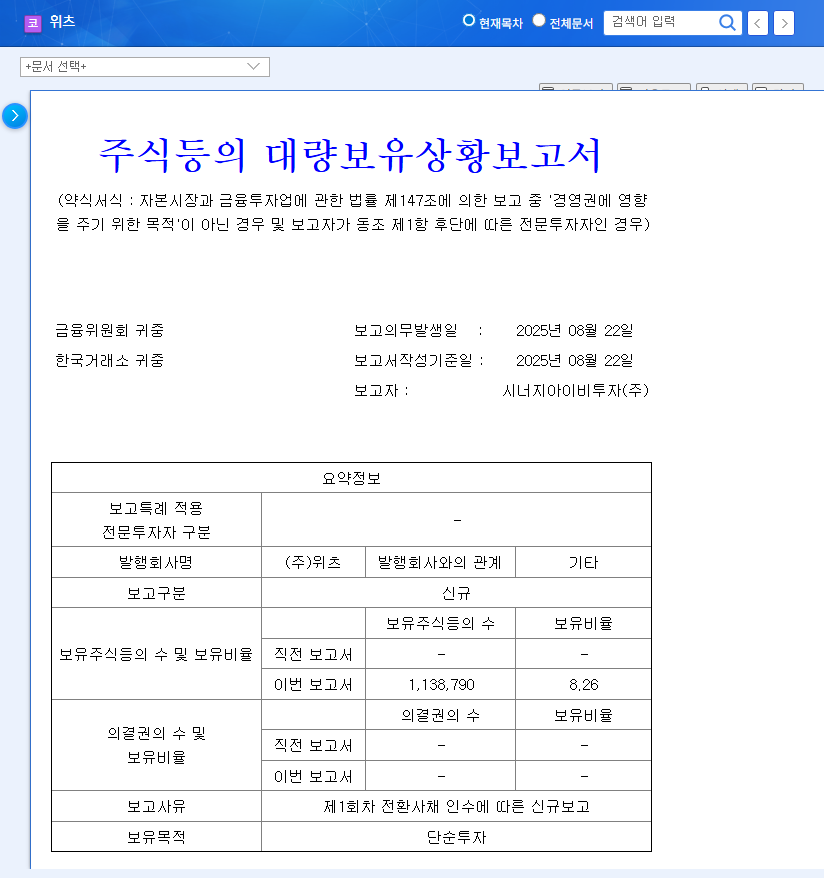

Synergy IB Investment acquired WITZ’s first series of convertible bonds through ‘Synergy-Premier Mezzanine Blind No. 1 New Technology Business Investment Association’ and ‘Synergy IB Shared Growth Innovation New Technology Investment Association’, securing an 8.26% stake. This is a significant development that could lead to changes in WITZ’s future shareholding structure and potential overhang issues.

2. Why Does it Matter? : Coexistence of Opportunities and Risks

Positive Aspects:

- – Visible expansion into the EV charging market through collaborations with KG Mobility and Hyundai Kefico

- – Strong technological competitiveness with over 700 patents related to power transmission

- – Recognition of growth potential through attraction of new investors

Negative Aspects:

- – Weak performance in the first half of 2025 (24.6% decrease in sales, 20.97% decrease in net profit)

- – Potential overhang issue and increased stock price volatility due to convertible bond issuance

- – Deterioration of financial soundness (increase in net debt/total capital ratio to 57.2%)

3. What Should Investors Do? : Investment Strategies

Short-term Investors: Pay close attention to information disclosure regarding convertible bonds, conversion timing, and the performance of the EV charging business in the second half of 2025.

Long-term Investors: Continuously monitor the successful establishment of the EV charging business and performance improvements, maintaining technological competitiveness, and efforts to secure financial soundness.

4. Investor Action Plan

It’s crucial to be aware of increased stock price volatility and continuously monitor WITZ’s business performance and information related to convertible bonds. In particular, the actual generation of sales and achievement of profitability in the EV charging business will be key indicators for investment decisions.

Frequently Asked Questions

Will Synergy IB Investment’s stake have a positive impact on WITZ’s stock price?

In the short term, attracting new investors could create momentum for a stock price increase, but the overhang issue from convertible bonds could also lead to higher volatility. The long-term impact depends on WITZ’s fundamental improvements.

What is the outlook for WITZ’s EV charging business?

The potential for business expansion is high through collaborations with major companies like KG Mobility and Hyundai Kefico, but continuous monitoring of market conditions, including intensifying competition and technological changes, is necessary.

What precautions should investors take when investing in WITZ?

Investment decisions should be made cautiously, considering the potential overhang issue from convertible bond issuance, short-term performance decline, and the possibility of deteriorating financial soundness. Investors should also continuously monitor the performance of the EV charging business and changes in the market’s competitive landscape.