1. What’s the $70M Contract About?

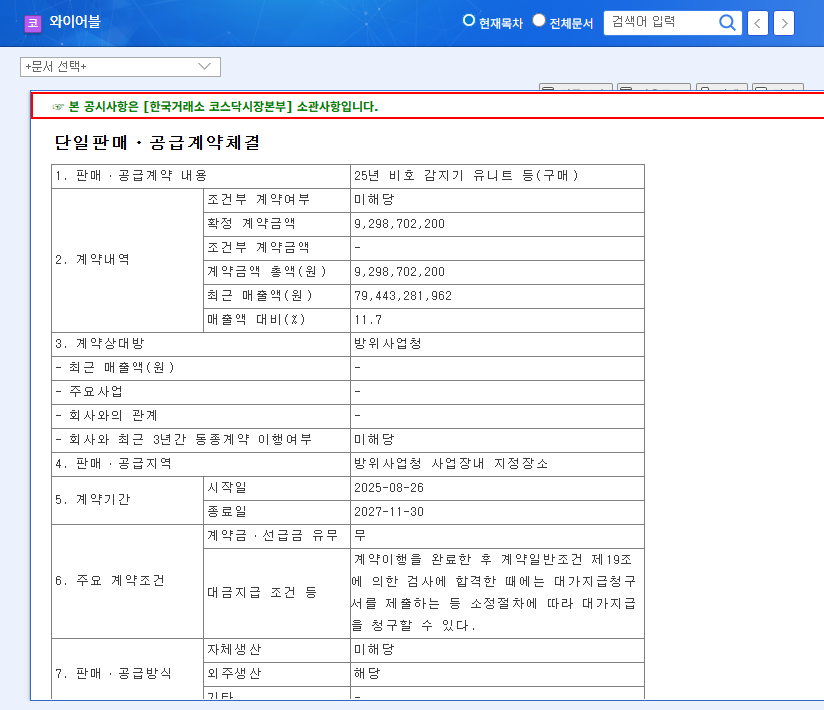

On August 26, 2025, Wireble Co., Ltd. signed a contract to supply ’25 Biho Detector Units’ to the Defense Acquisition Program Administration (DAPA). The contract is valued at $70 million, representing 11.7% of Wireble’s annual revenue. The contract period runs for two years and three months, from August 26, 2025, to November 30, 2027.

2. Why is This Contract Significant?

Wireble has been facing challenges due to declining revenue related to 5G. This contract provides a crucial new revenue stream and accelerates the company’s diversification efforts. Entering the defense sector offers the potential for a more stable revenue base. Furthermore, securing a contract with DAPA enhances Wireble’s credibility and brand recognition.

3. What Does This Mean for the Stock Price?

While this contract is a positive development, investors shouldn’t expect a dramatic short-term surge in the stock price. The $70 million, while substantial, may not be enough to immediately offset the company’s recent underperformance. However, in the medium to long term, the potential for further defense contracts, the success of new business ventures, and overall improved profitability could positively influence the stock price.

4. What Should Investors Do?

- Short-term investors: Proceed with caution due to potential short-term volatility. While the contract is good news, tangible improvements in financial performance may take time.

- Long-term investors: Carefully monitor the possibility of additional defense contracts, the progress and success of new business ventures, and the company’s overall profitability trend to inform investment decisions.

How much will this contract contribute to Wireble’s financial performance?

The $70 million contract represents 11.7% of Wireble’s annual revenue. While the short-term impact may be limited, it is expected to contribute to revenue diversification and provide a new revenue stream in the medium to long term.

What are Wireble’s main business activities?

Wireble’s primary business activities include the construction and operation of telecommunications facilities, IoT, C-ITS, and defense projects.

What are the key investment risks to consider?

Investors should consider the company’s recent financial underperformance, declining 5G revenue, and the uncertainties surrounding new business ventures. Thorough research and analysis are crucial before investing.