Our latest analysis of the KidariStudio earnings report for Q3 2025 reveals a significant and promising turnaround in profitability. After a period of uncertainty, the company has posted strong operating and net profits, largely propelled by the relentless growth of its webtoon division. This comprehensive review breaks down the key financial figures, explores the drivers behind this recovery, and provides a strategic outlook for investors monitoring KidariStudio stock and the broader webtoon industry.

KidariStudio Q3 2025 Financial Results at a Glance

KidariStudio, Inc. announced its consolidated preliminary results for the third quarter of 2025, painting a picture of renewed financial health. These figures, sourced from their preliminary report, signal a positive shift that has caught the attention of the market. The numbers are based on the company’s official filing, which can be reviewed here: Official Disclosure.

Key Q3 2025 Figures:

– Revenue: KRW 52.8 billion

– Operating Profit: KRW 3.6 billion

– Net Profit: KRW 3.2 billion

While the revenue figure represents only a modest increase from the previous quarter, the true story lies in the bottom line. The substantial improvement in both operating and net profit indicates that the company’s strategic initiatives aimed at enhancing profitability are successfully taking hold.

The Webtoon Engine: Powering the Profit Rebound

The primary catalyst for the strong KidariStudio earnings is unequivocally its webtoon business. This segment has not only shown sustained growth but has become the financial backbone of the entire company, demonstrating resilience and a powerful global appeal.

Breaking Down the Webtoon Success

- •Dominant Revenue Share: The webtoon division accounted for a staggering 82.72% of the company’s total revenue, highlighting its central role in the business model.

- •Platform Stability: Proprietary platforms like Bomtoon, Lezhin Comics, and Delitoon continue to provide a stable and growing revenue stream from both domestic and international audiences.

- •Global Market Penetration: The company is capitalizing on the booming global webtoon market, which is projected to grow exponentially in the coming years. This global reach is a key factor in its long-term growth potential.

Operational Efficiency and Lingering Challenges

Beyond the webtoon segment, KidariStudio’s management has implemented effective cost-saving measures. The consolidated operating profit for the first half of 2025 showed a remarkable 92.58% increase year-over-year, partly due to valuation gains on financial assets and disciplined cost control. The parent company’s return to an operating profit of KRW 0.38 billion is another positive sign of improving core operations.

However, not all segments are performing well. The MD (merchandise) and video businesses continue to be a drag on overall performance, with year-over-year revenue decreases of 9.16% and 33.25%, respectively. A successful turnaround strategy for these underperforming divisions remains a critical task for management and a key point for investors to watch.

Future Outlook & Strategic Analysis for Investors

Looking ahead, the trajectory of KidariStudio stock will depend on a few key variables. The company’s ability to execute its growth strategy while navigating market uncertainties is paramount.

Key Growth Catalysts for KidariStudio Stock

- •IP Diversification: The real long-term value lies in monetizing its vast library of Intellectual Property (IP). Expanding popular webtoons into games, animations, and merchandise can unlock significant new revenue streams. For more details, read our analysis on webtoon IP licensing.

- •Aggressive Global Expansion: Continued strategic entry into new markets, particularly in North America and Europe, will fuel top-line growth and solidify its position as a global leader.

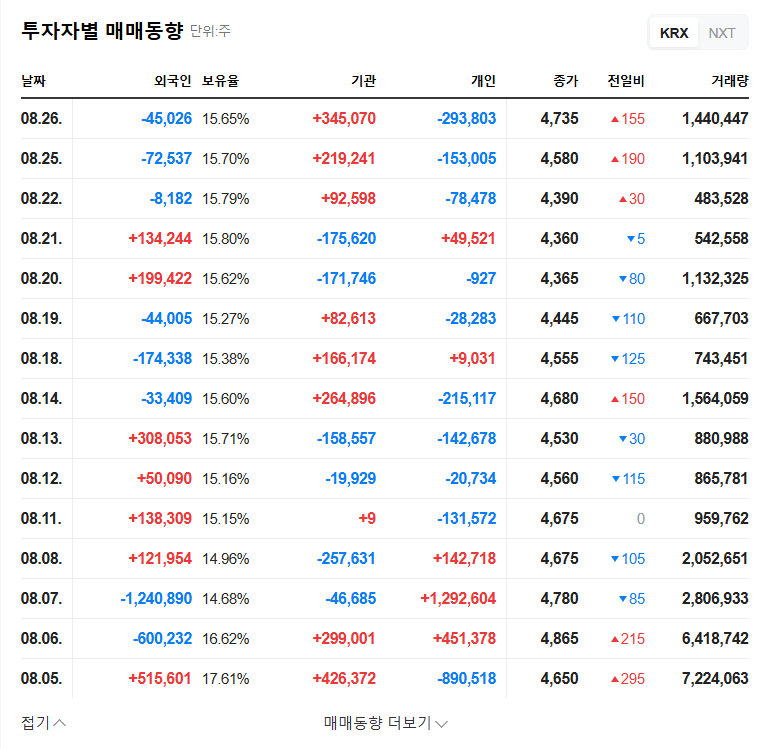

- •Market Sentiment: After a period of decline, the stock has shown signs of a gradual recovery since October 2024. Positive KidariStudio earnings reports like this one could continue to build positive investor sentiment, leading to a sustained, steady recovery rather than a speculative spike.

Investor Action Plan & Final Verdict

For those considering an investment, the Q3 2025 results are a clear positive. However, prudent investors should continue to monitor the execution of the company’s strategy. Key areas to watch include the successful turnaround of the MD and video segments, progress in IP monetization, and the company’s resilience in the face of macroeconomic factors like interest rate changes and currency fluctuations.

The verdict is cautiously optimistic. KidariStudio’s core webtoon business is a powerful and growing asset. If the company can translate this operational strength into consistent, company-wide profitability, the long-term outlook for its stock is bright.

[Disclaimer] This report is based on publicly available information and is for informational purposes only. It is not intended as investment advice. Investors should conduct their own research, and the final responsibility for investment decisions rests with the individual.