Recent news about d’Alba Global has sparked intense discussion within the investment community. The announcement of a significant d’Alba Global shareholder sale by a major stakeholder, Our Venture Partners, has created short-term uncertainty. While such a move can trigger immediate selling pressure, seasoned investors know that the real story often lies beyond the headlines. Is this a signal of underlying weakness, or a strategic repositioning that presents a unique buying opportunity for those focused on long-term value? This comprehensive d’Alba Global investment analysis will dissect the event, evaluate the company’s robust fundamentals, and outline key factors to monitor moving forward.

The Catalyst: A Major Shareholder Reduces Their Stake

On November 13, 2025, a public filing revealed that Our Venture Partners, a key shareholder in d’Alba Global Co., Ltd., had reduced its holdings. According to the Official Disclosure, the venture firm’s stake decreased from 6.86% to 6.37% through open market sales. This 0.49 percentage point reduction, while not a complete exit, is substantial enough to warrant careful consideration. The stated reason for the transaction was simply ‘changes in holdings,’ a common phrase that can cover anything from routine profit-taking after a successful investment period to a strategic portfolio rebalancing.

It’s critical to understand the context of such sales. Venture capital firms often operate on a timeline, and exiting positions after a company goes public, like d’Alba Global did in May 2025, is a standard part of their business model to return capital to their own investors.

Unpacking the Company’s Unwavering Fundamentals

While the market reacts to the shareholder news, a deeper look at d’Alba Global‘s core business reveals a company on a powerful upward trajectory. The performance outlined in its H1 2025 report paints a picture of resilience and explosive growth, particularly in the international market.

A Global Force in Vegan Beauty and Beyond

d’Alba Global is not just another cosmetics company. It has carved out a premium niche with its flagship vegan brand ‘d’Alba’ and is expanding its ecosystem with the health food line ‘Veganery’ and a push into beauty devices. This diversification strategy taps into the rapidly growing global demand for clean and ethical beauty products, a trend confirmed by market research from firms like Grand View Research.

Remarkable Financial Turnaround

The financial metrics from the first half of 2025 are compelling and demonstrate the company’s operational excellence:

- •Explosive Revenue Growth: Fueled by a massive surge in its export ratio from 22.0% in 2023 to an astounding 59.8% in H1 2025, the company is on track to exceed 300 billion KRW in annual revenue.

- •Profitability Achieved: After navigating operating losses, d’Alba Global achieved a significant turnaround, posting an impressive operating profit margin of 24.28% in H1 2025.

- •Strengthened Financial Health: A 2024 capital increase and improved profitability have drastically reduced the company’s debt ratio, providing a solid foundation for future growth initiatives. For more on this, see our guide on how to analyze a company’s balance sheet.

Investor Outlook: Risks vs. Rewards

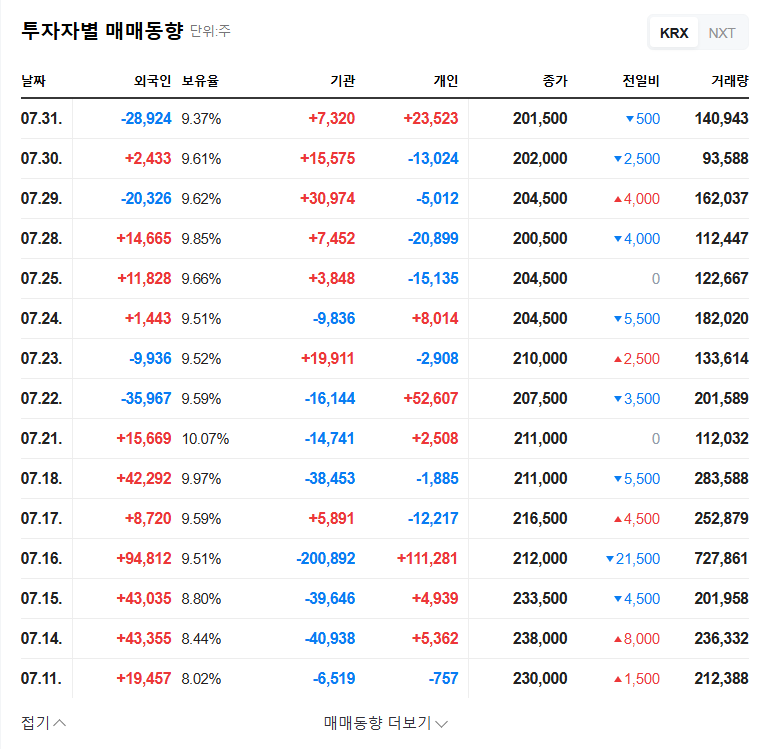

The analysis of d’Alba Global stock presents a classic case of short-term noise versus long-term signal. The immediate market reaction may be negative due to fears of further selling, but the underlying fundamentals suggest a different story.

Key Monitoring Points for Investors

- •Future Shareholder Activity: Is this a one-time sale or the beginning of a larger exit? Continued monitoring of Our Venture Partners’ holdings is essential.

- •Sustained Performance: Can the company maintain its impressive growth and profitability in upcoming quarters? The full-year 2025 earnings report will be a critical data point.

- •Risk Management: With a high proportion of international sales, the company’s strategies for managing exchange rate volatility will be crucial to protecting its profit margins.

- •Competitive Landscape: The beauty industry is fierce. Investors should watch for how d’Alba Global continues to innovate and differentiate itself from competitors.

In conclusion, while the d’Alba Global shareholder sale introduces a short-term headwind, it does not diminish the company’s impressive fundamental turnaround and significant long-term growth potential. For investors with a longer time horizon, any undue selling pressure resulting from this news could represent an attractive entry point to own a stake in a rapidly growing global beauty powerhouse.