UTI’s Treasury Stock Disposal: What Happened?

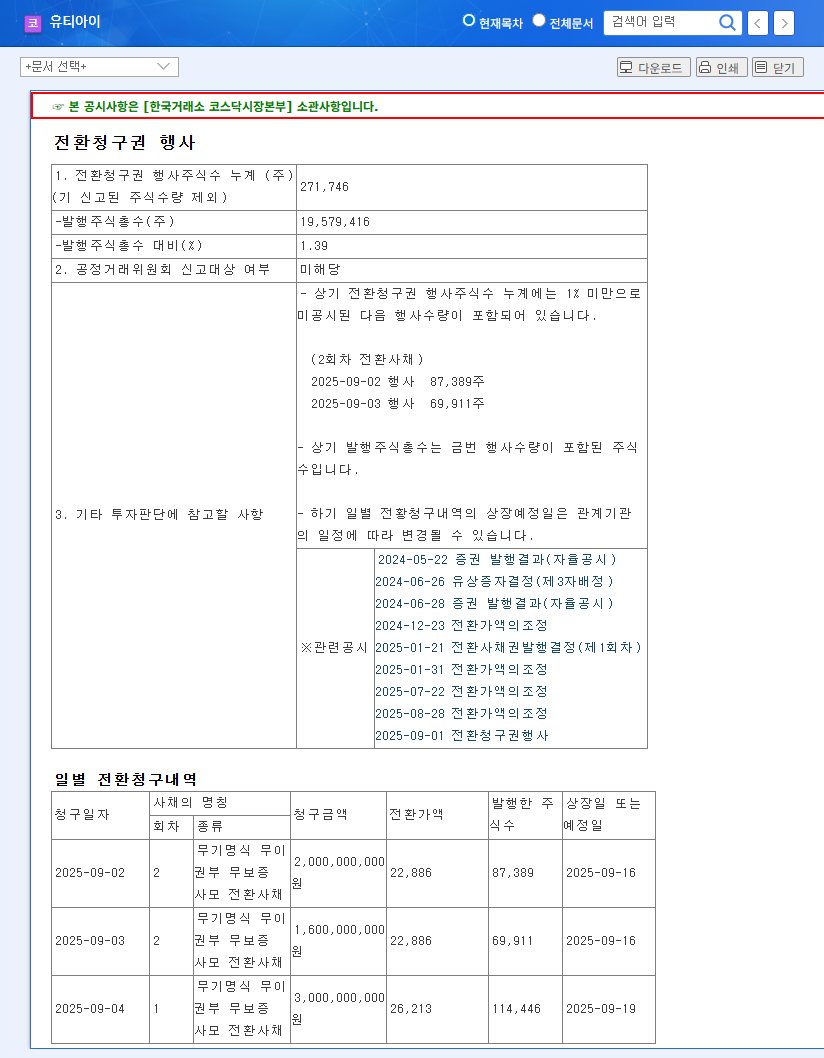

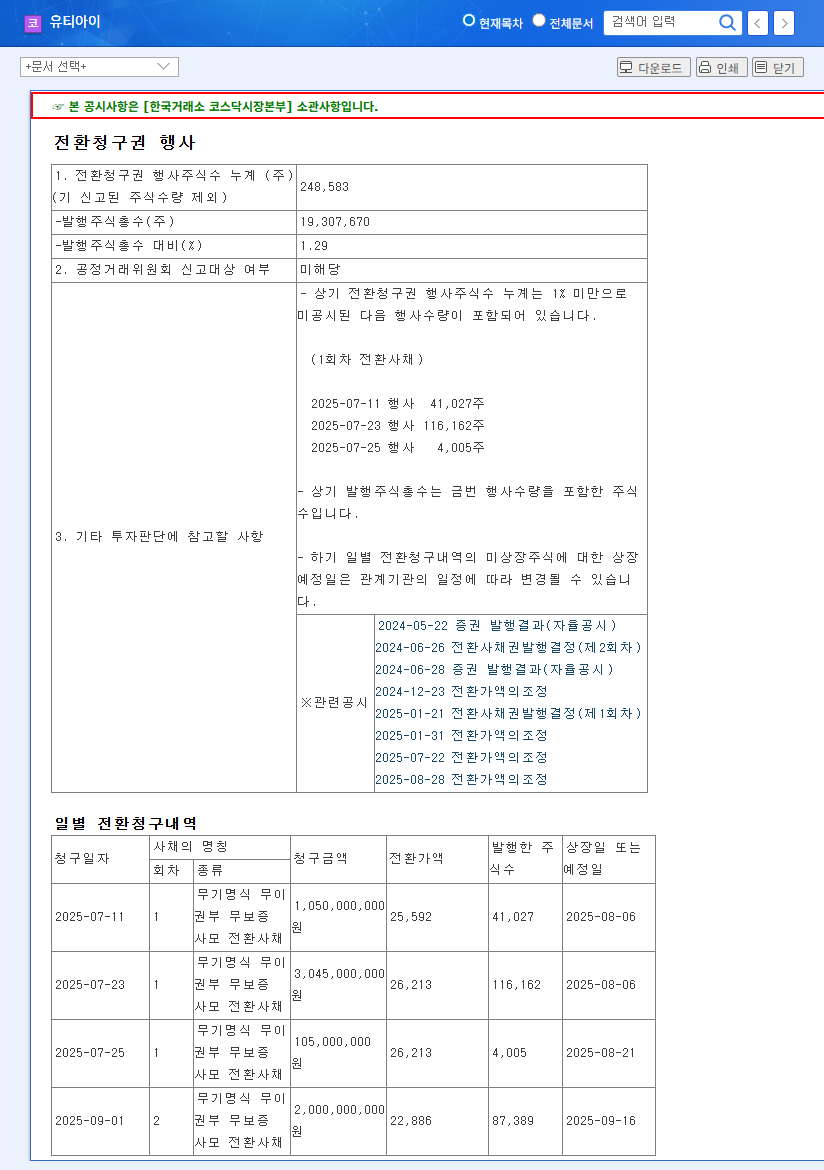

On September 24, 2025, UTI decided to dispose of 210,101 shares of treasury stock, worth approximately \5.2 billion. The purpose is to issue convertible bonds with treasury stock as the exchange target.

Background and Current Status of UTI

UTI is trying to offset the sluggish camera window business with new businesses (slimming, flexible glass). However, operating losses continue due to investments in new businesses and deteriorating profitability of its Vietnamese subsidiary, UTI VINA. The high debt ratio also burdens financial stability.

- Sales: Expected to recover from 2024 and grow slightly in 2025

- Profitability: Expected to recover from 2024, but UTI VINA’s profitability remains unstable

- Financial Structure: High debt ratio persists

Impact of Treasury Stock Disposal

Issuing convertible bonds through treasury stock disposal can contribute to securing liquidity and improving the financial structure. However, the potential for stock dilution, continued sluggishness in existing businesses, and increased financial burden from investments in new businesses should also be considered.

What Should Investors Do?

Caution is advised. Investors should closely monitor the performance of new businesses, profitability improvement of UTI VINA, additional efforts to improve the financial structure, and the impact of macroeconomic variables.

- Check the performance of new businesses and profitability improvement of UTI VINA

- Monitor additional efforts to improve financial structure

- Analyze the impact of macroeconomic variables (exchange rates, interest rates, etc.)

FAQ

Why is UTI disposing of its treasury stock?

To raise funds and improve its financial structure by issuing convertible bonds.

What precautions should investors take?

Investors should closely monitor the performance of new businesses, the profitability improvement of UTI VINA, and efforts to improve the financial structure. The impact of macroeconomic variables should also be considered.

What is UTI’s future outlook?

UTI has long-term growth potential, but faces the challenge of improving profitability and securing financial soundness in the short term. Investors need to closely monitor the company’s future moves.