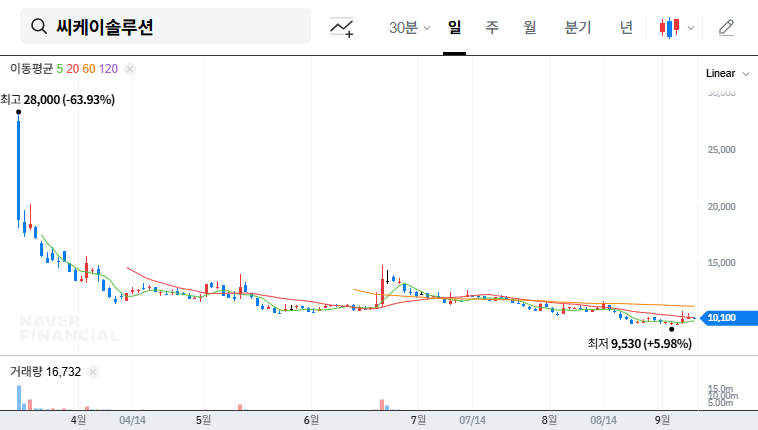

What Happened?

CK Solution secured a $22 million contract with LG Energy Solution Michigan, Inc. for the ESMIL BP2-1 NND+Cell+FA Line #2 UT+Process Installation project. The contract period is from September 8, 2025, to December 31, 2025 (3 months).

Why is this Contract Important?

This contract is expected to be a crucial catalyst for CK Solution’s recovery from its underperformance in the first half of 2025. Strengthening the partnership with a key client like LG Energy Solution increases the likelihood of future contracts and expands CK Solution’s experience in the US market, contributing to enhanced global competitiveness.

What’s Next?

In the short term, the $22 million contract is projected to boost CK Solution’s revenue and improve profitability. Furthermore, the reinforced collaboration with LG Energy Solution is anticipated to positively influence long-term growth drivers.

- Positives: Revenue growth, improved profitability, stronger partnership, enhanced US market presence.

- Risks: Short 3-month contract duration, contract execution risks, exchange rate fluctuations, potential slowdown in the battery market.

What Should Investors Do?

This contract is expected to improve investor sentiment towards CK Solution and provide upward momentum for the stock price. However, investment decisions should be made considering the short-term nature of the contract and uncertainties in the battery market. Continuous monitoring of contract execution, exchange rate fluctuations, and market conditions is crucial. It’s also important to observe the performance of new business segments and assess the long-term growth potential.

What are CK Solution’s main businesses?

CK Solution operates in various sectors, including secondary batteries, machinery, defense, environment, and information & communications. This contract is related to their secondary battery business.

What is the value of this contract?

$22 million, which represents 10.11% of CK Solution’s revenue for the first half of 2025.

Who is the counterparty to this contract?

LG Energy Solution Michigan, Inc., the US subsidiary of LG Energy Solution.

What is the contract duration?

From September 8, 2025, to December 31, 2025 (3 months).