What Happened?

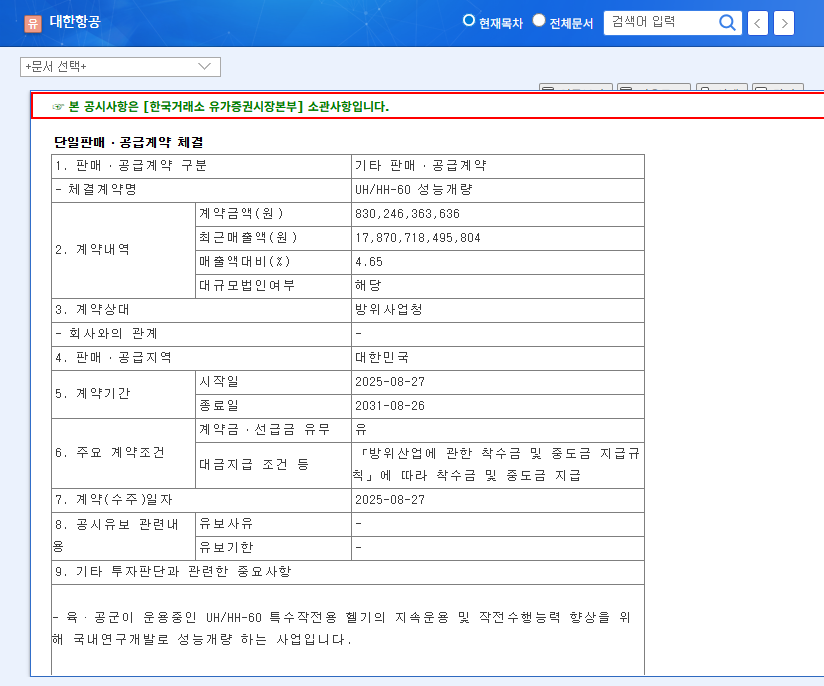

Korean Air signed a $600 million contract with DAPA for UH/HH-60 helicopter performance upgrades. The contract spans six years and represents 4.65% of Korean Air’s revenue.

Why Does it Matter?

This contract holds substantial implications for Korean Air’s financial health and business diversification. It secures stable revenue for six years and is expected to positively impact the company’s high debt-to-equity ratio. It also accelerates growth in the aerospace division and reinforces Korean Air’s technological capabilities.

What’s the Impact?

- Financial Impact: Increased revenue and profits, improved operating margin, and stabilized cash flow are expected, contributing to a stronger financial structure.

- Business Diversification: Reinforces the military/aerospace business, diversifying the portfolio and securing new growth engines.

- Technological Prowess: Participating in helicopter upgrades demonstrates Korean Air’s advanced technological capabilities.

What Should Investors Do?

While this contract is a positive sign, investors should consider the following:

- Monitor improvements in financial health and debt repayment capacity.

- Analyze trends in key macroeconomic variables such as oil prices and exchange rates.

- Evaluate the performance of new businesses like in-flight Wi-Fi and UAM.

- Assess the potential for additional orders and business expansion in the defense sector.

Overall, this contract is expected to positively influence Korean Air’s fundamentals. However, a cautious approach and continuous monitoring are recommended for investment decisions.

How will this contract impact Korean Air’s financials?

It is expected to improve the financial structure through increased revenue, improved operating margin, and stabilized cash flow.

What is the contract value?

$600 million.

What is the contract duration?

Six years.