What Happened? Going Concern Uncertainty Disclosed

Samhwa Electronic held an IR session at Shinhan Investment Corp’s Premier Corporate Day on September 10, 2025, explaining recent management performance and answering questions. However, the market’s focus is on the recently disclosed semi-annual report, which includes ‘going concern uncertainty,’ raising serious questions about the company’s viability.

Why This Situation? Deteriorating Financials and Uncertain Future

According to the semi-annual report, Samhwa Electronic’s financial health is critical. The debt-to-equity ratio stands at 356%, and the net debt-to-equity ratio is 196%, both exceedingly high. Sales decreased compared to the same period last year, and both operating and net income losses widened. This is likely a combined result of external factors such as rising raw material prices, exchange rate fluctuations, and an economic slowdown, coupled with internal management issues.

What’s Next? IR Results and Future Outlook

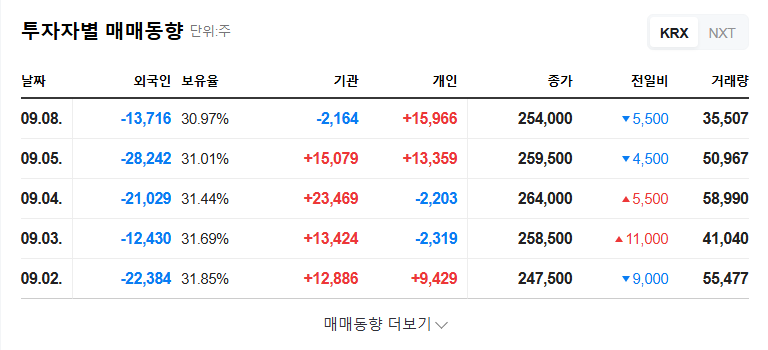

While the management announced financial restructuring plans during the IR, the market reaction remains to be seen. Following the going concern uncertainty disclosure, the stock price is under pressure, and the possibility of a short-term rebound seems limited. The long-term outlook will depend on the management’s ability to execute its plan and overall market conditions.

What Should Investors Do? Cautious Approach and Thorough Analysis Needed

- Analyze IR Content: Carefully examine the feasibility and specifics of the financial restructuring plan.

- Monitor Macroeconomic Conditions: Continuously observe the impact of changes in external factors like interest rates, exchange rates, and raw material prices.

- Evaluate Business Competitiveness: Assess the company’s competitiveness and ability to adapt to market changes, particularly in its growth sectors like eco-friendly auto parts and radio wave absorbers.

This analysis is not investment advice, and all investment decisions are the investor’s responsibility.

Frequently Asked Questions (FAQ)

What does Samhwa Electronic’s ‘going concern uncertainty’ disclosure mean?

It signifies a high probability of the company going bankrupt or ceasing operations within one year. It’s a warning that the company’s financial status is precarious, making it difficult to continue normal business operations.

Should I invest in Samhwa Electronic?

Currently, investing in Samhwa Electronic carries extremely high risk. If considering investment, carefully analyze the feasibility of the financial restructuring plan presented during the IR, changes in the macroeconomic environment, and business competitiveness before making a decision.

What is the outlook for Samhwa Electronic’s future stock price?

In the short term, downward pressure on the stock price is likely to continue. The long-term stock price outlook will depend on management’s financial restructuring efforts and market conditions. Monitor the execution of the plan announced during the IR and the market’s reaction.