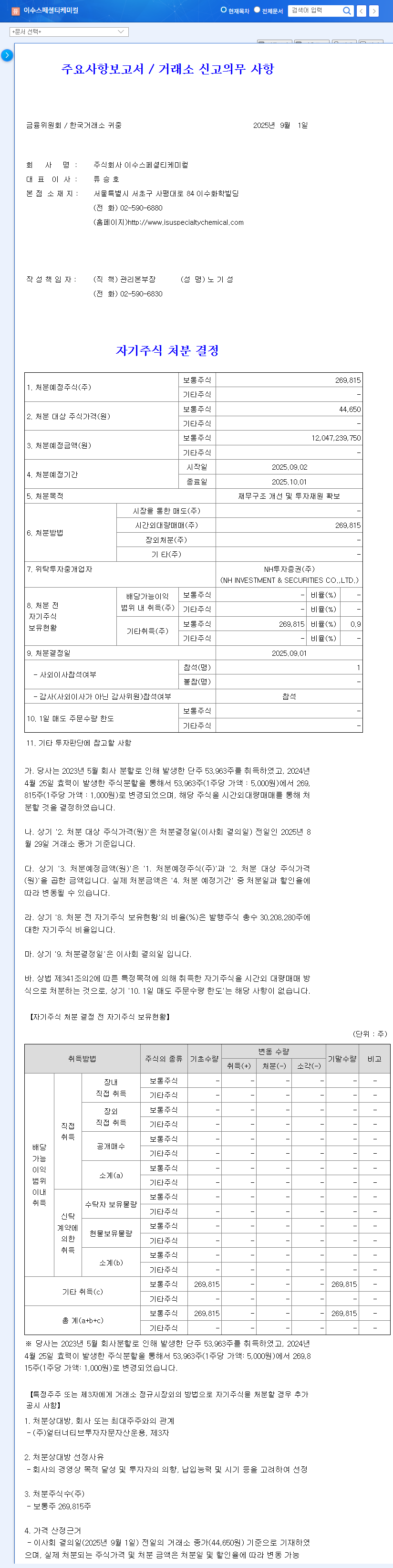

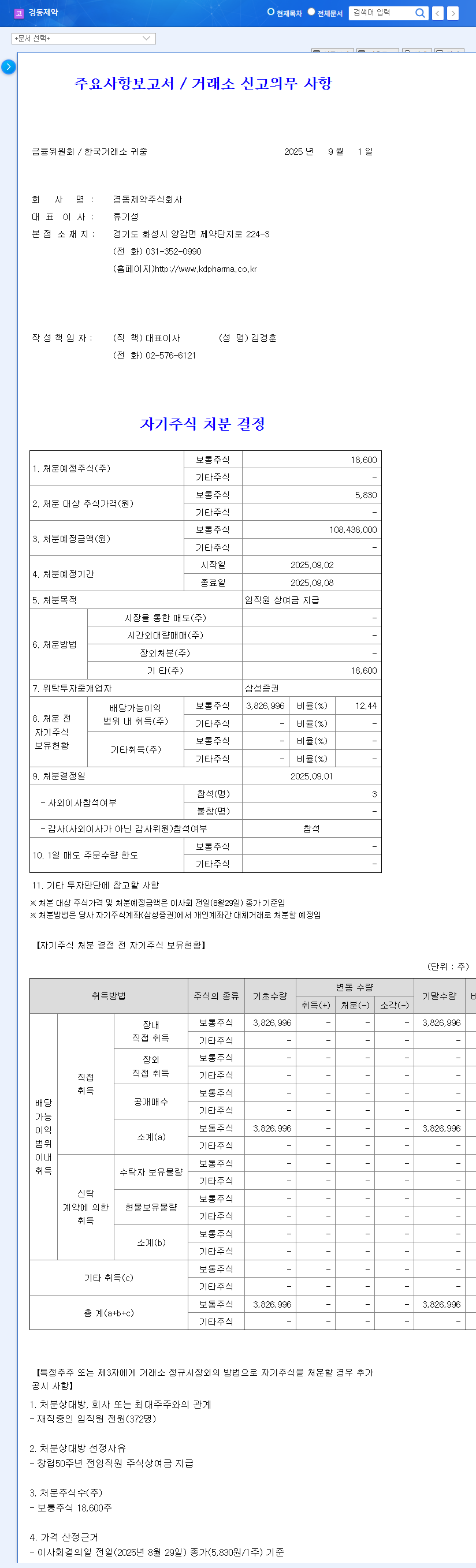

1. What Happened? : Wave Electro’s Treasury Stock Disposal Decision

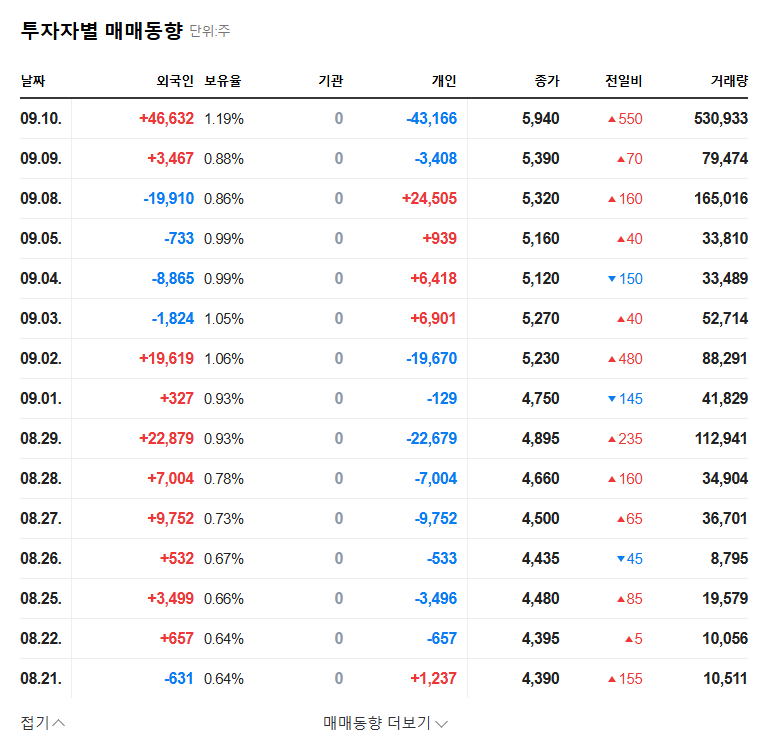

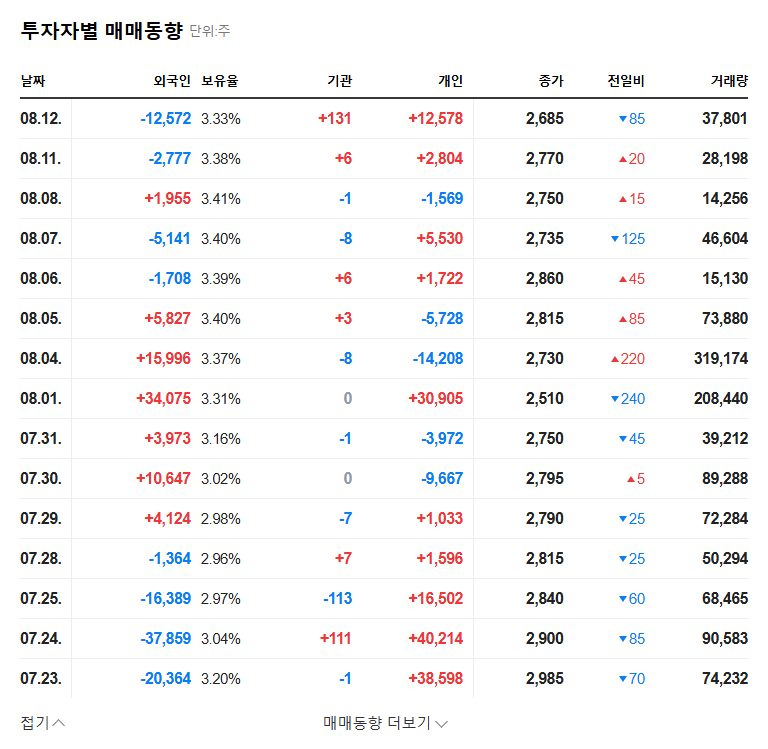

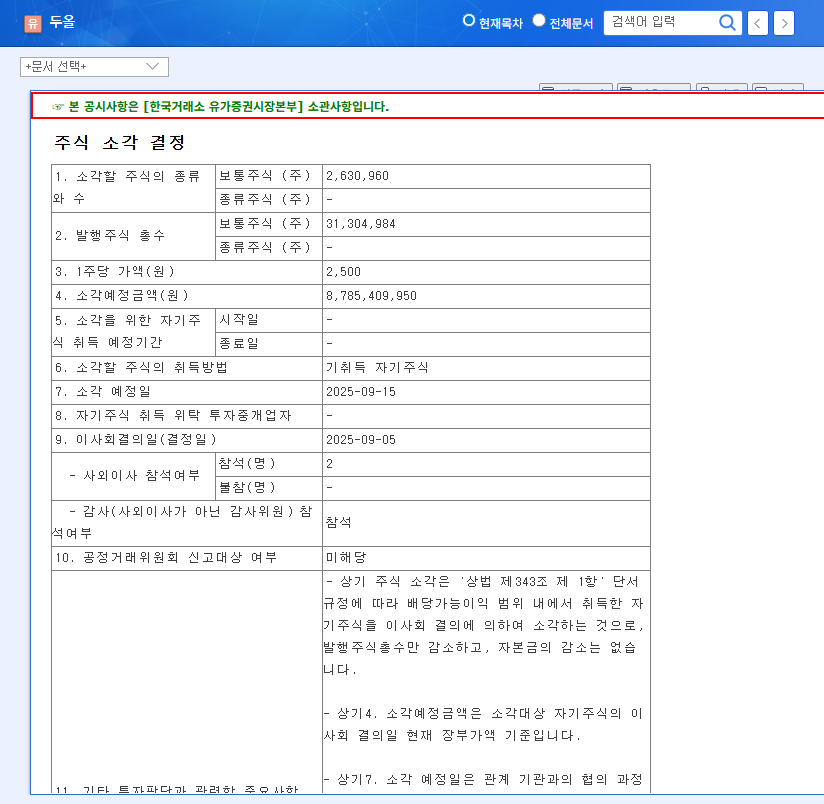

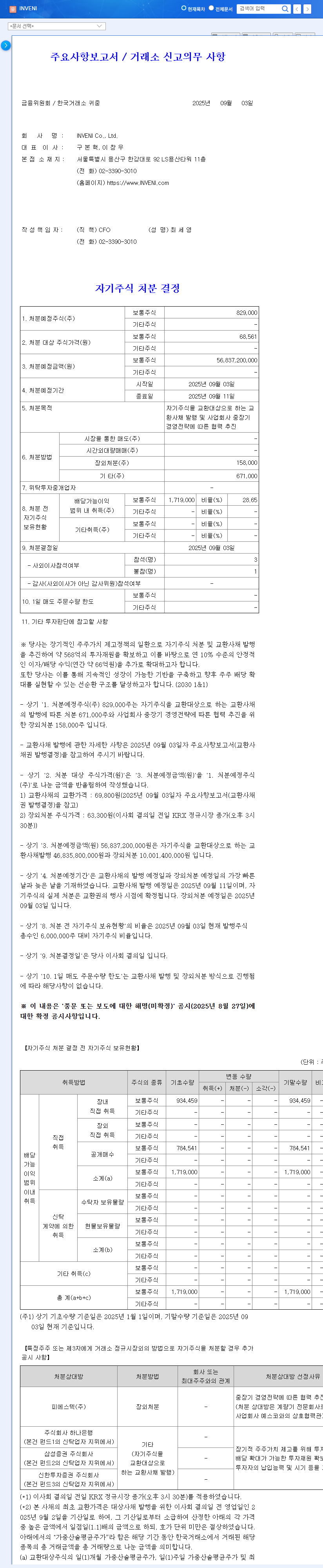

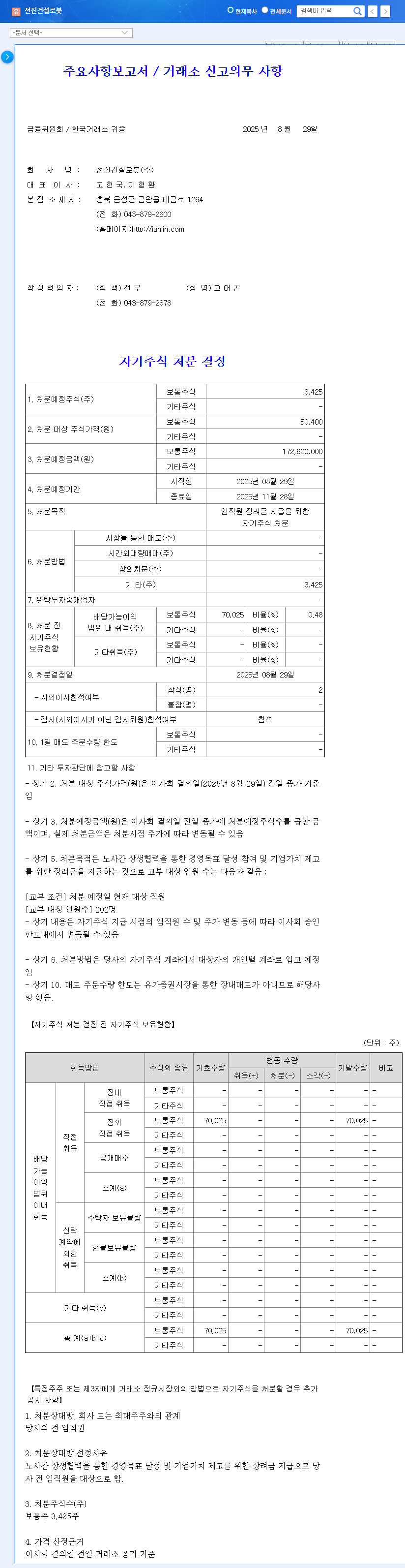

Wave Electro has decided to dispose of treasury stock amounting to approximately 7 billion KRW, representing 8.0% of its total outstanding shares (based on an 87 billion KRW market capitalization). This decision aims to issue convertible bonds, with the proceeds intended for future expansion of the defense business and investment in research and development.

2. Why? : Background and Objectives

Wave Electro has experienced declining sales and an operating loss due to sluggish performance in its telecommunications business segment. This treasury stock disposal is seen as a way to raise funds to invest in its growth engine, the defense business, and improve its financial structure.

3. So What? : Positive and Negative Impact Analysis

Positive aspects include the potential for increased corporate value through investment in the defense business and improved financial structure. However, negative aspects to consider include the potential for stock dilution due to the conversion of convertible bonds and increased short-term stock price volatility.

4. Investor Action Plan

- Check Convertible Bond Terms: Carefully review the details such as conversion price and conversion ratio to analyze the potential dilution effect.

- Monitor Fund Utilization Plan: Continuously monitor whether the raised funds are used efficiently.

- Watch Fundamentals and Macroeconomic Changes: Analyze the company’s earnings improvement and the impact of changes in the macroeconomic environment.

In conclusion, this treasury stock disposal requires attention to the long-term growth potential rather than short-term volatility. Investors should make informed decisions based on thorough analysis.

Frequently Asked Questions (FAQ)

What is treasury stock disposal?

Treasury stock disposal refers to a company selling its own shares. Companies may dispose of treasury stock for various reasons, and in Wave Electro’s case, it is for raising funds to issue convertible bonds.

What are convertible bonds?

Convertible bonds are bonds that give the bondholder the right to convert them into the issuer’s shares. Wave Electro plans to issue convertible bonds with its treasury stock as the underlying asset.

How does treasury stock disposal affect stock prices?

Generally, treasury stock disposal implies the possibility of stock dilution due to an increase in the number of shares. However, depending on the purpose of the disposal and market conditions, it can also have a positive impact on the stock price. In the case of Wave Electro, if the raised funds lead to strengthened business competitiveness, it could positively affect the stock price in the long term.