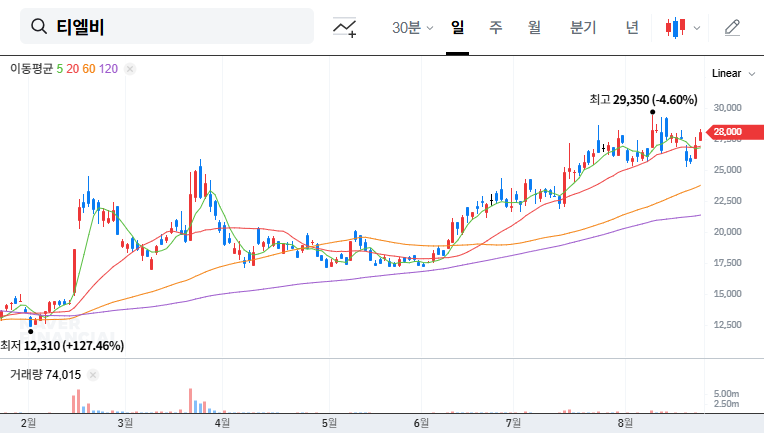

In a landmark quarter for the surging semiconductor industry, TLB Co., Ltd. (KRX: 356860) has emerged as a formidable player, capturing significant investor attention with its exceptional Q3 2025 financial results. As the demand for high-performance computing skyrockets, TLB’s specialization in critical components like memory module and SSD Printed Circuit Boards (PCBs) positions it at the heart of technological innovation. The company is now set to host a pivotal Investor Relations (IR) event on November 18th, offering a transparent look into the strategies driving its remarkable achievements and its ambitious medium-to-long-term vision.

This comprehensive analysis will unpack TLB’s record-breaking quarter, explore the market dynamics powering its growth, and evaluate the key messages investors should anticipate from the upcoming IR event. We will delve into its fundamentals, technological edge in areas like CXL memory, and what it means for the future of TLB stock and its role in the global semiconductor supply chain.

Unpacking Record Q3 2025 Performance

TLB Co., Ltd. delivered a stellar performance in the third quarter of 2025, shattering previous records and signaling strong underlying momentum. The financial results, detailed in their Official Disclosure (DART), highlight not just revenue growth but a dramatic improvement in profitability, reflecting operational efficiency and favorable market conditions.

Key Financial Highlights

- •Record Revenue: Achieved an all-time quarterly high of KRW 185.9 billion, marking a 36.4% increase year-over-year, driven by robust demand for memory module and SSD PCBs.

- •Explosive Profitability: Operating profit skyrocketed by an astonishing 526.6% YoY to KRW 17.38 billion. The operating profit margin significantly improved to 9.3%, showcasing enhanced cost management and a focus on high-value products.

- •Improved Financial Health: Total assets grew, and cash equivalents saw a significant rise, pointing to improved financial stability. The debt-to-equity ratio remains at a manageable 104.05%.

- •Production Efficiency: The production utilization rate rebounded to 69.46%, indicating a healthy alignment of capacity with market demand.

Core Growth Drivers & Market Environment

TLB’s success isn’t accidental; it’s the result of strategic positioning within a favorable market. The company’s focus on high-performance semiconductor PCB technology places it at the epicenter of several powerful macro trends.

The AI and Data Center Revolution

The exponential growth of Artificial Intelligence, cloud computing, and massive data centers requires a new class of memory and storage solutions. According to industry reports from Gartner, this segment is expected to see double-digit growth for the foreseeable future. TLB’s PCBs are essential components in the DDR5 memory modules and high-speed SSDs that power these data-hungry applications, directly linking its growth to this technological revolution.

Pioneering Next-Generation Technology: CXL and SOCAMM

TLB is not just meeting current demand; it’s building for the future. The company is heavily invested in next-generation memory interconnects like Compute Express Link (CXL memory) and new form factors like LPCAMM/SOCAMM. These technologies are set to redefine server architecture by allowing for more efficient, high-bandwidth memory pooling. By developing advanced PCBs for these emerging standards, TLB is securing its relevance and competitive advantage for years to come.

This upcoming investor relations event is a critical opportunity for TLB Co., Ltd. to bridge the gap between its impressive performance and its current market valuation, outlining a clear path to sustained growth.

Investor Outlook and IR Event Expectations

With a “Positive (Buy)” outlook, the upcoming IR event is expected to be a catalyst for TLB stock. Investors should look for clear communication on how the company plans to capitalize on its momentum and address potential risks.

Key Investment Points to Watch

- •Growth Justification: Can management provide a compelling narrative and concrete forecasts that justify the current high P/E ratio (418.53x)? The focus will be on future earnings potential, not just past performance.

- •Operational Excellence: Expect details on the continued ramp-up of the Vietnam factory, its impact on cost structure, and plans for further efficiency improvements.

- •Risk Mitigation: Investors will seek clarity on strategies to manage macroeconomic risks, including exchange rate volatility (given a 74.5% export ratio) and rising raw material costs.

- •Customer Relationships: Confirmation of deepening partnerships with key clients like Samsung Electronics and SK Hynix will reinforce the stability of future revenue streams. Find out more about our analysis of the memory market.

Frequently Asked Questions (FAQ)

How was TLB Co., Ltd.’s financial performance in Q3 2025?

TLB Co., Ltd. achieved its highest-ever quarterly revenue of KRW 185.9 billion (a 36.4% YoY increase). Operating profit surged by 526.6% to KRW 17.38 billion, demonstrating substantial improvement in both growth and profitability.

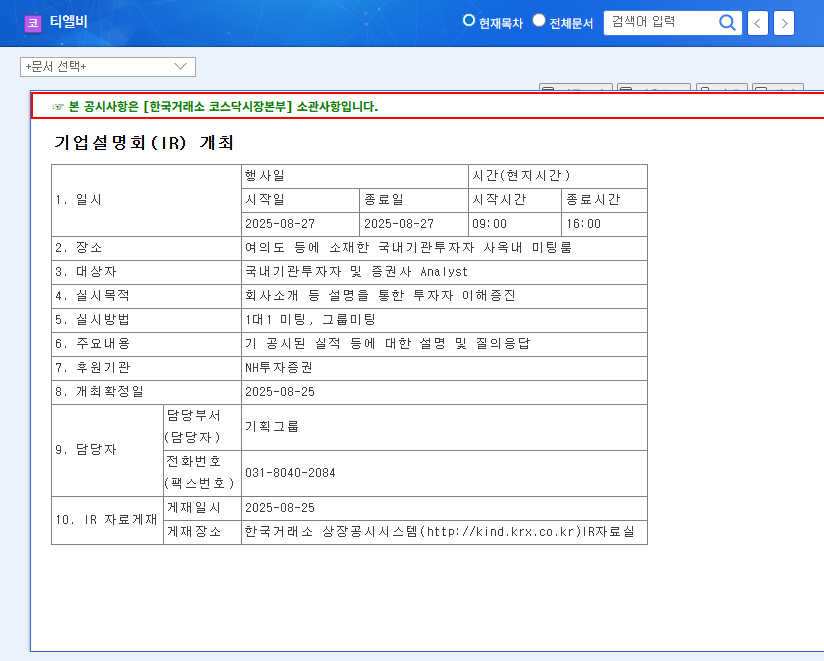

When is the TLB Co., Ltd. Investor Relations (IR) event?

The IR event is scheduled for November 18, 2025, at 9:00 AM (KST). The purpose is to detail the Q3 2025 performance, present the company’s strategic vision, and engage with investors in a Q&A session.

What are the main risks for investors?

The primary risks include a high valuation (P/E ratio of 418.53x), which requires strong future growth to be justified. Investors should also monitor macroeconomic factors like exchange rate fluctuations, interest rate trends, and potential supply chain disruptions.