This comprehensive Hyosung TNC Q3 2025 earnings analysis unpacks the preliminary results for Hyosung TNC Corporation (KRX: 298020), revealing a complex financial narrative. While top-line revenue beat market consensus, a severe plunge in profitability has sounded alarms for investors. This report provides a deep-dive analysis of the fundamental drivers behind this performance, the immediate impact on Hyosung TNC stock, and a strategic action plan to navigate the challenges ahead. We will explore whether the company’s long-term growth initiatives can offset the current headwinds.

Hyosung TNC’s Q3 2025 Earnings: The Headline Numbers

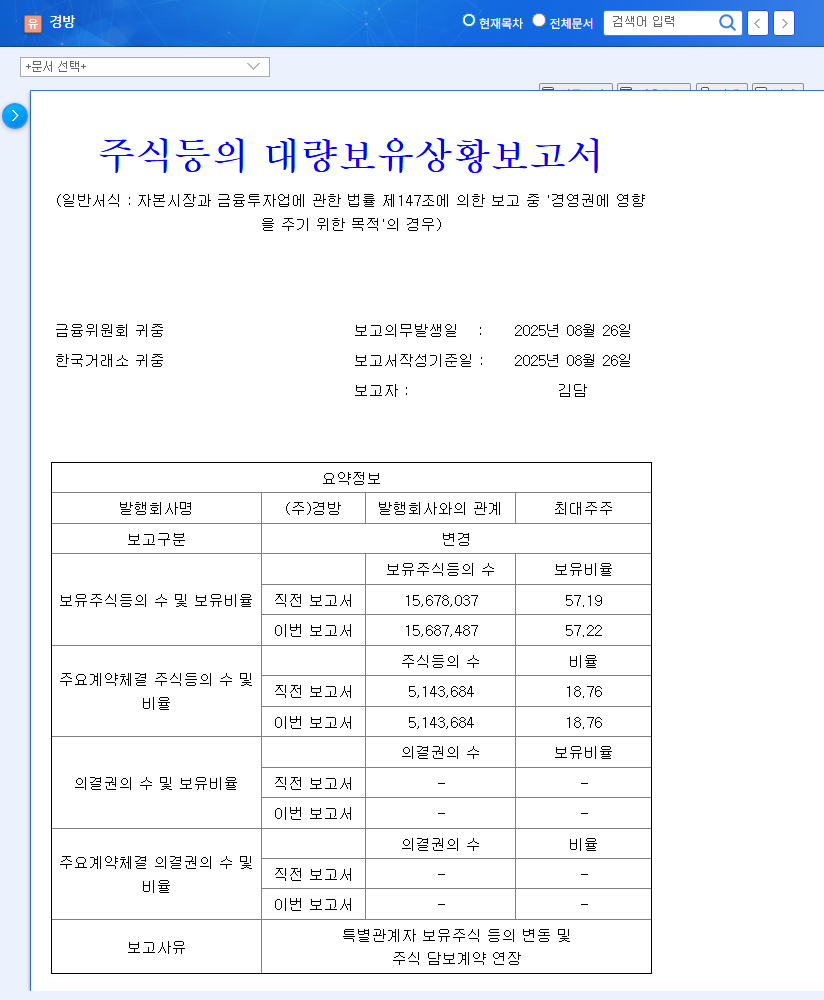

Hyosung TNC announced its preliminary consolidated results for the third quarter of 2025, presenting a stark contrast between sales performance and bottom-line profitability. The market’s reaction has been cautious, focusing on the significant profit miss. All figures are based on the official company filing. You can view the complete Official Disclosure (DART) for more details.

- •Revenue: KRW 2,009.8 billion. This figure was 5% above the market consensus of KRW 1,916.7 billion, a seemingly positive signal.

- •Operating Profit: KRW 56.1 billion. This result was a significant 17% below market expectations of KRW 67.7 billion, highlighting core operational challenges.

- •Net Profit: KRW 8.1 billion. A staggering 81% miss compared to the market estimate of KRW 42.2 billion, raising serious concerns about financial costs and tax burdens.

Deconstructing the Profit Plunge: Key Factors

To understand the alarming divergence between revenue and profit, we must analyze the company’s fundamentals, financial health, and the broader macroeconomic environment influencing its operations.

1. Business Structure and Diversification Efforts

Hyosung TNC maintains a dominant position in the global spandex market, but its trading division (steel, chemicals) still accounted for over 61% of revenue in H1 2025. The recent acquisition of Hyosung Chemical’s special gas (NF3) business is a strategic pivot towards high-value sectors like semiconductors and displays. While this move is crucial for long-term growth, the short-term integration costs and capital outlay have contributed to financial strain, as reflected in the Hyosung TNC Q3 2025 earnings.

2. Rapidly Deteriorating Financial Health

The H1 2025 report already signaled a worrying trend. While revenue was stable, operating profit fell 44.3% and net profit plunged 65.9% year-on-year. This was driven by squeezed margins and rising financial expenses. The acquisition further magnified these issues:

The most significant red flag is the surge in the debt-to-equity ratio, which skyrocketed from a manageable 66.4% to 111.4%. This sharp increase in leverage signals a significant deterioration in financial stability and increases risk for equity holders.

Furthermore, negative cash flow from operations and investments indicates challenges in managing working capital effectively while absorbing large-scale investments.

3. Macroeconomic and Market Headwinds

Several external factors are pressuring Hyosung TNC’s profitability. Volatility in the prices of key raw materials for spandex, such as PTMG and MDI, directly impacts production costs. While some material prices saw a slight decline in Q3, it wasn’t enough to offset deeper structural cost issues and weakening global demand. For a broader market context, investors can review global commodity price trends from authoritative sources like Bloomberg. Additionally, while a stronger US dollar can benefit exporters, the gains were insufficient to counter the significant increase in financial costs, a key driver of the net profit collapse. These industry-wide pressures are something we discuss further in our guide to the global textile market.

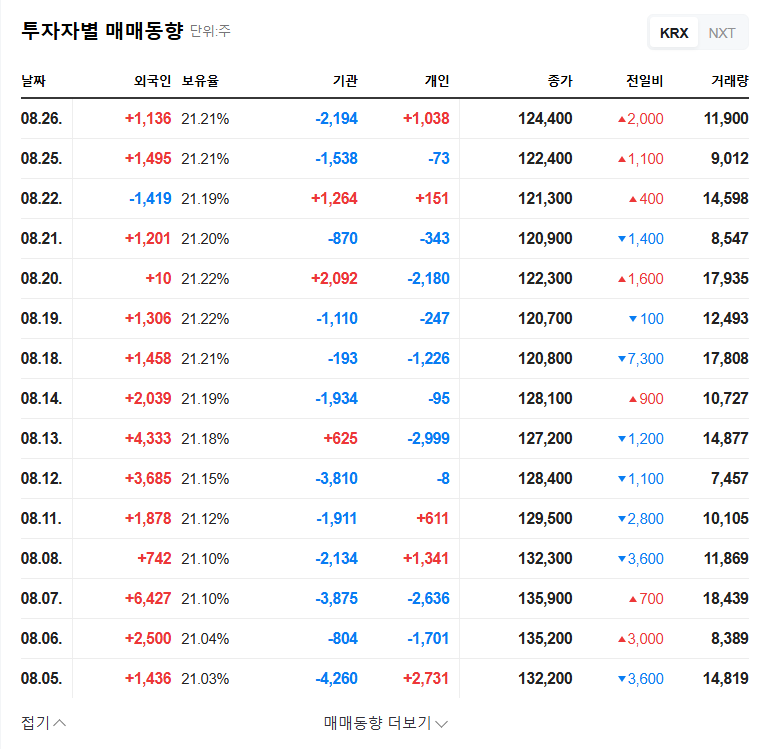

Outlook for Hyosung TNC Stock (KRX: 298020)

The Q3 earnings report will undoubtedly cast a shadow over the company’s stock in the short term. The substantial miss on profitability metrics will likely disappoint the market and could trigger analyst downgrades. The deteriorating balance sheet, particularly the high debt ratio, will further dampen investor sentiment.

The mid-to-long-term outlook is contingent on management’s ability to execute a turnaround. The key catalyst will be the successful integration and scaling of the new special gas business. If this high-margin segment begins contributing meaningfully to the bottom line, it could create a compelling new growth story. However, until then, the company’s value will be tied to its ability to restore profitability in its core businesses and deleverage its balance sheet.

Investor Action Plan: Key Items to Monitor

For current and potential investors in Hyosung TNC (KRX 298020), a cautious and vigilant approach is required. Focus on the following strategic areas:

- •Management’s Turnaround Strategy: Scrutinize the upcoming earnings call and investor communications for a clear, concrete plan to address the profit decline. Vague promises are not enough; look for specific cost-cutting targets and operational efficiency initiatives.

- •Financial Deleveraging Efforts: Monitor the company’s plans to reduce its debt-to-equity ratio. This could include non-core asset sales, capital restructuring, or using operational cash flow to pay down debt. Quarterly financial reports will be crucial.

- •New Business Performance: Track the revenue and profit contribution from the special gas business. Look for signs that the acquisition is integrating successfully and beginning to deliver on its high-margin promise.

- •Core Spandex Market Recovery: Keep an eye on raw material price trends and signs of demand recovery in the global apparel market, which is a primary driver for the core spandex segment.

In conclusion, while the Hyosung TNC Q3 2025 earnings report presents significant challenges, the company’s strategic pivot into new growth areas provides a potential path to recovery. The coming quarters will be critical in demonstrating whether management can navigate these headwinds and transform these challenges into a foundation for future growth.