1. What Happened? – Decision to Extend Deliberations

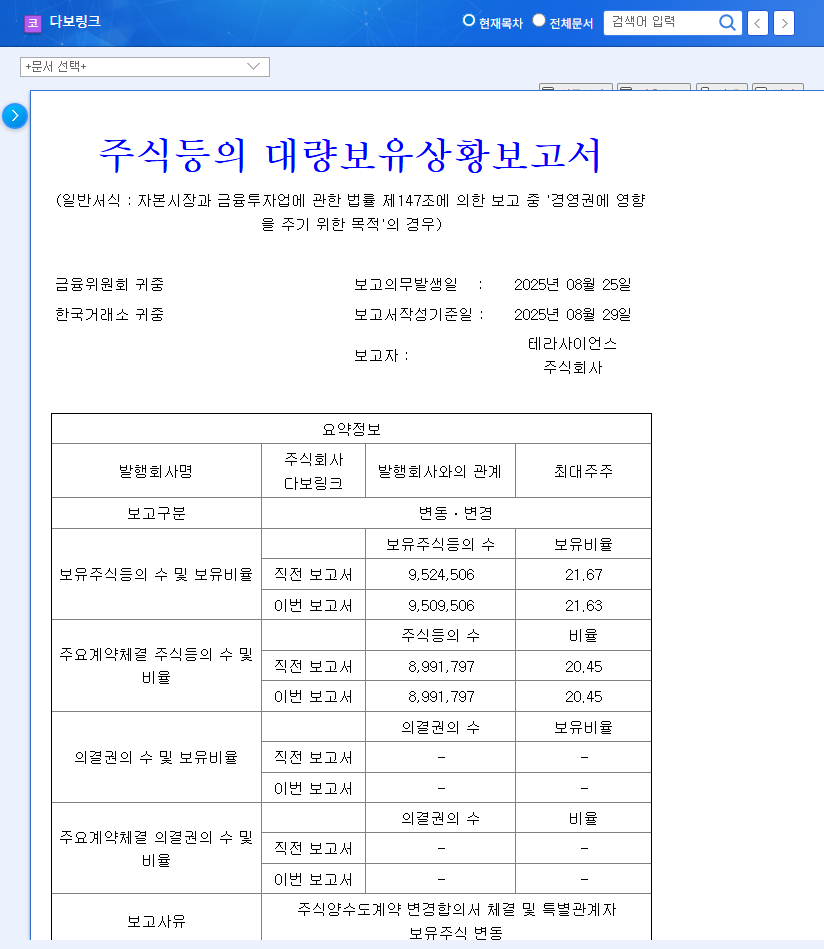

Terascience faced a delisting crisis due to an auditor’s disclaimer of opinion and other financial issues. On September 19, 2025, the Corporate Review Committee decided to extend deliberations until October 31st. The final decision regarding delisting will be made after reviewing the company’s progress on its improvement plan. October 31st is Terascience’s deadline.

2. Why Did This Happen? – Deteriorating Fundamentals and Auditor’s Disclaimer

Terascience is grappling with significant fundamental problems, including struggling existing businesses, uncertain new ventures, consecutive disclaimers of opinion from external auditors, and capital impairment. The auditor’s disclaimer raises serious concerns about the company’s accounting transparency and financial soundness.

3. What’s Next? – Uncertainty and Opportunity Coexist

- Increased Uncertainty: The successful implementation of the improvement plan by October 31st remains uncertain, potentially leading to increased stock price volatility.

- Trading Suspension Possibility: If the improvement plan is deemed insufficient, trading suspension and delisting are highly probable.

- Dampened Investor Sentiment: Despite the extension, investor unease is expected to persist.

However, if Terascience successfully implements its plan and improves its fundamentals by October 31st, this crisis could present a turnaround opportunity.

4. What Should Investors Do? – Prudent Approach and Risk Management are Crucial

Investing in Terascience requires extreme caution. Investors must closely monitor the implementation of the improvement plan until October 31st and prepare for the worst-case scenario (delisting). It’s vital to avoid being swayed by short-term price fluctuations and focus on the long-term prospects of the company’s fundamental improvement.

Frequently Asked Questions

Why is Terascience facing a delisting crisis?

Due to serious financial problems, including an auditor’s disclaimer of opinion and capital impairment, combined with struggling existing businesses and uncertain new ventures.

What does the extension of deliberations mean?

It means immediate delisting is avoided, but the final decision will be made on October 31st, after reviewing the company’s progress on its improvement plan.

What should investors do?

Investors should exercise extreme caution, closely monitor the implementation of the improvement plan, and diligently manage risk.