The recent announcement regarding the VIOL Co., Ltd. delisting application from the Korea Exchange has sent ripples through the investment community. As a leader in the aesthetic medical device market, VIOL’s move to go private marks a pivotal moment for the company and, most importantly, its minority shareholders. This decision, initiated on November 6, 2025, requires careful consideration and an informed strategy from investors holding its stock.

This comprehensive guide will break down every aspect of the VIOL Co., Ltd. delisting process. We will explore the timeline, the reasons behind the move, the specific protection measures for shareholders, and a step-by-step action plan to help you navigate this transition and protect your investment.

Understanding the VIOL Co., Ltd. Delisting Timeline

To fully grasp the situation, it’s essential to understand the sequence of events that led to this point. The process has been methodical, reflecting a clear strategic objective by the new majority ownership.

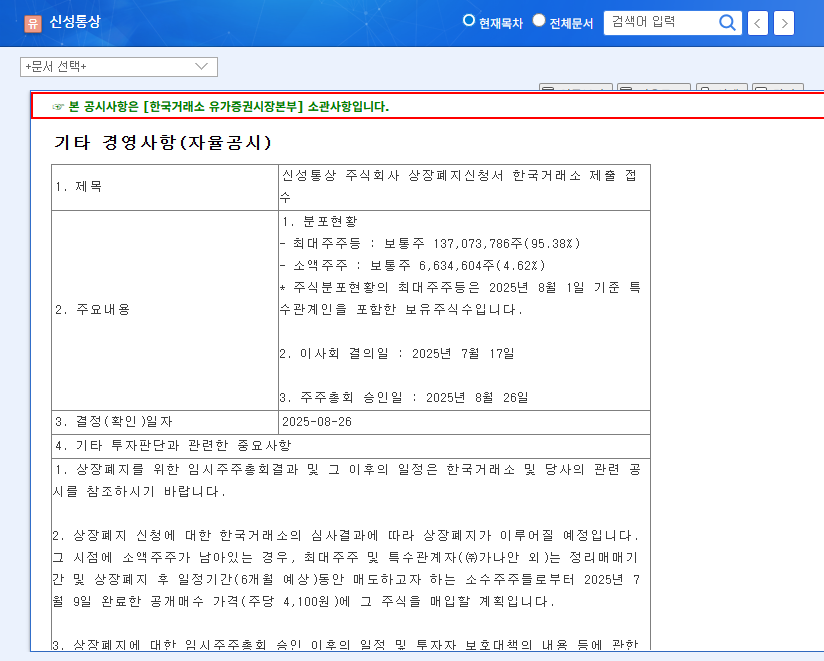

- •September 29, 2025: The Board of Directors officially approves the resolution to delist the company.

- •November 6, 2025: An extraordinary general meeting of shareholders is held, where the delisting plan receives the necessary approval.

- •November 6, 2025: Immediately following shareholder approval, VIOL Co., Ltd. formally submits its delisting application to the Korea Exchange. This move was documented in an Official Disclosure on the DART system.

Why is VIOL Going Private?

The primary driver behind the delisting is a strategic shift following a change in majority ownership. VIG Partners, a leading private equity firm, established Vienna Investment Purpose Company to acquire a controlling stake from the previous largest shareholder, DMS Co., Ltd. Their goal is to take VIOL private and incorporate it as a wholly-owned subsidiary.

By going private, VIOL can achieve several strategic advantages:

- •Long-Term Focus: Freed from the pressure of quarterly earnings reports and public market scrutiny, management can concentrate on long-term growth strategies, research, and development.

- •Management Efficiency: Delisting reduces significant administrative and compliance costs associated with being a publicly traded company.

- •Strategic Flexibility: Private ownership allows for quicker, more decisive actions and investments without the need for extensive public shareholder consensus.

With a minority shareholder ratio of just 2.10%, the path to privatization is significantly streamlined, allowing the new ownership to execute its vision for the company more effectively.

A Detailed VIOL Shareholder Guide: Protection & Options

The company has outlined a clear two-phase plan to protect the interests of its remaining minority shareholders. Understanding these options is critical to making an informed decision.

Phase 1: Public Tender Offer

During the grace period for trading (정리매매 기간) before the final delisting, VIOL will conduct a public tender offer. This is an official offer to purchase shares from minority shareholders at a fixed price.

- •Offer Price: 12,500 KRW per common share.

- •Purpose: To provide a clear and immediate liquidity event for shareholders who wish to exit their position at a predetermined price before the stock becomes illiquid.

Phase 2: Comprehensive Share Exchange

For any shareholders who do not participate in the tender offer or sell on the open market during the grace period, a second mechanism will be available after the company is officially delisted.

The comprehensive share exchange is a legal procedure that will convert all remaining minority shares into cash or shares of the parent company, effectively completing the process of making VIOL a wholly-owned subsidiary. The terms will be based on a fair valuation as prescribed by law, but it’s crucial to review the specifics when announced. For more details on these financial instruments, resources like Investopedia offer excellent explanations.

Your Action Plan: What Should Shareholders Do?

The VIOL Co., Ltd. delisting presents a critical juncture. Here is a recommended course of action:

- 1. Stay Informed: Actively monitor all official announcements from VIOL and the Korea Exchange. Pay close attention to the exact dates of the grace period for trading and the tender offer period. Missing these windows can complicate your exit strategy.

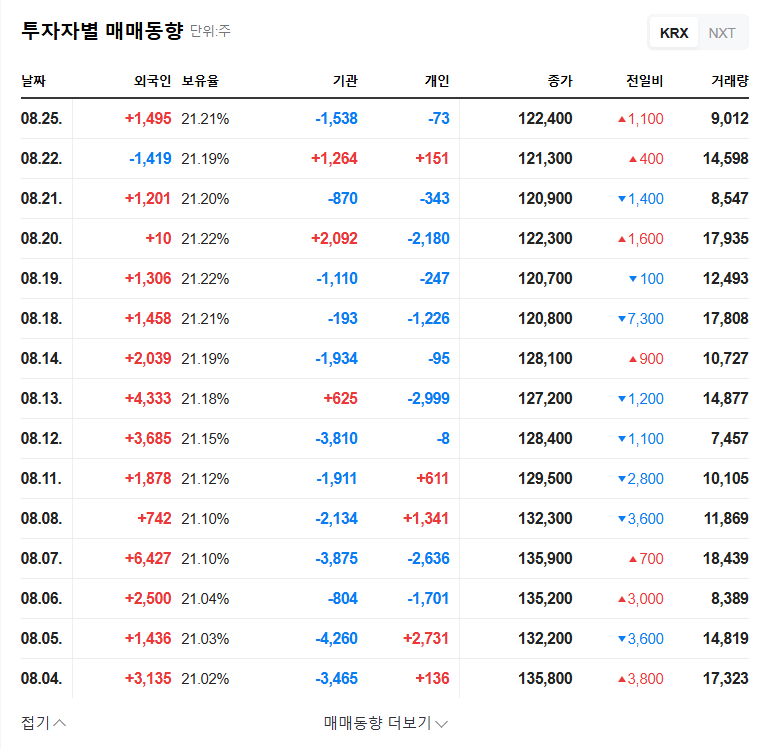

- 2. Evaluate the Offer: Assess whether the 12,500 KRW per share price is fair value for your investment. Consider the company’s financial performance (stable revenue growth but decreased operating profit), its position in the aesthetic medical device market, and its future potential as a private entity.

- 3. Decide Your Strategy: Based on your evaluation, choose one of three paths: sell during the grace period, accept the public tender offer, or hold your shares and participate in the post-delisting comprehensive share exchange. Each has different implications for timing and liquidity.

- 4. Seek Professional Advice: If you are uncertain, consulting with a financial advisor is highly recommended. They can provide personalized advice based on your portfolio and financial goals, ensuring you make the optimal decision for your circumstances.

Ultimately, the decision to delist is a strategic one aimed at fostering long-term, sustainable growth for VIOL Co., Ltd. For minority shareholders, the key is to remain proactive, well-informed, and to make a deliberate choice that aligns with their investment objectives.