E8 Lands $800 Million Contract with Samsung: What Happened?

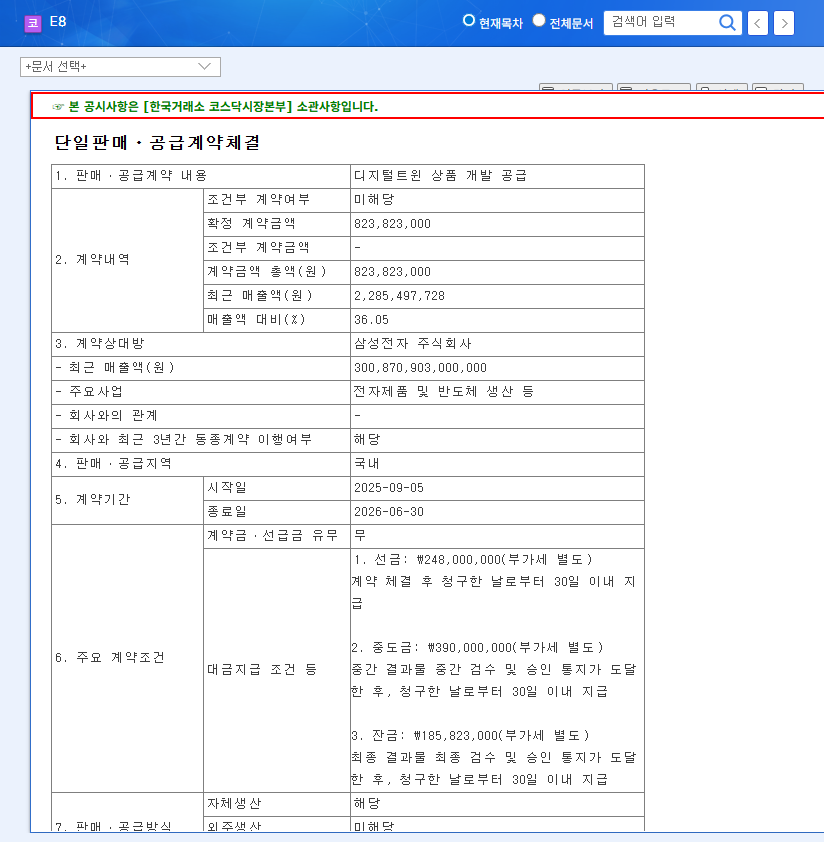

E8 announced on September 5, 2025, that it has secured an $800 million contract with Samsung Electronics for the ‘Development and Supply of Digital Twin Products’. The contract period is nine months, ending on June 30, 2026.

What Does This Contract Mean for E8?

This contract signifies more than just increased revenue for E8.

- Significant Revenue Boost: The $800 million contract represents 36.05% of E8’s 2024 revenue and is expected to contribute significantly to its 2025 performance. It even surpasses E8’s first-half 2025 revenue of $930 million.

- Enhanced Credibility: The partnership with Samsung validates E8’s technology and business capabilities. It’s expected to increase the likelihood of securing further large-scale contracts.

- Leading the Digital Twin Market: Collaboration with Samsung will further strengthen E8’s digital twin technology and enhance its market competitiveness.

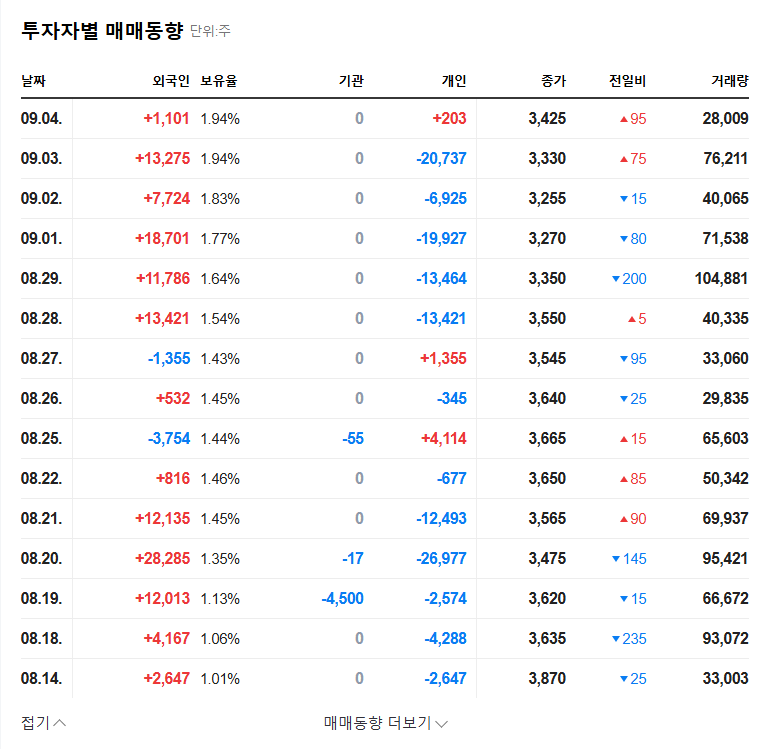

What Should Investors Do?

This contract is a positive signal, demonstrating E8’s long-term growth potential. We maintain a ‘buy’ rating and recommend monitoring the contract’s implementation and any further large-scale contract wins.

- Key Monitoring Points:

- Contract implementation and profitability

- Progress of digital twin product development

- Further large-scale contract wins

- Improvements in financial structure

※ Disclaimer: This analysis is not investment advice. Investment decisions are the sole responsibility of the investor.

What is the size of the contract between E8 and Samsung?

$800 million.

How much will this contract contribute to E8’s revenue?

It represents 36.05% of E8’s 2024 revenue and is expected to make a substantial contribution to its 2025 performance.

What is E8’s main business?

Developing digital twin and simulation technologies.