1. What Happened?

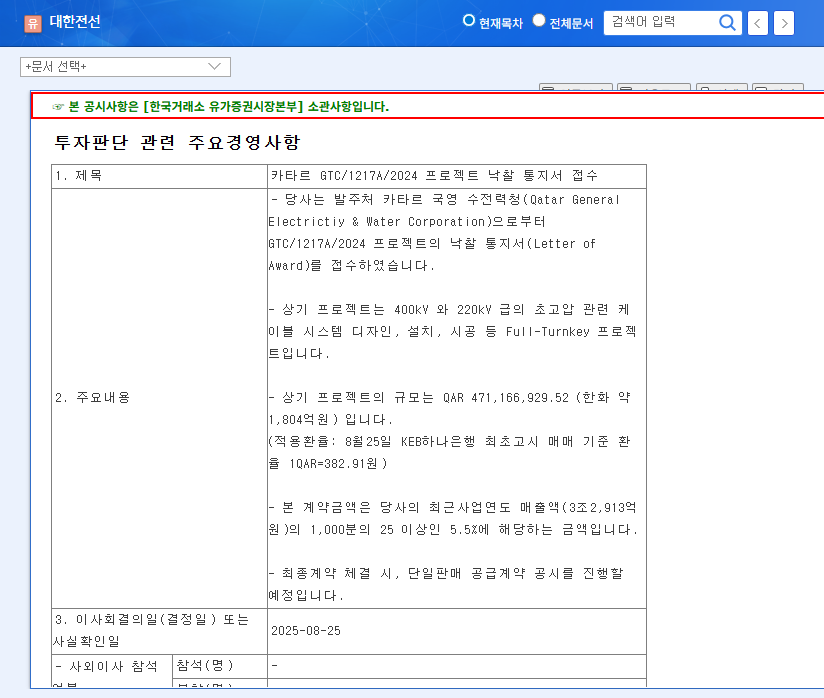

Taihan Cable secured a $135 million turnkey project from Qatar General Electricity & Water Corporation (Kahramaa) for a 400kV and 220kV high-voltage cable system. This represents 5.5% of Taihan Cable’s revenue in the latest fiscal year, marking a substantial win.

2. Why Does It Matter?

This project marks a significant step in Taihan Cable’s global expansion and business diversification strategy. Not only does it establish a foothold in the Middle Eastern market, but securing a full turnkey project validates the company’s technical capabilities and project management expertise. This win increases the likelihood of securing similar projects in the future and positively impacts long-term growth prospects.

3. What Does This Mean for Taihan Cable?

Positive Impacts:

- Increased revenue and potential for improved profitability

- Expansion into new markets and geographic diversification

- Validation of technical expertise and enhanced brand image

- Improved investor sentiment and potential stock price momentum

Potential Risks:

- Volatility in raw material prices and exchange rates

- Unforeseen challenges during project execution

While short-term financial burden is possible, Taihan Cable’s sound financial position suggests this is unlikely to be a major concern.

4. What Should Investors Do?

While this contract presents a positive catalyst for Taihan Cable, investors should consider several factors before making investment decisions.

- Confirmation of the final contract signing and its terms

- Monitoring fluctuations in raw material prices and exchange rates

- Analysis of competitor activity and market conditions

Overall, this contract win is a positive indicator of Taihan Cable’s growth potential. However, investment decisions should always be approached with caution, and careful consideration of the factors mentioned above is crucial.

FAQ

Q: What is the project’s value?

A: The project is valued at $135 million, representing 5.5% of Taihan Cable’s revenue in the last fiscal year.

Q: Will this project positively impact Taihan Cable’s stock price?

A: In the short term, it could act as a positive catalyst for the stock price. However, the long-term stock performance will depend on the actual project execution and market conditions.

Q: What should investors be cautious about?

A: Investors should consider the final contract’s terms, the volatility of raw material prices and exchange rates, and potential risks associated with project execution.