1. What happened at SY?

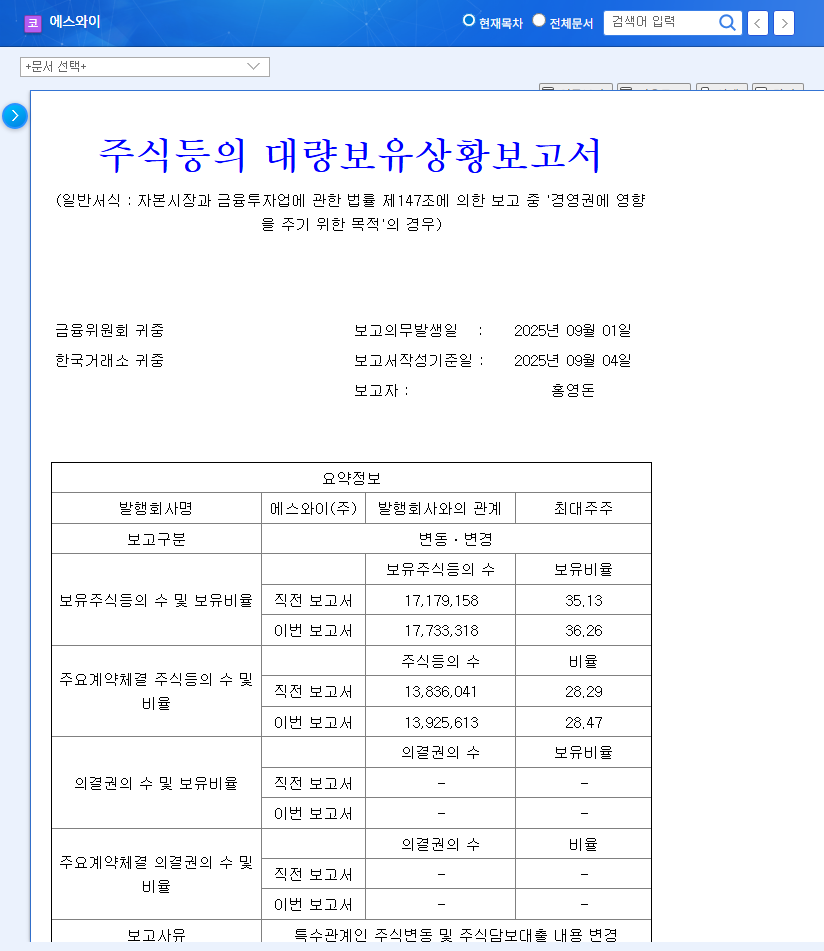

On September 5, 2025, SY’s representative reporter, Hong Young-don, increased his stake from 35.13% to 36.26% for management influence. The stake increase was achieved through open market purchases by related parties.

2. Why the stake increase?

It’s interpreted as a demonstration of their commitment to enhance management stability and long-term corporate value through strengthened management control. It’s also possible that this reflects an internal assessment that the current stock price is undervalued.

3. So, what will happen to the stock price?

Positive Factors:

- Expectation of management stability through strengthened control

- Potential improvement in internal investment sentiment

Negative Factors:

- Continued sluggish performance in the first half of 2025 (sharp decline in sales, operating loss)

- Stagnant sandwich panel market and volatility in raw material prices

- Risks from exchange rate and interest rate fluctuations

In conclusion, while the reinforcement of management is a positive sign, overcoming the short-term sluggish performance is key.

4. What should investors do?

- Check for visibility of performance improvement (sales recovery, operating profit turnaround)

- Whether cost management and price competitiveness are maintained

- Check financial soundness (debt ratio, debt dependence)

- Monitor changes in macroeconomic indicators (interest rates, exchange rates, construction market)

- Evaluate response strategies to changes in the competitive environment

Careful investment decisions are necessary, focusing on mid- to long-term business strategies and the potential for performance improvement.

What is SY’s main business?

SY manufactures and sells building materials such as sandwich panels and deck plates.

What factors recently affected SY’s stock price?

The main factors are the increase in stake for management reinforcement and the sluggish performance in the first half of 2025.

What should I be aware of when investing in SY?

You should consider the visibility of performance improvement, cost management capabilities, financial soundness, and changes in the macroeconomic environment.