What Happened? Analyzing SW Steel Tech’s Major Shareholder Stake Change

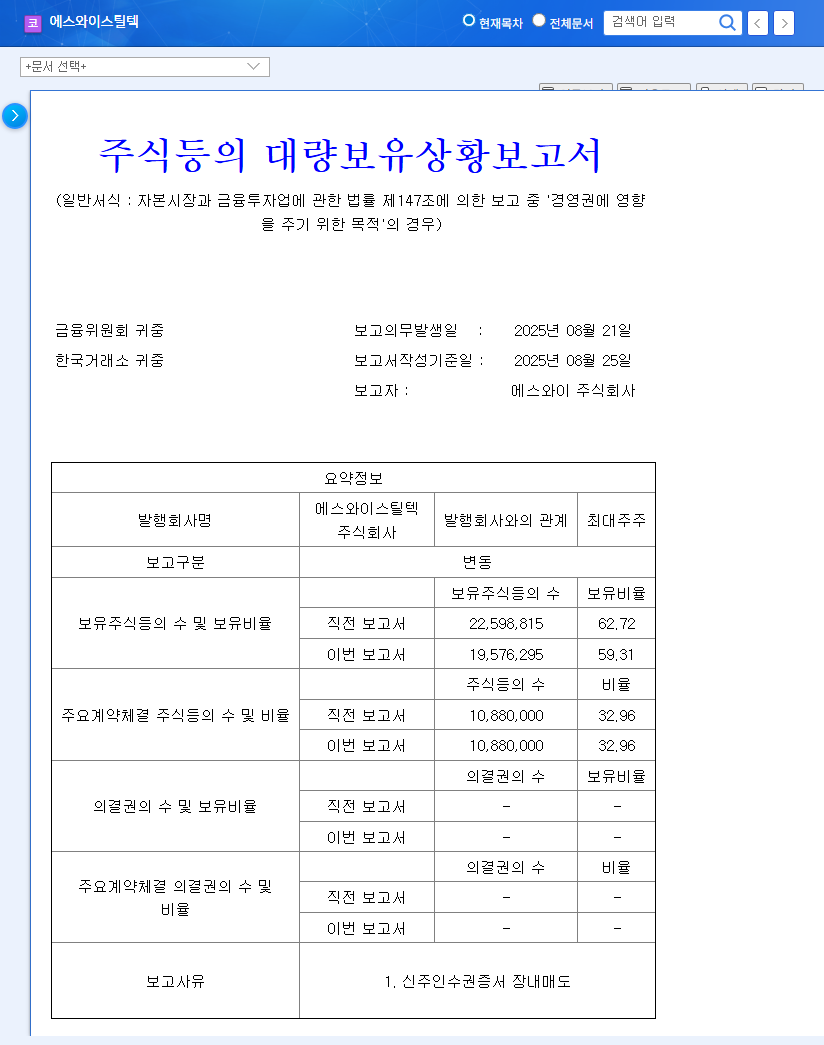

SW Steel Tech’s major shareholder, SW Corp., announced on September 19, 2025, a decrease in its stake from 59.31% to 42.90%. This change is attributed to a combination of factors, including participation in a rights offering, allocation of new shares from a bonus issue, insider selling by related parties, and the expiration of BW warrants.

Why Does It Matter? Impact on Corporate Value and Stock Price

- Management Stability: While 42.90% is still a significant stake for maintaining management control, the decrease raises concerns about potential share dilution or overhang issues.

- Financial Impact: The rights offering allows the company to raise capital and improve its financial structure, but the bonus issue could lead to share dilution.

- Business Impact: Investment of the raised capital in the soundproofing material business could boost growth momentum, but strengthening the competitiveness of the core deck plate business is crucial.

- Stock Price Impact: Short-term uncertainty and potential selling pressure could negatively impact the stock price, but long-term gains are possible depending on business expansion and financial improvements.

What Should Investors Do? Action Plan

- Close Monitoring: Investors should closely monitor the use of proceeds from the rights offering, performance of the soundproofing material business, and changes in key financial indicators.

- Cautious Investment Decisions: Given the current uncertainties, it’s advisable to wait for further information and observe the company’s business plan execution before making investment decisions. The reversal of the declining profitability trend is a key factor to consider.

FAQ

What caused the change in SW Steel Tech’s major shareholder stake?

A combination of factors, including participation in a rights offering, allocation of new shares from a bonus issue, insider selling by related parties, and expiration of BW warrants.

How will this stake change affect the stock price?

Short-term uncertainty may lead to a price decline, while long-term gains are possible depending on business expansion and financial improvements.

What should investors do?

Closely monitor the company’s actions and financials, and make cautious investment decisions.