1. What Happened? Background of the Stake Increase

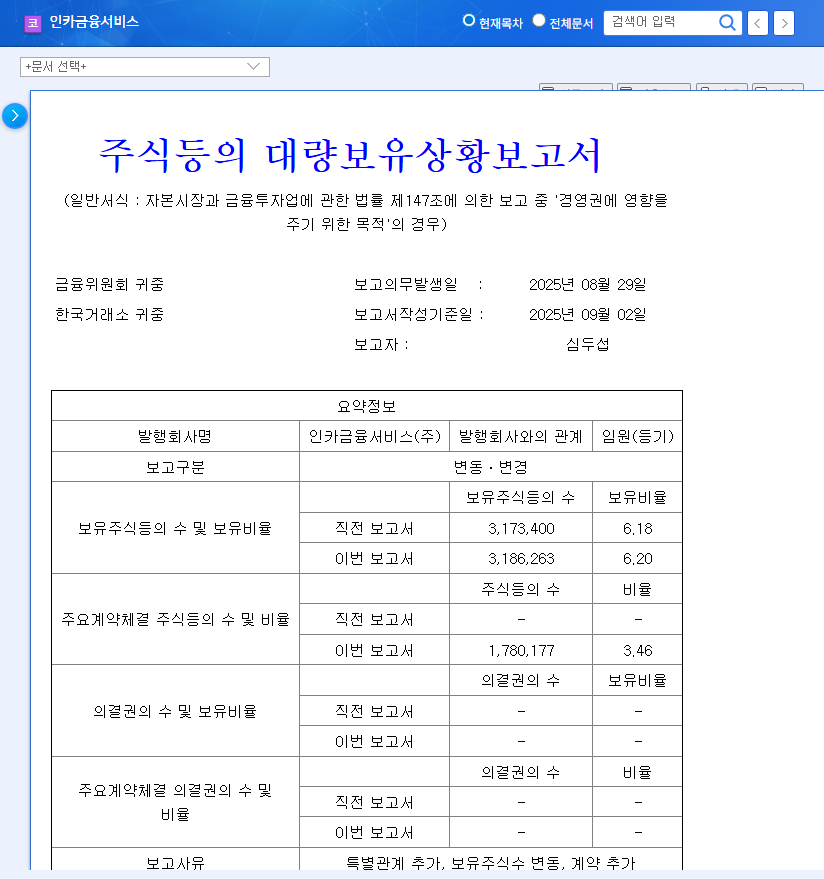

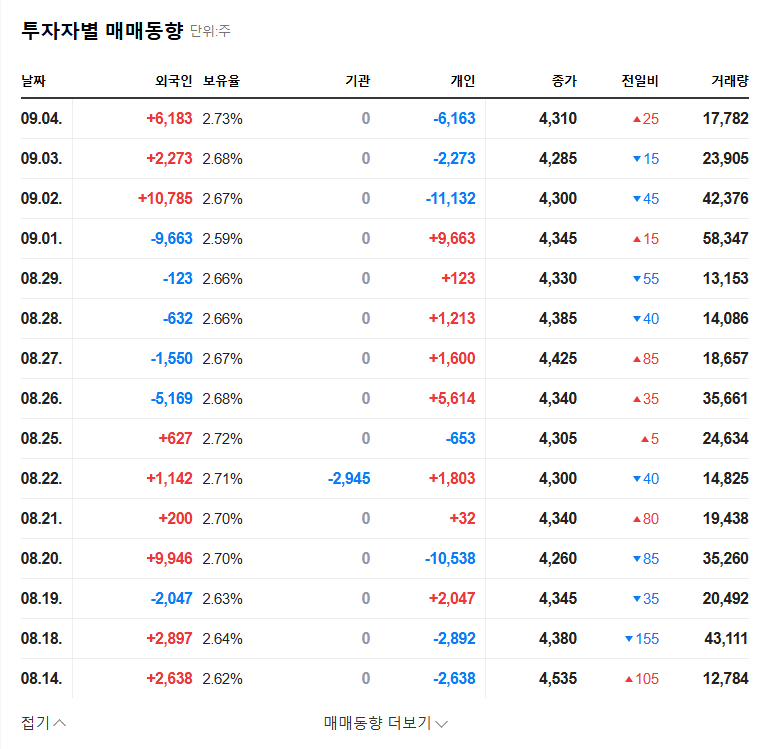

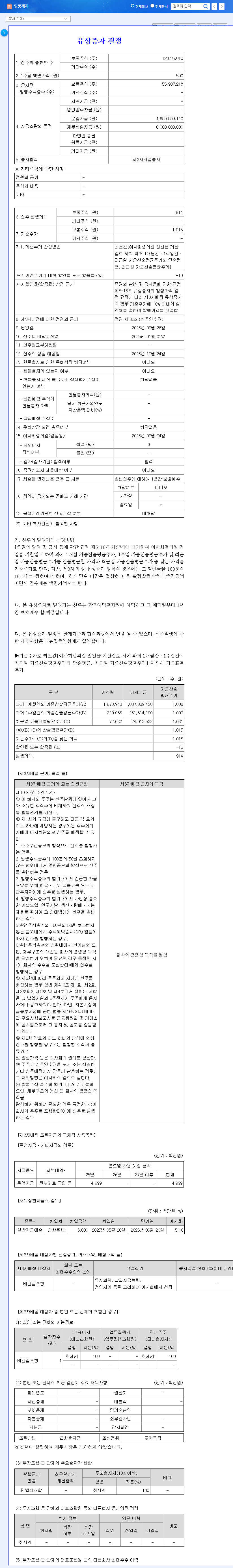

On September 5, 2025, Inka Financial Services announced that the stake held by CEO Byung-chae Choi and related parties had slightly increased from 41.33% to 41.34%. This resulted from Kyung-sook Lee and Kyung-hee Lee purchasing 1,000 and 6,000 common shares, respectively, through on-market transactions.

2. Why Is This Important? Implications and Potential Impact of the Stake Increase

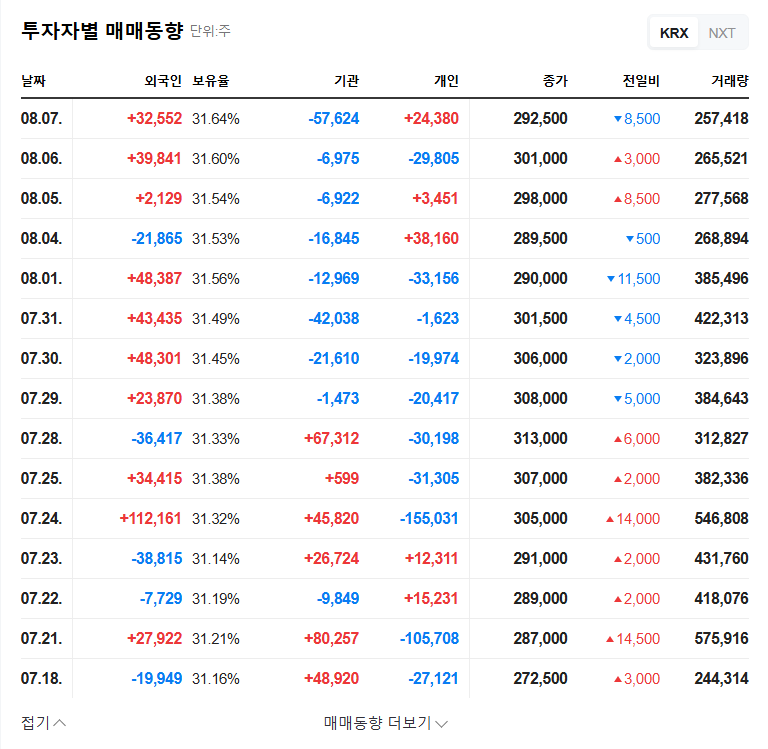

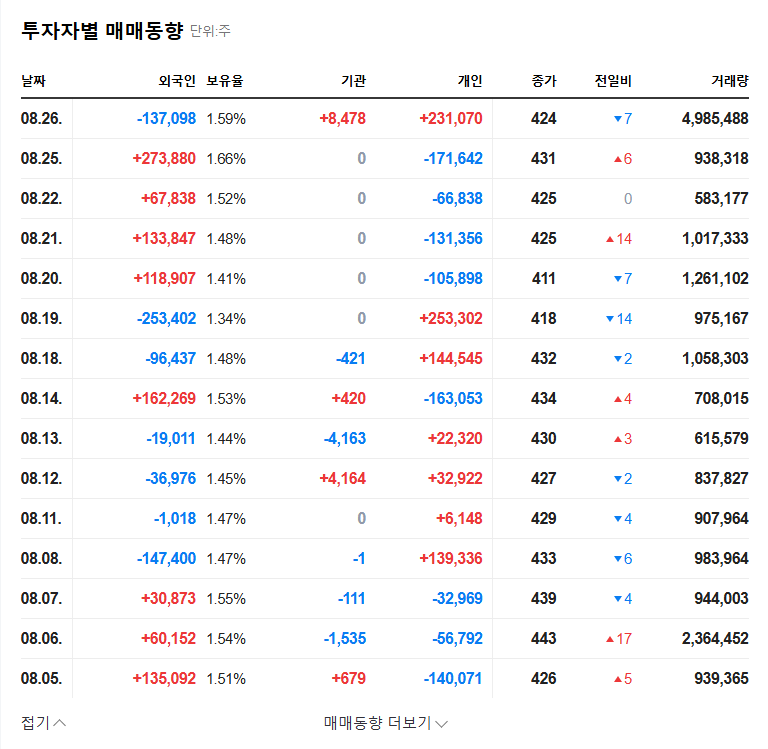

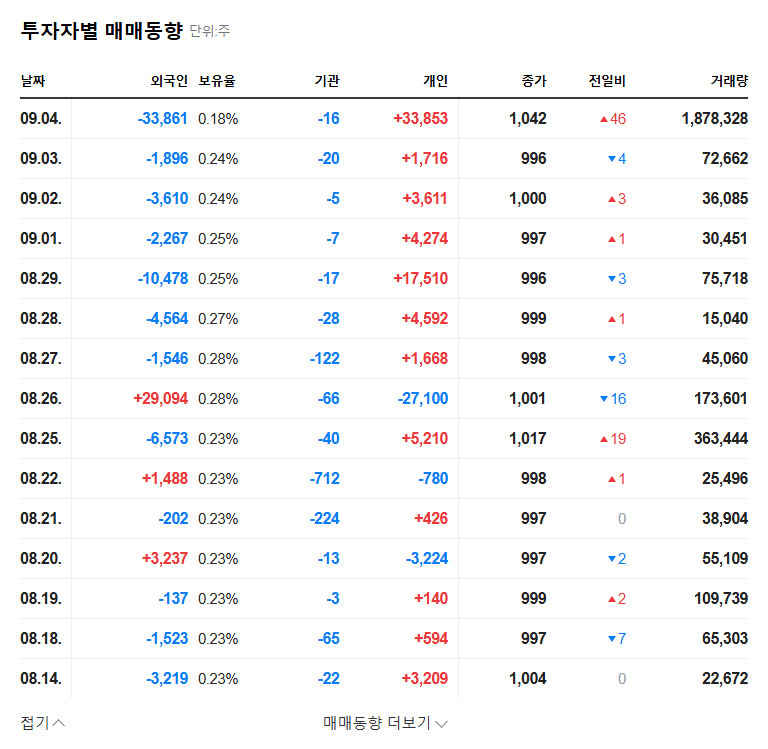

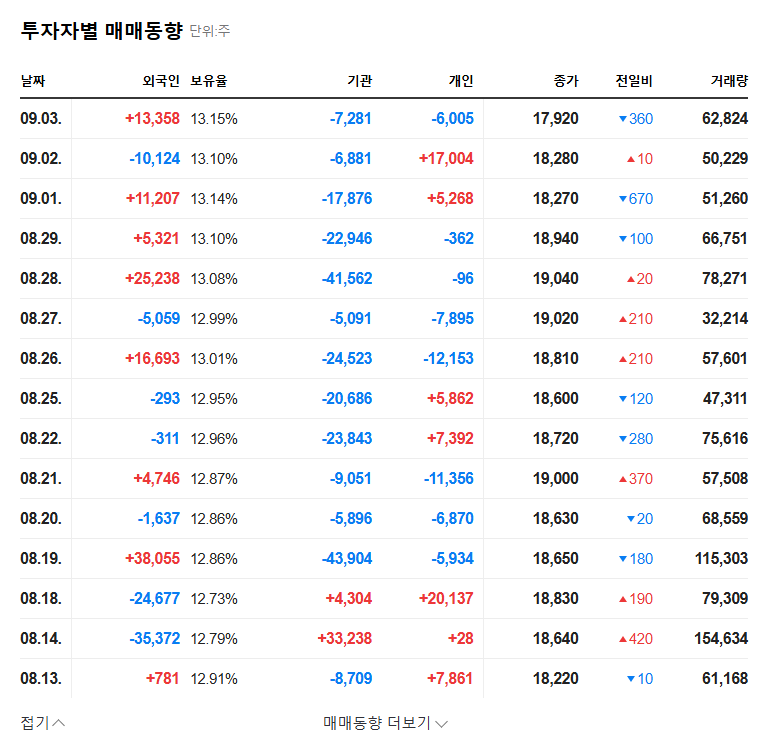

An increase in the major shareholder’s stake suggests a commitment to strengthening management control and generally has a positive impact on stock prices. Considering the recent upward trend in Inka Financial Services’ stock price, this stake increase could further reinforce the upward momentum. However, the still-high debt-to-equity ratio could act as a risk factor. The motives behind the purchases by Kyung-sook Lee and Kyung-hee Lee are unclear, but given the small volume, their impact is expected to be minimal.

3. About Inka Financial Services: Company Fundamentals and Market Analysis

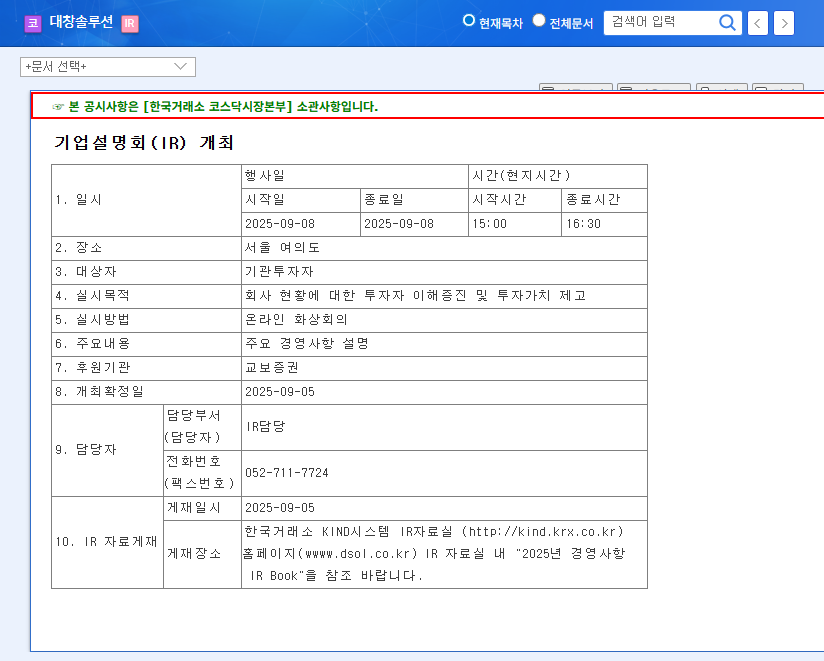

Inka Financial Services recorded consolidated revenue of KRW 468.9 billion in the first half of 2025, an 18.3% increase year-on-year, and its market capitalization surpassed KRW 600 billion. The company maintains a stable revenue structure centered around long-term insurance and is securing future growth engines through a diversified subsidiary business portfolio and investments in IT technology. However, the high debt-to-equity ratio requires continuous management. The current market situation is influenced by various factors such as exchange rates, interest rates, and oil prices, and interest rate fluctuations can impact Inka Financial Services’ financial soundness.

4. What Should Investors Do? Investment Points and Action Plan

- Strengths: Stable business foundation, growth potential, management’s commitment to responsible management, positive stock price trend

- Risks: High debt-to-equity ratio

- Action Plan: Pay close attention to future earnings announcements and efforts to improve financial soundness

While this stake increase can be interpreted as a positive signal, investment decisions should be made cautiously. Continuously monitor the company’s financial situation and market conditions, and make investment decisions based on your investment objectives and risk tolerance.

FAQ

Does an increase in the major shareholder’s stake always have a positive impact on the stock price?

While generally interpreted as a positive signal, this is not always the case. Various factors, including the company’s fundamentals and market conditions, must be considered comprehensively.

How should Inka Financial Services address its high debt-to-equity ratio?

The company should continue its efforts to lower its debt-to-equity ratio by reducing debt and increasing capital. Investors should continuously monitor the company’s efforts to improve its financial soundness.

How can I invest in Inka Financial Services?

You can open a stock trading account and purchase Inka Financial Services shares through a securities company’s HTS or MTS. Thorough information gathering and analysis are necessary before investing.