KSP’s ₩20 Billion Convertible Bond Issuance: What’s Happening?

On September 9, 2025, KSP announced its decision to issue ₩20 billion worth of convertible bonds (CBs). The issuance will be private, with a conversion price of ₩6,830, and payment due on September 17th. Key investors include Kiwoom Securities, JB Woori Capital, IBKC-JB Woori-Life Mezzanine New Technology Investment Association No. 1, and Shinhan Investment Corp.

Why Issue Convertible Bonds?

While no official announcement has been made regarding the specific purpose, convertible bonds are typically used for various reasons including securing operating funds, research and development, new business investments, facility investments, or debt repayment. Considering KSP’s recent underperformance in the first half of 2025, it’s likely that the funds will be used for improving financial structure and securing new growth engines.

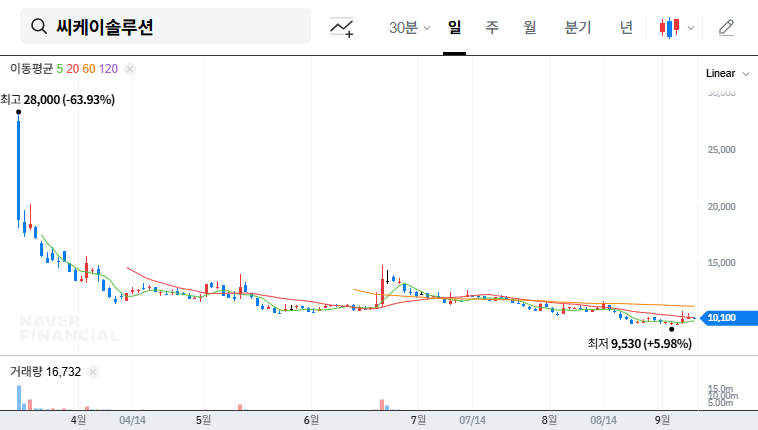

Potential Impact on Stock Price

- Positive Impact: The ₩20 billion in funding could improve KSP’s financial structure and enable new business investments. The announcement itself could also act as a short-term catalyst for stock price appreciation.

- Negative Impact: If the CBs are converted into shares, it could lead to stock dilution, putting downward pressure on the share price. The possibility of conversion price adjustments in case of stock price decline is also a concern. Furthermore, the issuance coinciding with poor first-half earnings could negatively impact investor sentiment.

What Should Investors Do?

Currently, the investment outlook for KSP is “Neutral.” Investors should weigh both the potential for growth enabled by the new funding and the risk of stock dilution. Before making any investment decisions, it’s crucial to carefully consider the specific plans for the funds raised, the potential for recovery in the shipbuilding industry, and KSP’s future earnings potential.

Frequently Asked Questions (FAQ)

What are Convertible Bonds (CBs)?

Convertible bonds are a type of debt security that gives the holder the option to convert the bond into a predetermined number of shares of the issuing company’s common stock before maturity. Investors can receive interest payments like a bond or convert to stock for potential capital gains if the stock price rises.

What is the purpose of KSP’s CB issuance?

While no official announcement has been made, common uses include securing operating funds, R&D investment, new business ventures, facility investments, or debt repayment. Considering KSP’s underperformance in the first half of 2025, it is likely intended for improving financial structure and pursuing new growth opportunities.

How might the CB issuance affect the stock price?

The potential for business expansion through the raised capital is positive. However, conversion to shares could lead to dilution, potentially putting downward pressure on the stock price. The possibility of conversion price adjustments should also be considered.

What should investors consider?

It’s important to consider the intended use of funds, the potential recovery of the shipbuilding industry, KSP’s future earnings potential, and other relevant factors before making investment decisions.