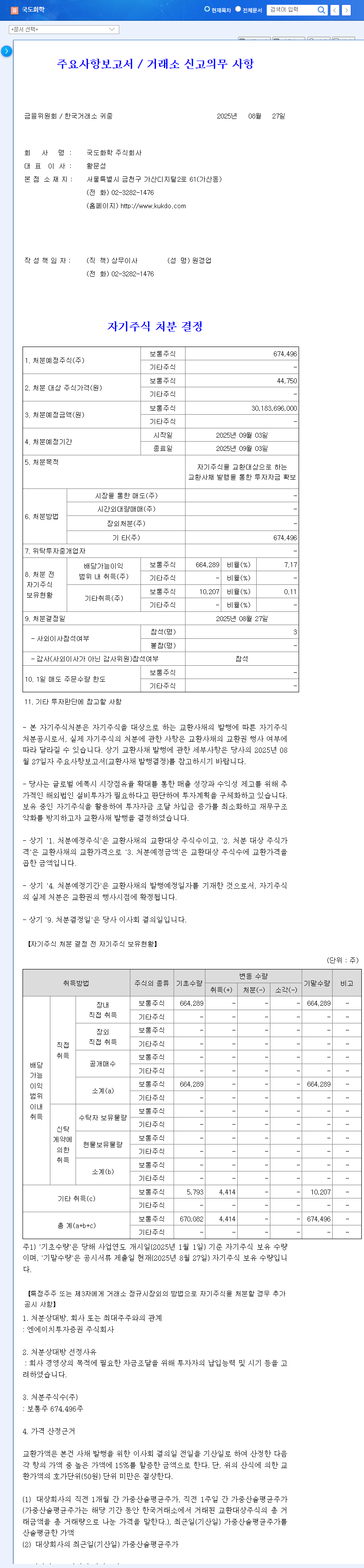

1. What Happened?

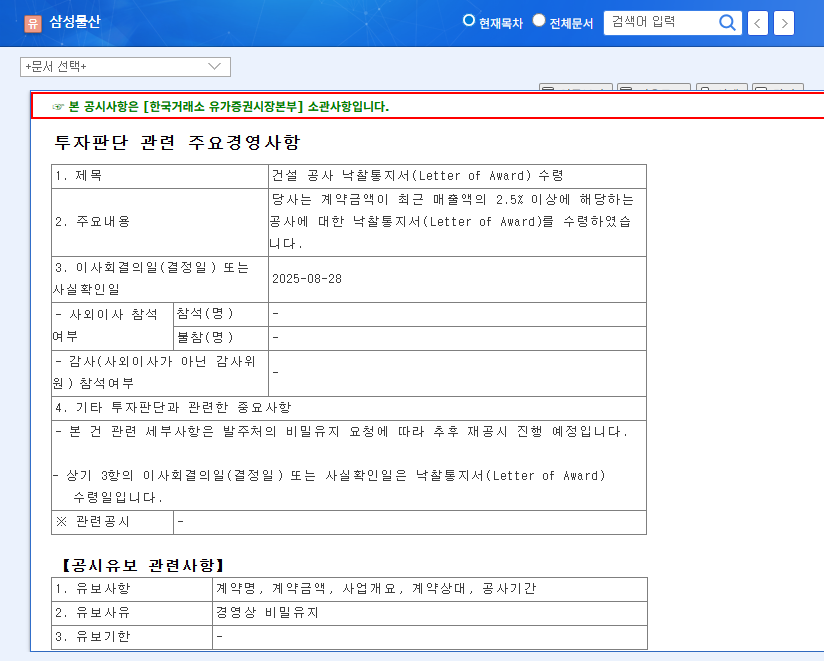

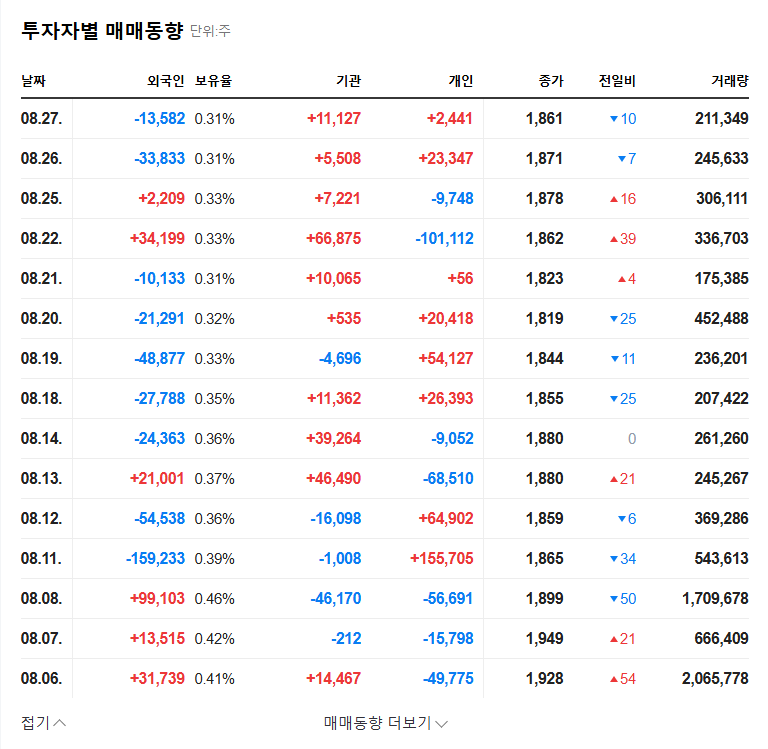

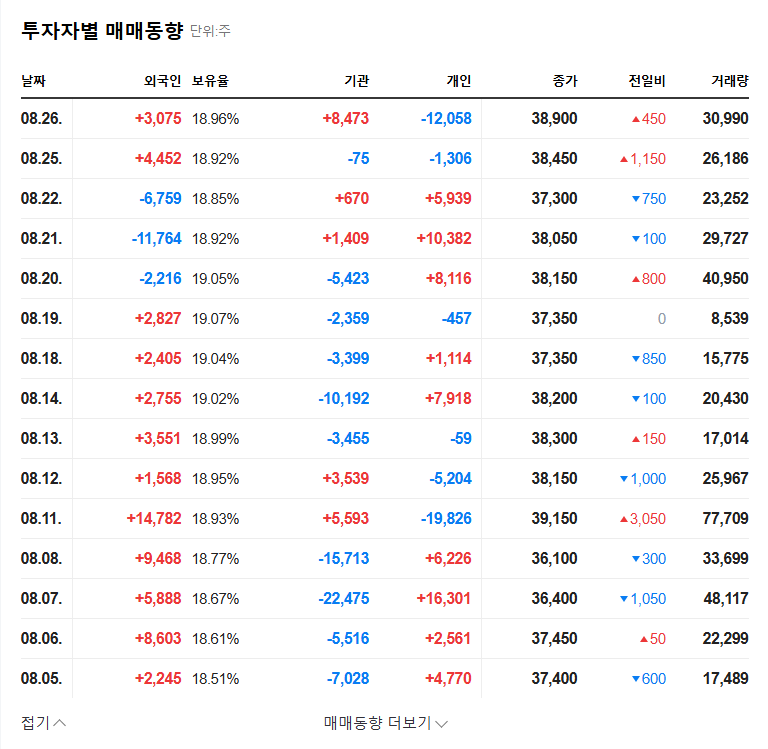

Samsung C&T received a Letter of Award (LOA) for a major construction project on August 29, 2025. The project’s scale, exceeding 2.5% of Samsung C&T’s recent revenue, is expected to significantly contribute to future sales growth.

2. Why Does It Matter?

This win signifies more than just a single contract. Firstly, it is projected to contribute to Samsung C&T’s stable growth by boosting future revenue and strengthening its business portfolio. Secondly, securing this large-scale project amidst fierce competition demonstrates Samsung C&T’s strong business competitiveness.

3. What’s the Impact?

- Positive Effects: Increased Revenue, Diversified Business Portfolio, Enhanced Competitiveness

- Potential Risks: Uncertainty of Actual Revenue Generation Timing, Project Profitability Fluctuations, Large-Scale Project Management Risks

- External Factors: Volatility in Raw Material Prices and Exchange Rates, Potential Global Economic Downturn

Despite the positive outlook, investors should be aware that actual project commencement and completion may take time, and profitability may fluctuate due to external factors.

4. What Should Investors Do?

Investors should consider the following:

- Review project details (contract terms, projected profitability, etc.)

- Monitor macroeconomic indicators (exchange rates, oil prices, interest rates, etc.)

- Analyze and compare competitors.

- Make investment decisions from a long-term perspective.

It is essential to focus on the company’s long-term growth potential rather than being swayed by short-term stock price fluctuations. Consult with a financial advisor for further information.

Frequently Asked Questions

Q: Will this contract positively impact Samsung C&T’s stock price?

A: It is expected to provide positive momentum in the short term, but the long-term impact depends on the successful execution of the project.

Q: What are the key factors to consider when investing?

A: Investors should consider changes in the macroeconomic environment, project profitability, and the company’s project management capabilities.

Q: Where can I find more information?

A: Refer to Samsung C&T’s investor relations materials, securities firm analysis reports, and financial information disclosure websites.