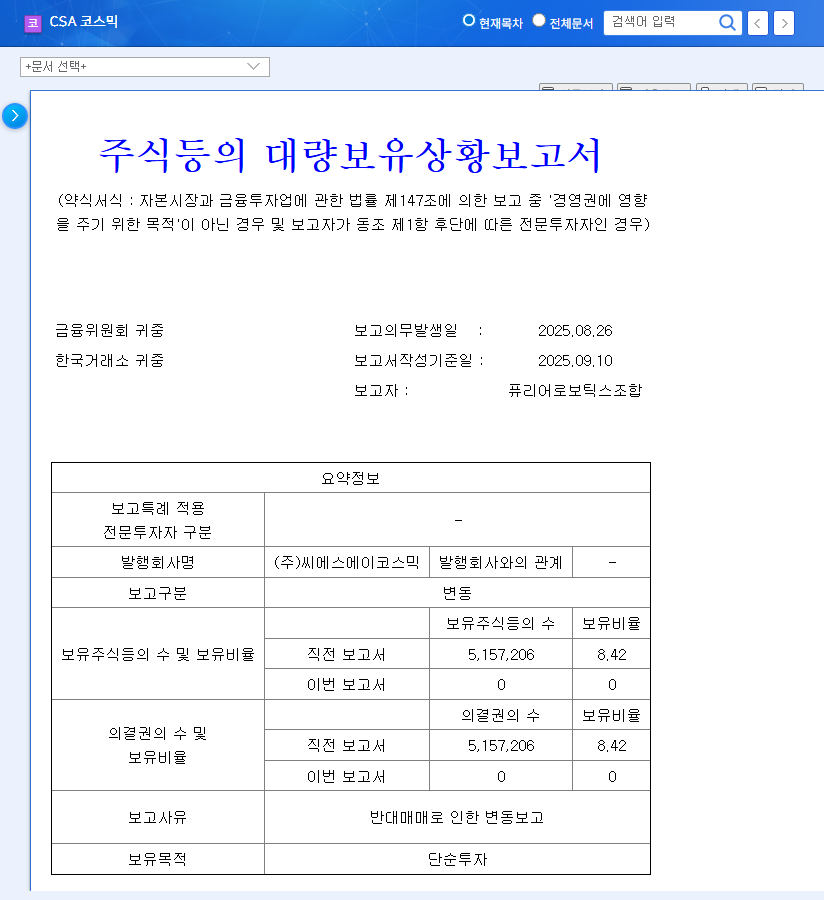

Fourier Robotics Divests Entire 8.42% Stake in CSA Cosmic – What Happened?

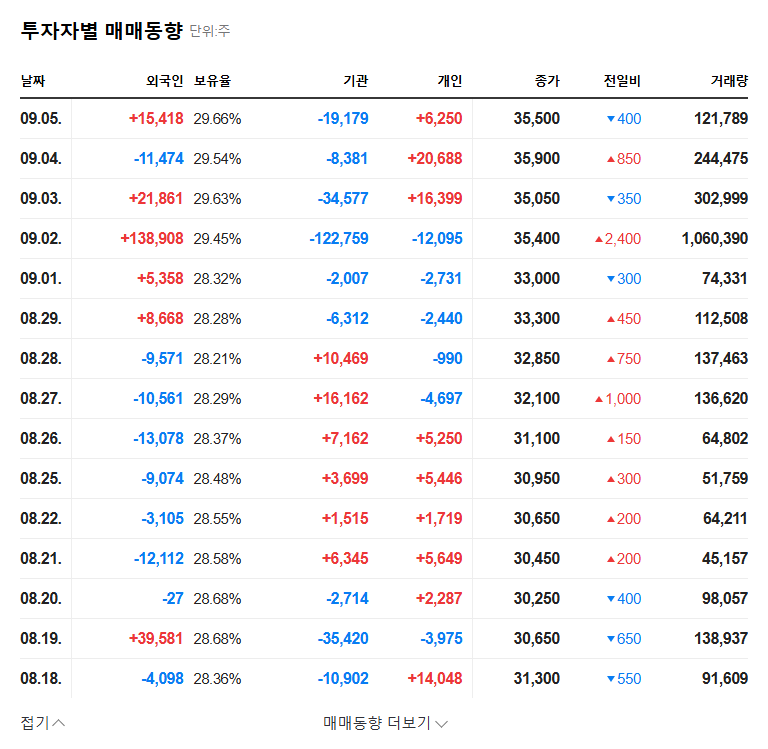

Fourier Robotics sold its entire 5,157,206 shares (8.42%) of CSA Cosmic stock between August 26th and September 5th, 2025. Reported as a “forced sale,” this divestment is presumed to have occurred during the liquidation of collateralized shares.

Background of the Sale and Its Impact on CSA Cosmic

While the divestment itself doesn’t change CSA Cosmic’s fundamentals, the sale of such a significant stake (8.42%) could create a short-term supply-demand imbalance, leading to downward pressure on the stock price. Coupled with CSA Cosmic’s recent struggles with declining sales, worsening profitability, and management changes, this event could negatively impact investor sentiment.

What Should Investors Do? – Key Investment Points

- Beware of Increased Short-Term Volatility: The stock price may experience heightened volatility as the market absorbs the large volume of sold shares. Caution is advised for short-term investors.

- Monitor Fundamental Improvements: CSA Cosmic’s long-term investment value hinges on strengthening its core business competitiveness and improving profitability. Continuous monitoring of relevant indicators is crucial.

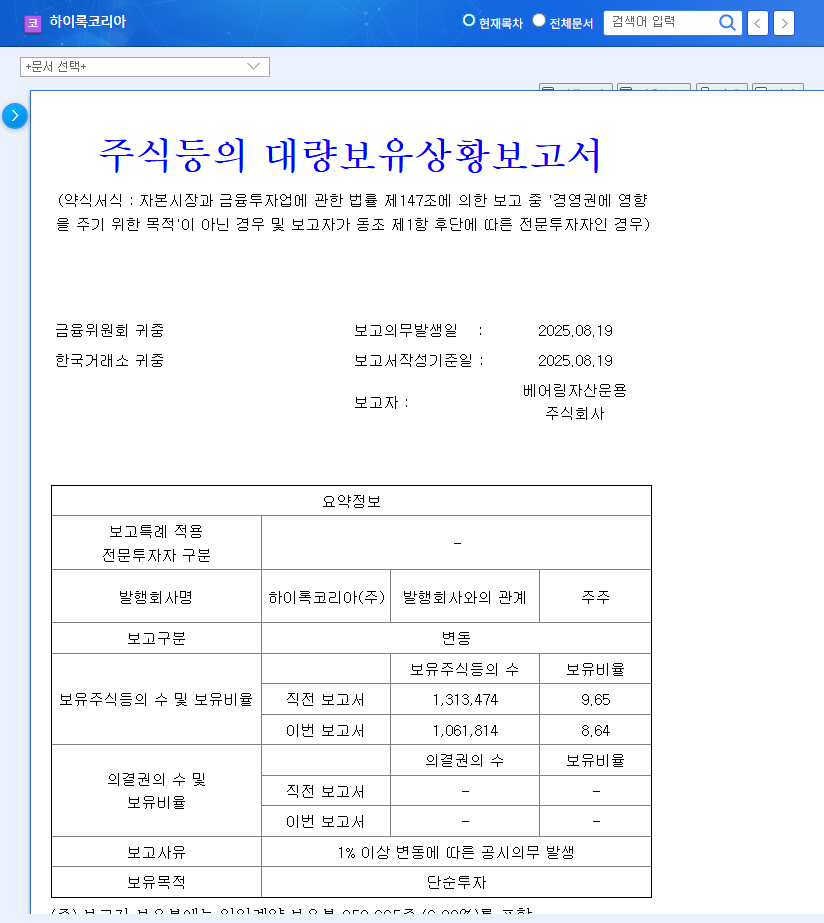

- Potential Emergence of New Investors: Fourier Robotics’ divestment could present an opportunity for other investors seeking new prospects. Pay attention to the emergence of new investors and their strategies.

FAQ

Does Fourier Robotics’ divestment mean CSA Cosmic is going bankrupt?

No, the divestment itself doesn’t signify CSA Cosmic’s bankruptcy. However, it can heighten concerns about the company’s financial health and business outlook.

Should I buy CSA Cosmic stock now?

CSA Cosmic is currently facing financial difficulties and management uncertainties. Investment decisions should be made cautiously, considering individual risk tolerance and investment strategy.

What is the future stock price outlook for CSA Cosmic?

The future stock price depends on various factors, including the company’s business improvement efforts, market conditions, and investor sentiment. Be mindful of short-term volatility and closely monitor changes in the company’s fundamentals.