What Happened?

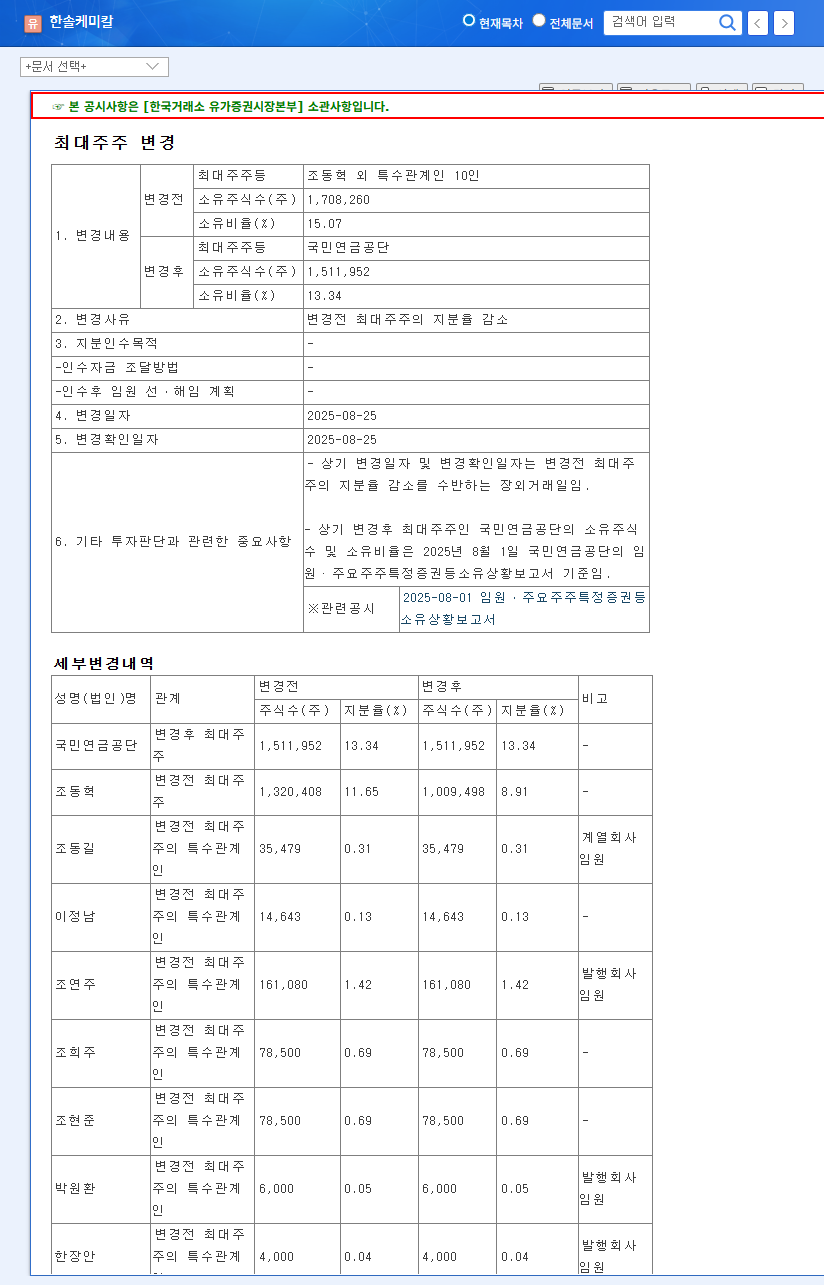

Chairman Dong-Hyuk Cho sold 310,910 shares, representing 2.72% of his 16.60% stake, to GS through an off-market transaction. This reduced his stake to 13.88%. The reasons cited were off-market sale and changes in collateral agreements.

Background of the Sale and Market Impact

This stake sale could put downward pressure on the stock price in the short term. A large-scale stake sale by the largest shareholder often raises concerns about increased selling pressure and management uncertainty. The sale to GS, in particular, suggests the possibility of a strategic partnership or changes in governance structure, which could lead to various market interpretations.

Hansol Chemical’s Fundamentals and Future Outlook

Hansol Chemical recorded sales of KRW 431.5 billion (+13.7% YoY) in the first half of 2025, showing robust growth. Notably, the electronic and secondary battery materials sector saw significant growth (+28.0%). The company maintains solid fundamentals, including improved operating profit margin (20.9%), stable debt-to-equity ratio (35.7%), and healthy operating cash flow. Hansol Chemical continues to invest in securing future growth engines. However, risk factors such as rising raw material prices, intensifying competition, and rising interest rates need to be monitored continuously.

What Should Investors Do?

- Short-term Investment Strategy: It’s advisable to remain cautious immediately following the event, watching for potential selling pressure and awaiting further information on the evolving relationship with GS.

- Mid-to-Long-term Investment Strategy: Given the company’s strong fundamentals, a drop in stock price could present a buying opportunity. However, continuous monitoring of external factors is crucial.

- Risk Management: Investors holding Hansol Chemical stock should prepare risk management strategies, including stop-loss orders, in anticipation of potential price volatility.

Frequently Asked Questions

Will Chairman Cho’s stake sale affect Hansol Chemical’s management control?

While Chairman Cho’s stake has decreased, he remains the largest shareholder. However, it’s important to monitor potential further stake changes and the evolving relationship with GS.

What are Hansol Chemical’s main businesses?

Hansol Chemical manufactures electronic and secondary battery materials, including Precursor, anode binder, separator binder, and silicon anode materials. They also operate in other areas like hydrogen peroxide and latex production.

What precautions should investors take?

Investors should consider the potential for increased short-term stock price volatility and the impact of external factors (interest rates, exchange rates, raw material prices, etc.). A thorough analysis of the company’s fundamentals and market conditions is crucial before making investment decisions.