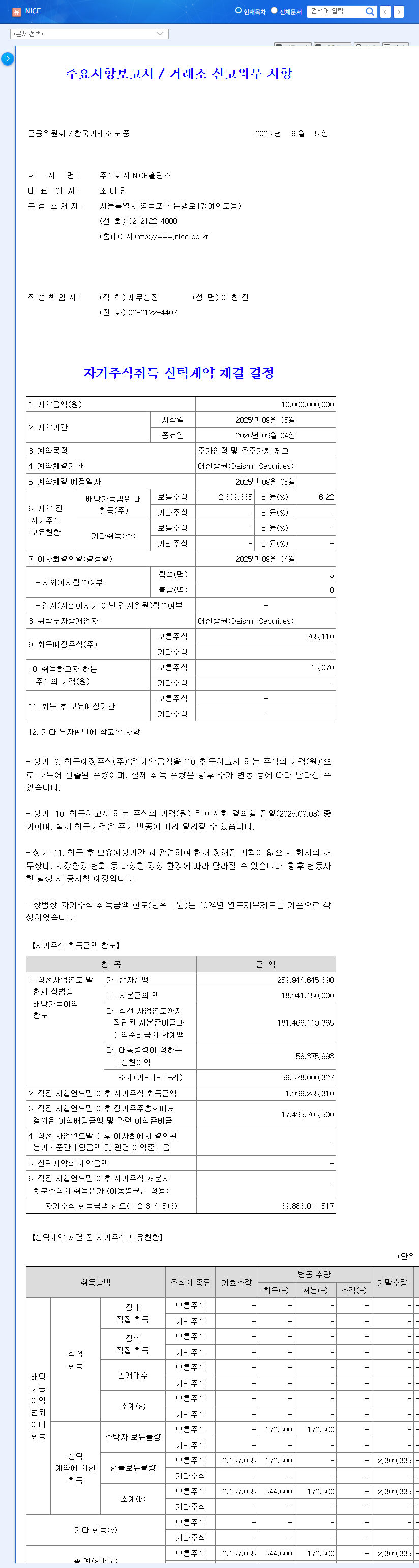

1. What Happened? LB Investment Reduces Stake in Protina

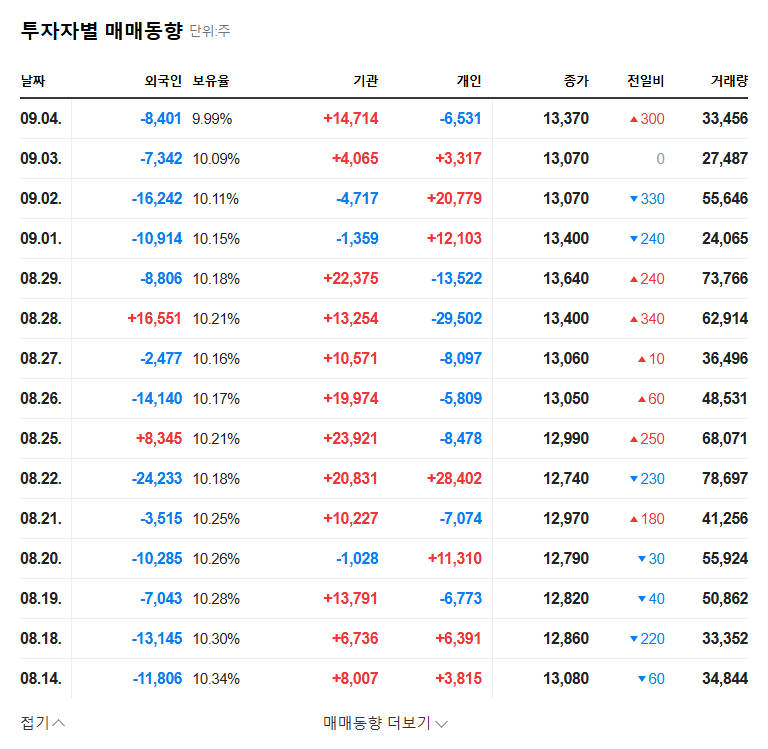

LB Investment reduced its stake in Protina from 7.98% to 6.22%. This was publicly announced as a stake change for simple investment purposes.

2. Why the Stake Reduction? Background and Interpretation

LB Investment officially stated the reason as ‘simple investment purposes.’ It is highly likely that the decision was made for profit-taking or portfolio adjustments after a certain period following Protina’s KOSDAQ listing. It’s reasonable to interpret this as a change in LB Investment’s own investment strategy rather than a negative judgment on Protina’s fundamentals.

3. Impact of the Stake Change on Protina

- Short-term impact: Potential increase in stock price volatility and negative investor sentiment. However, an upward trend in stock price was observed at the time of the sale.

- Long-term impact: No change in fundamentals. The increasing trend of foreign investors’ interest (rising foreign ownership rate) is a positive sign.

4. What Should Investors Do? Short-term/Long-term Investment Strategies

- Short-term investment: Be mindful of increased stock price volatility. Short-term stock price declines can be used as opportunities for bargain hunting.

- Mid-to-long-term investment: Focus on Protina’s core technological competitiveness and growth potential. Continuous monitoring of SPID Platform market expansion and profitability improvement is necessary.

LB Investment’s stake reduction can be interpreted as short-term noise, and Protina’s mid-to-long-term growth outlook remains valid. It is crucial for investors to focus on the company’s fundamentals and growth potential rather than short-term stock price fluctuations.

FAQ

Why did LB Investment sell its stake in Protina?

Officially, it was stated as for ‘simple investment purposes.’ It is highly likely that it was for profit-taking or portfolio adjustments after Protina’s KOSDAQ listing.

Is this stake sale bad news for Protina?

While it may increase stock price volatility in the short term, it doesn’t affect the company’s fundamentals. The growing interest from foreign investors is a positive sign.

Should I invest in Protina?

Protina has high growth potential based on its SPID Platform. Investment decisions should be made at your own discretion and responsibility, focusing on the company’s fundamentals and growth potential rather than short-term stock price fluctuations.