A recent disclosure about a major shareholder’s stock gift at Raontech (418420) has generated buzz among investors. While such news can create short-term noise, it provides a valuable opportunity for a deeper look. Does this minor event change the long-term outlook for Raontech stock? Or should the real focus be on the company’s foundational strength and its prime position within the explosive XR market growth? This comprehensive Raontech analysis will explore the company’s core technology, financial health, and long-term potential to help investors make informed decisions.

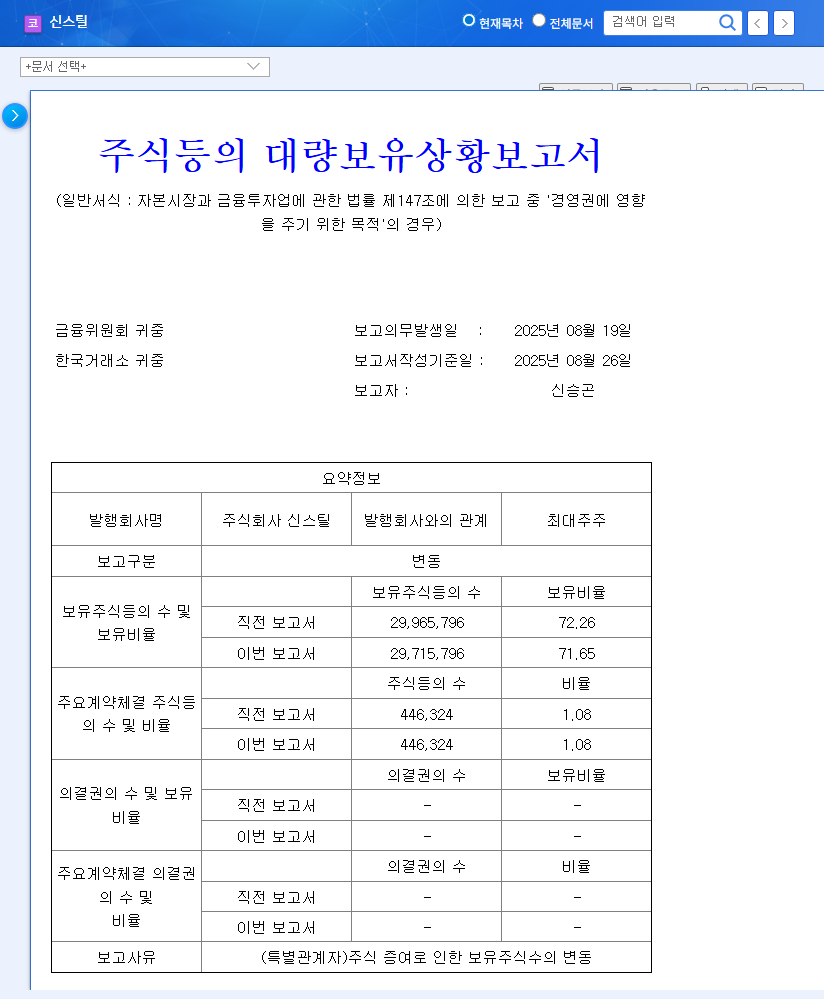

Analyzing the Shareholder Stock Gift

On October 2, 2025, Raontech announced that major shareholders had gifted a small portion of their shares. This transaction resulted in a total stake reduction of just 0.31 percentage points, moving from 29.63% to 29.32%. For those interested in the specifics, the Official Disclosure (DART) provides the complete details. In investment terms, this change is minimal and has no bearing on the company’s management control. Such events are often part of long-term personal financial or inheritance planning and are not indicative of a change in the company’s fundamental direction. Therefore, while the market may react momentarily, savvy investors should look past this to the core drivers of the Raontech stock value.

Raontech’s Core Technology: The Engine of Growth

Raontech is a fabless semiconductor company at the forefront of the XR revolution. It specializes in designing and developing micro-displays and System on Chips (SoCs), which are the essential building blocks for next-generation XR devices like smart glasses, AR headsets, and VR goggles. The company’s expertise in advanced micro-display technology is its primary competitive advantage.

Key Micro-Display Technologies

- •LCoS (Liquid Crystal on Silicon): A mature and cost-effective technology known for high resolution, making it ideal for projectors and AR head-up displays (HUDs).

- •OLEDoS (OLED on Silicon): Offers superior contrast, faster response times, and lower power consumption. This technology is crucial for high-end VR and AR devices where deep blacks and vibrant colors are paramount.

- •LEDoS (LED on Silicon): Considered the next frontier, promising ultra-high brightness and incredible durability, making it perfect for outdoor-use AR glasses and advanced optical applications.

Raontech’s mastery across this trio of technologies positions it as a critical supplier for a wide range of XR products, from consumer electronics to enterprise solutions. This technological diversification is a key pillar of its long-term strategy. For more details, see our deep dive into micro-display technology trends.

Financial Health and Performance Analysis

A closer look at Raontech’s financials reveals a company in a strong growth phase. For the first half of 2025, revenue reached KRW 4.945 billion, marking an 11.85% year-over-year increase. More impressively, the micro-display segment, its core business, saw revenues skyrocket by 219.18%. This surge demonstrates accelerating adoption of its technology. The company also achieved an operating profit, signaling a positive turn towards sustainable profitability.

While its debt-to-equity ratio of 93.6% is manageable, it’s an area to monitor. The high R&D spending, though a drag on short-term profits, is a necessary investment to maintain its technological lead in a fiercely competitive market. The key for investors is to see this R&D translate into future revenue streams.

The Macro Landscape: Explosive XR Market Growth

The most compelling tailwind for Raontech stock is the phenomenal growth trajectory of the Extended Reality (XR) market. As major tech giants like Apple, Meta, and Google pour billions into building the metaverse and next-generation computing platforms, the demand for high-performance, low-power micro-displays is set to explode. Market research firms like Statista predict the global XR market could reach hundreds of billions of dollars within the decade. This isn’t just about gaming; it encompasses enterprise training, remote collaboration, healthcare, and advanced manufacturing. Raontech, as a specialized component provider, is perfectly positioned to supply the ‘picks and shovels’ for this digital gold rush.

Investor Action Plan: A Prudent Approach

Short-Term Perspective

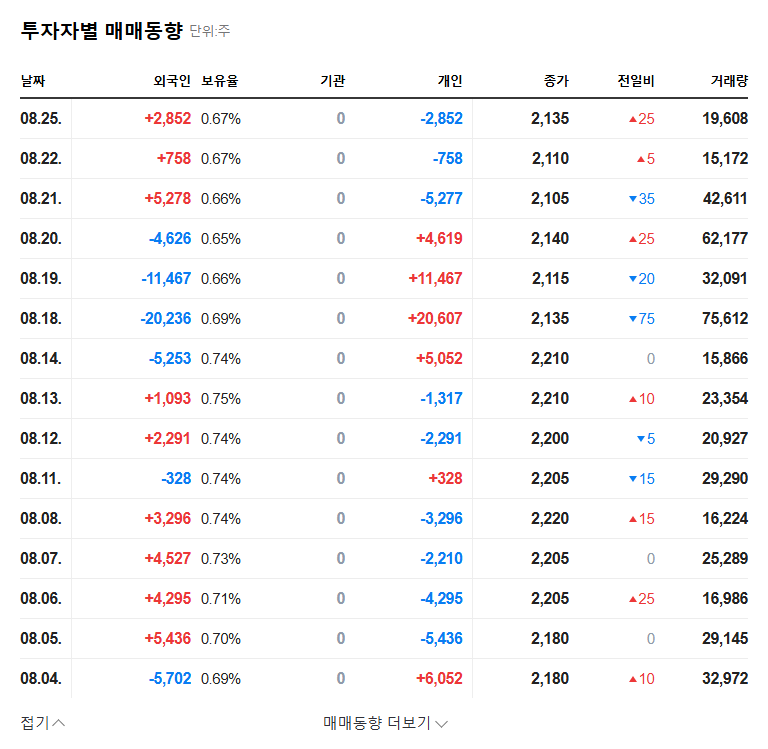

In the short term, investors should disregard the noise from the minor shareholder stake change. Instead, focus should remain on the company’s quarterly performance reports and any new client partnerships or design wins. The stock price will be more influenced by tangible business progress than by minor administrative disclosures.

Long-Term Investment Thesis

The long-term case for the 418420 stock is built on three pillars:

- •Market Growth: The sustained, multi-year expansion of the XR market.

- •Technological Leadership: Raontech’s ability to innovate and lead in LCoS, OLEDoS, and LEDoS technologies.

- •Execution: The company’s capacity to convert R&D investment into profitable revenue and capture significant market share.

In conclusion, Raontech represents a high-potential investment geared towards the future of computing. The recent stock gift is a non-event for the company’s fundamentals. Based on its strong technological position and the immense XR market growth, a long-term ‘Buy’ perspective is warranted for investors with an appetite for growth-oriented technology stocks.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. All investment decisions carry risk, and investors should conduct their own thorough due diligence.