The semiconductor industry is abuzz following a major announcement from Genesem Inc., a key player in backend automation equipment. The company’s recent decision regarding a Genesem Inc. stock dividend has captured the attention of investors, prompting critical questions about its impact on share price, intrinsic value, and the company’s future. This move, granting 0.5 new common shares for every existing share, is more than a simple line item—it’s a strategic signal that warrants a thorough investigation.

In this comprehensive guide, we will dissect this financial event, providing a clear and detailed analysis to help you make informed investment decisions. We’ll explore the immediate details, the company’s underlying financial health, and the long-term implications for shareholders.

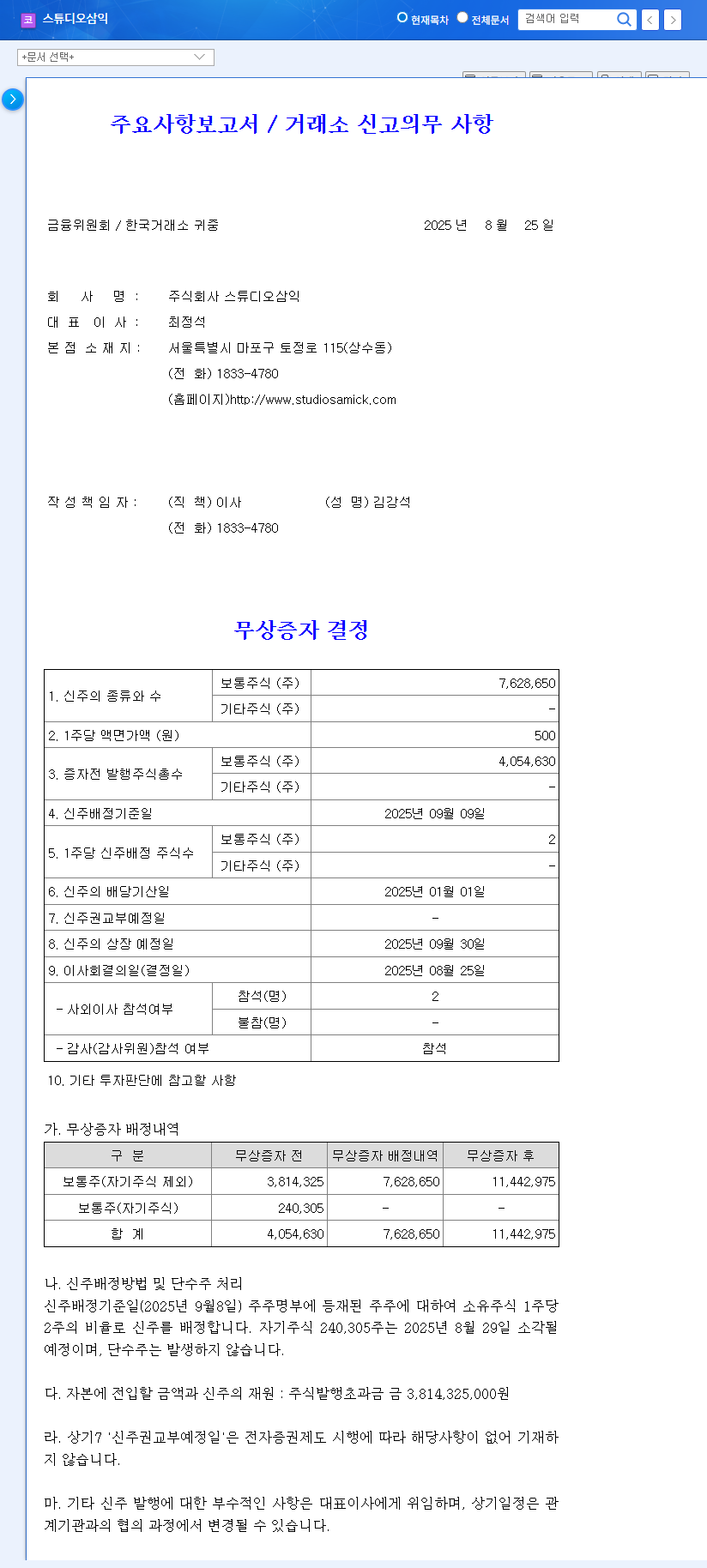

The Announcement: Genesem’s Stock Dividend Details

On November 10, 2025, Genesem Inc. officially declared its plan to issue a stock dividend. This is a significant event for existing shareholders and potential investors alike. The core of the decision is a dividend ratio of 0.5, meaning for every one common share an investor holds, they will receive an additional half-share.

This is a non-cash distribution that increases the total number of shares outstanding, effectively diluting the price per share while keeping the investor’s total stake value the same, at least in theory. The move is often seen as a sign of management’s confidence. For full transparency, you can view the Official Disclosure (DART Report).

Key Dates for Investors

- •Announcement Date: November 10, 2025

- •Record Date: November 25, 2025 (Shareholders must be on record by this date to be eligible)

- •New Shares Listing Date: December 17, 2025 (The new shares begin trading)

Understanding Genesem Inc. & Its Financial Health

Before analyzing the dividend’s impact, it’s crucial to understand the company behind it. Genesem Inc. specializes in semiconductor backend equipment—the machinery used in the final stages of chip manufacturing, including testing, handling, and packaging. With over 130 patents, they possess unique technological capabilities in a market projected for robust growth. The company is also making strategic moves, such as establishing a China JV for market expansion.

Financial Snapshot (H1 2025)

The company’s recent financials present a mixed but interesting picture:

- •Revenue: KRW 27.02 billion (A decrease year-over-year).

- •Operating Profit: KRW 1.346 billion (Shifted to profitability, a positive sign of operational efficiency).

- •Net Profit: KRW 171 million (Decreased year-over-year, a point of concern).

- •Debt-to-Equity Ratio: 74.83% (Increased, indicating higher leverage that needs monitoring).

While the return to operating profitability is a strong positive, the declining revenue and net profit, combined with rising debt, create a complex backdrop for the Genesem Inc. stock dividend decision.

Stock Dividend Analysis: The Pros and Cons for Investors

A stock dividend is fundamentally different from a cash dividend. For a deeper understanding, resources like Investopedia’s guide on stock dividends can be helpful. Let’s break down what Genesem’s move means.

Potential Positives

- •Increased Liquidity: With more shares in circulation at a lower price per share, the stock becomes more accessible to a wider range of retail investors. This can significantly boost trading volume and liquidity.

- •Positive Market Signal: Management may issue a stock dividend to signal confidence in the company’s future earnings potential. It suggests they believe the company will grow enough to support a larger number of outstanding shares without value erosion.

- •Enhanced Shareholder Value Perception: It is a form of shareholder return that rewards long-term investors and can improve the company’s image as being shareholder-friendly.

Neutral Factors & Potential Risks

- •No Change in Intrinsic Value: This is critical. A stock dividend is like cutting a pizza into more slices. The size of the pizza (the company’s total value) doesn’t change. Any short-term price jump is based on market sentiment, not a fundamental improvement.

- •No Financial Structure Improvement: The dividend is an accounting entry moving funds from retained earnings to paid-in capital. It brings in no new cash and does not help pay down debt. Given Genesem’s rising debt-to-equity ratio, this is a significant consideration.

- •Risk of Profit-Taking: A sentiment-driven price rally after the announcement could be short-lived. Investors should be wary of a potential sell-off around the new shares listing date as early movers take profits.

Strategic Investor Outlook & Final Recommendation

The Genesem Inc. stock dividend is a catalyst that could generate short-term excitement and liquidity. The high dividend ratio is certain to attract market attention. However, savvy investors must look beyond the immediate hype and focus on the fundamentals.

Our investment opinion remains Neutral. The positive signal from management is tempered by the lack of fundamental change to the company’s value and the existing financial concerns like declining net profit and rising debt. For those interested in this sector, you might also want to read our guide on How to Analyze Semiconductor Stocks for broader context.

Actionable Points for Monitoring

- •Watch Q4 2025 Earnings: The next earnings report is crucial. Look for sustained operating profitability, a reversal in the net profit decline, and a strategy to manage the debt-to-equity ratio.

- •Monitor Market Reaction: Observe trading volumes and price stability after the new shares are listed on December 17. A sharp decline could indicate that the initial excitement has faded.

- •Track Business Developments: Pay close attention to news regarding the China JV and any new major client orders, as these are the true drivers of long-term value.