The recent announcement of a large-scale KPF stock cancellation has captured the attention of the market. But what does this corporate action truly signify for current and prospective investors? This move, often seen as a bullish signal, goes beyond mere accounting to reflect a company’s confidence in its future and commitment to its shareholders. This analysis will delve into the specifics of KPF’s decision, dissect the company’s underlying financial health, and provide a clear outlook on what this means for your investment strategy.

The Details of the KPF Stock Cancellation

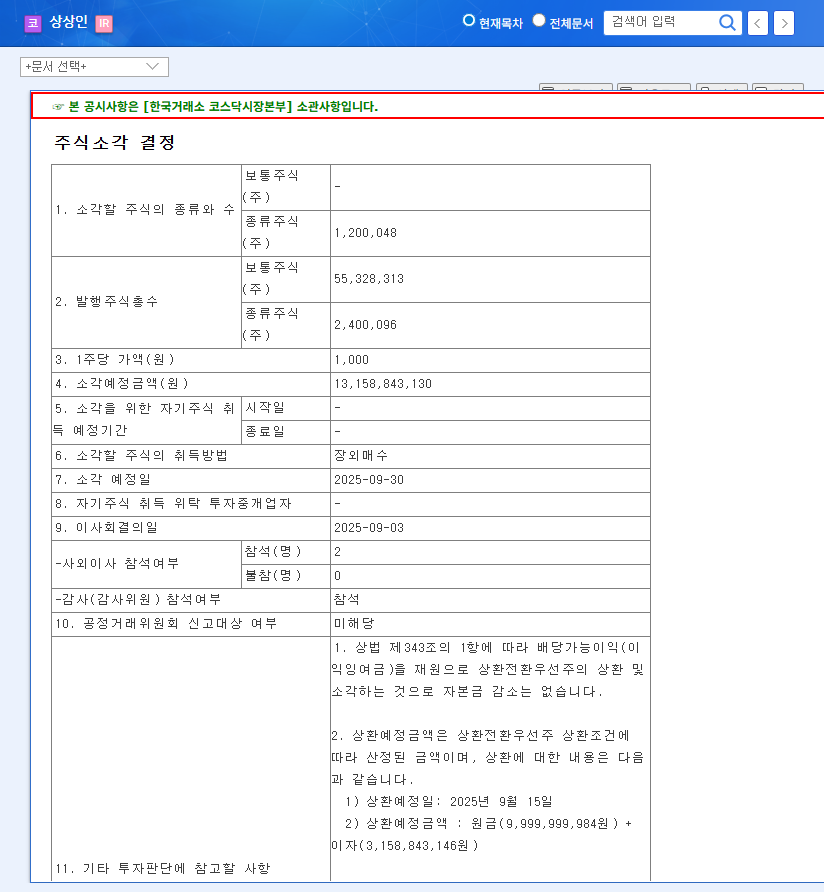

KPF (케이피에프) formally announced its strategic decision to cancel a significant number of its own shares. As detailed in the Official Disclosure filed on November 14, 2025, the key details are as follows:

- •Shares to be Cancelled: 666,206 common shares.

- •Total Value: Approximately 3.1 billion KRW, utilizing treasury shares previously acquired by the company.

- •Scheduled Cancellation Date: November 24, 2025.

This process, also known as treasury stock retirement, permanently removes these shares from circulation. Unlike a simple buyback where shares can be reissued, a cancellation reduces the total outstanding share count, creating a direct and lasting impact on key financial metrics.

Why Cancel Shares? The Impact on Shareholder Value

A stock cancellation is a powerful tool in a company’s financial arsenal. It is often interpreted by the market as a sign that the management believes its stock is undervalued. By reducing the supply of shares, the value of the remaining shares is theoretically increased. For a deeper understanding, you can learn more about stock buybacks and cancellations from authoritative financial sources. For KPF, this move is expected to deliver several key benefits:

- •Increased Earnings Per Share (EPS): With fewer shares to divide the net income among, the EPS automatically increases, making the stock appear more profitable and attractive to investors.

- •Enhanced Shareholder Value: The principle of scarcity applies. A smaller pool of outstanding shares means each share represents a larger ownership stake in the company, potentially driving up the stock price.

- •Positive Market Signaling: This action signals management’s confidence in the company’s financial stability and future earnings potential. It is a tangible commitment to a robust KPF shareholder value policy.

A Closer Look at KPF’s Financial Analysis

To understand the context of the stock cancellation, we must perform a thorough KPF financial analysis based on its Q3 2025 results. The decision wasn’t made in a vacuum but against a backdrop of mixed financial signals.

Areas of Concern

The company faced some headwinds. Consolidated revenue saw a slight year-on-year decrease of 3.5% to 568.77 billion KRW, with operating profit also dipping by 3.6% to 33.31 billion KRW. These figures were primarily influenced by reduced sales in the marine cable segment and volatility in raw material costs. Furthermore, while the debt-to-equity ratio has improved, it remains relatively high at 133.4%, indicating a need for continued financial discipline.

Positive Growth Indicators

Conversely, there are strong positive signals. KPF’s cash flow from operating activities showed a remarkable improvement, soaring to 40.69 billion KRW. This demonstrates a robust recovery in the company’s core ability to generate cash. Strategically, KPF is strengthening its global footprint by establishing TMC Texas Inc., a move aimed at penetrating the lucrative North American market. This, combined with the stock cancellation, points to a proactive strategy focused on long-term growth and investor confidence.

In this context, the KPF stock cancellation appears to be a strategic move to signal strength and reward shareholders amidst a period of operational transition and strategic investment.

Investor Outlook and Action Plan

For investors, this news presents a complex but largely positive picture. The immediate effects of improved EPS and enhanced shareholder value could provide a short-term boost to the stock. However, a sustainable increase in value depends on the company’s ability to address its fundamental challenges.

Key factors to monitor include:

- •Fundamental Profitability: The price appreciation from the cancellation will only be sustained if KPF improves its core profitability and manages risks like market competition and shipbuilding industry fluctuations.

- •Success of Growth Initiatives: The performance of the new U.S. entity and efforts to strengthen the fastener and automotive parts businesses will be critical indicators of long-term success.

In conclusion, while the KPF stock cancellation is a highly positive signal of management’s commitment to shareholder returns, investors should base their decisions on a comprehensive review of the company’s long-term growth strategy and its progress in improving fundamental profitability. A deeper understanding of how to analyze a company’s financial statements will be invaluable. This event should be seen as one important piece of a much larger investment puzzle.