What Happened at Hwanggeum ST?

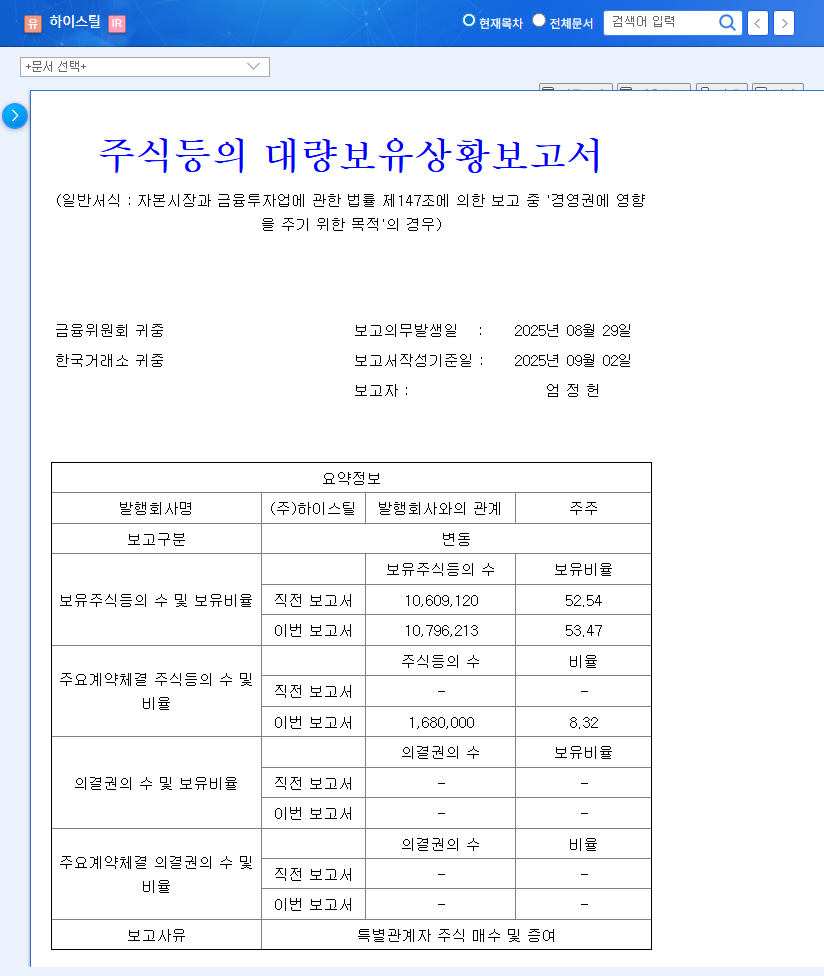

Kim Jong-hyun, the CEO and largest shareholder of Hwanggeum ST, increased his stake from 55.01% to 55.24% (0.23%p) through open market purchases over three days. This news was announced through a major shareholder report disclosed on September 24, 2025.

Why is the CEO’s Stake Increase Important?

This stake increase can be interpreted as a demonstration of commitment to strengthening management control and responsible management. The additional purchase, even with an already majority stake, can be seen as a sign of confidence in the company’s future.

How are Hwanggeum ST’s Fundamentals?

Hwanggeum ST demonstrates positive fundamentals through stable performance in its steel business, growth in its construction business, and expansion into new businesses such as ALC and smart farms. Financial soundness is also steadily improving, and a consistent dividend policy contributes to enhancing shareholder value.

- Steel Business: Strengthening competitiveness through in-house production facility development and high-value-added products.

- Construction Business: Growth based on proprietary technologies such as IPC girder technology.

- New Businesses: Securing future growth engines through ALC market entry and smart farm projects.

What Should Investors Do?

This stake increase can have a positive impact on stock prices in the short term. However, investment should always be approached with caution. It is important to continuously monitor stock price fluctuations, the CEO’s future actions, the company’s business performance, and changes in macroeconomic indicators.

Q: How will CEO Kim Jong-hyun’s stake increase affect the stock price?

A: Generally, an increase in stake by the largest shareholder is interpreted as a positive signal in the market and can lead to expectations of a stock price increase. However, a small change in an already majority stake may have a limited impact.

Q: What is the future business outlook for Hwanggeum ST?

A: Hwanggeum ST shows a positive outlook through solid growth in its steel and construction businesses, and expansion into new businesses. Continuous improvement in financial soundness and dividend policy are also expected to contribute to enhancing shareholder value.

Q: What precautions should be taken when investing?

A: Investment should always be approached cautiously. Investors should constantly monitor stock price fluctuations, the CEO’s actions, business performance, and macroeconomic indicators, and keep in mind that the responsibility for investment decisions lies with the investor.