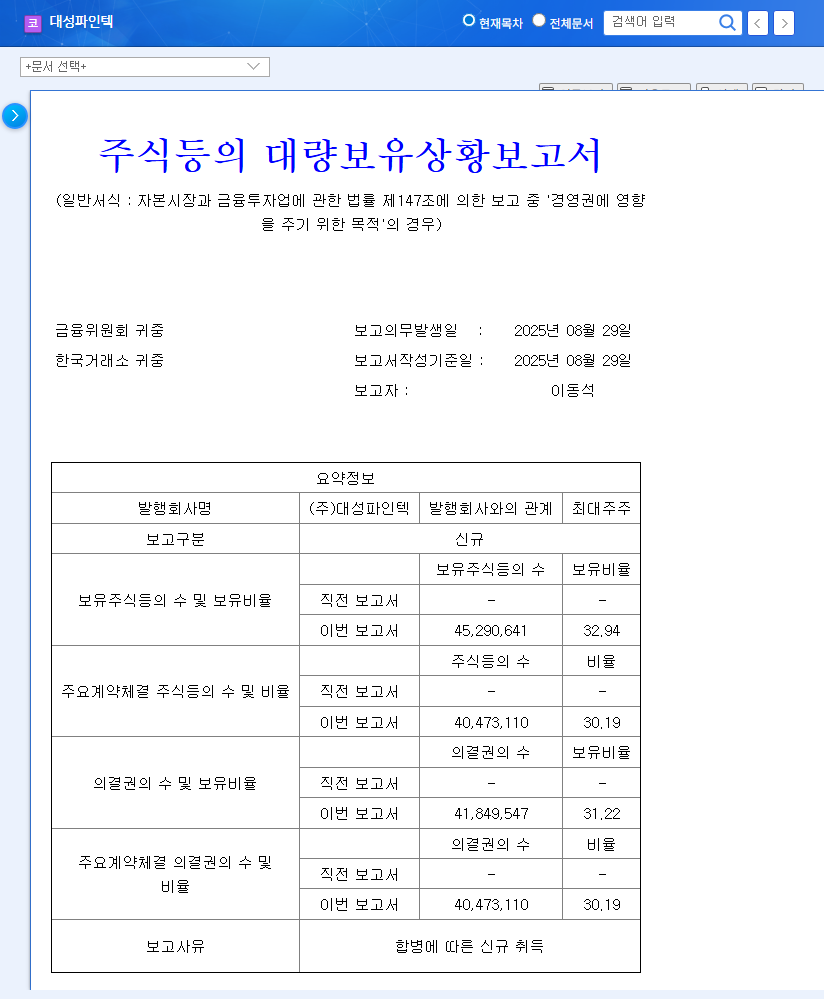

What Happened at Castech Korea?

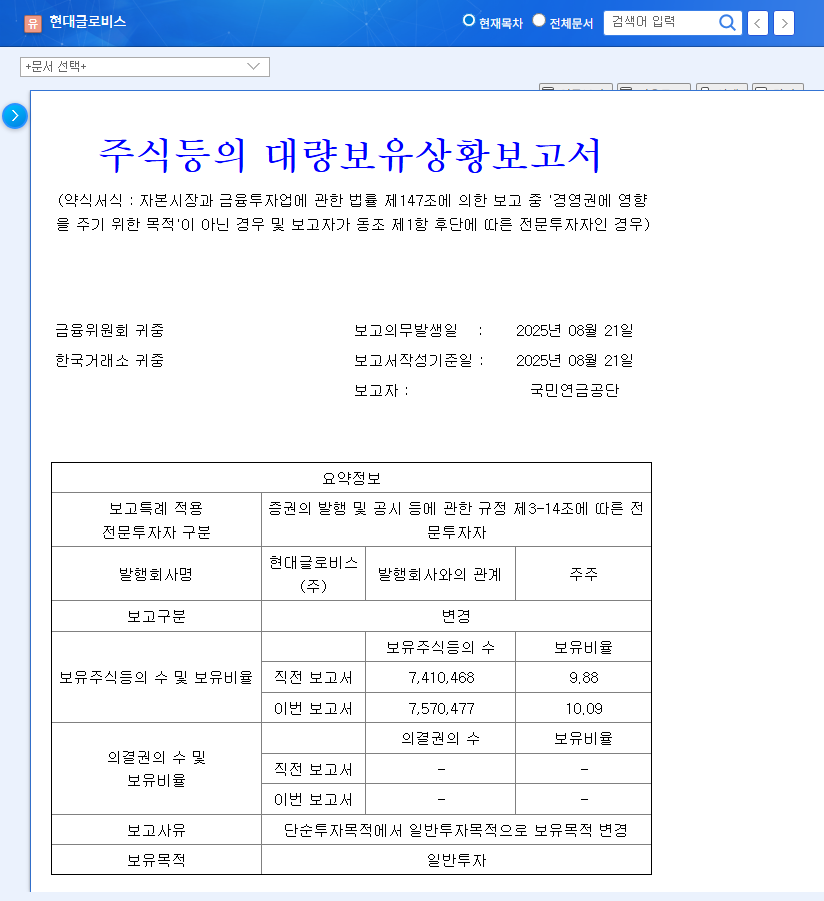

On September 10, 2025, CEO Hak-Cheol Lee and related parties increased their stake in Castech Korea by 0.87%p to 35.29%. The stake increase was due to open market purchases and the addition of related parties. The reported purpose is to influence management.

Is the Stake Increase Positive? Fundamental Analysis

The stake increase has positive aspects, such as strengthening and stabilizing management. However, it’s crucial to note that Castech Korea is currently experiencing a significant weakening of its fundamentals.

- Continuous Sales Decline: Sales in the first half of 2025 decreased by 3.1% year-on-year to KRW 80.4 billion. In particular, sales in the Electronic Comp. parts sector plummeted by 56.7%.

- Profitability Deterioration: Operating profit turned to a loss, net loss expanded, and operating profit margin recorded -2.6%.

- Financial Health Concerns: Increased total borrowings, rising debt ratio, and intensified liquidity burden.

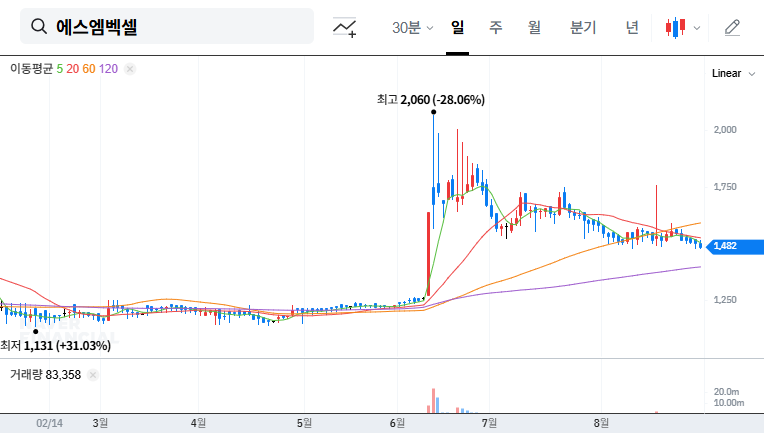

So, What Will Happen With the Stake Increase?

While the stake increase may contribute to management stability in the short term, it is difficult to offset the deteriorating fundamentals. The mid-to-long-term stock price trend depends on fundamental improvements. Strengthening competitiveness in the automotive turbocharger parts business, recovery of the Electronic Comp. parts division, and securing new growth engines are key.

Investor Action Plan

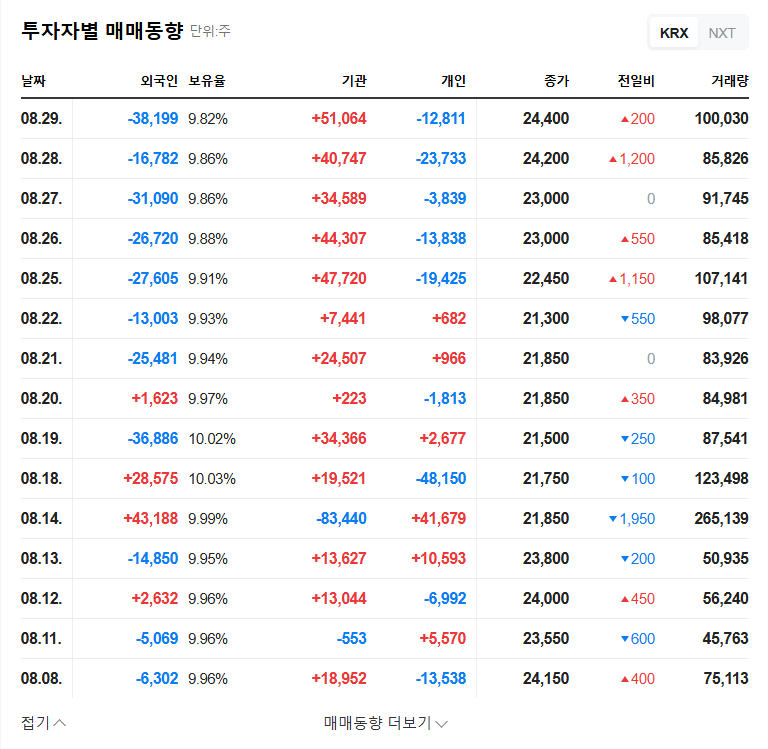

- Monitor Fundamental Improvements: Closely monitor future earnings announcements and business plans, paying particular attention to the recovery of the Electronic Comp. parts business and the discovery of new business opportunities.

- Check Efforts to Restore Financial Soundness: Confirm efforts to manage debt and improve financial structure.

- Evaluate Management’s Will: Observe the actual management performance from a long-term perspective following the stake increase.

In conclusion, investments in Castech Korea should be approached with caution, and investment decisions should be made by continuously observing whether fundamentals improve.

FAQ

What are Castech Korea’s main businesses?

Castech Korea is a manufacturing company that produces automotive turbocharger parts, electronic components, and other parts. It is currently facing difficulties due to the slowdown in the automobile market and the slump in the Electronic Comp. parts sector.

Will the stake increase positively affect the stock price?

In the short term, it may have a positive impact on stock price due to expectations for management stability. However, without fundamental improvements, it is difficult to expect a sustained increase.

Is it a good idea to invest in Castech Korea?

Currently, there are significant risk factors in terms of fundamentals, so investment should be approached with caution. It is important to continuously observe whether the company’s fundamentals improve and make investment decisions accordingly.