1. What Happened?

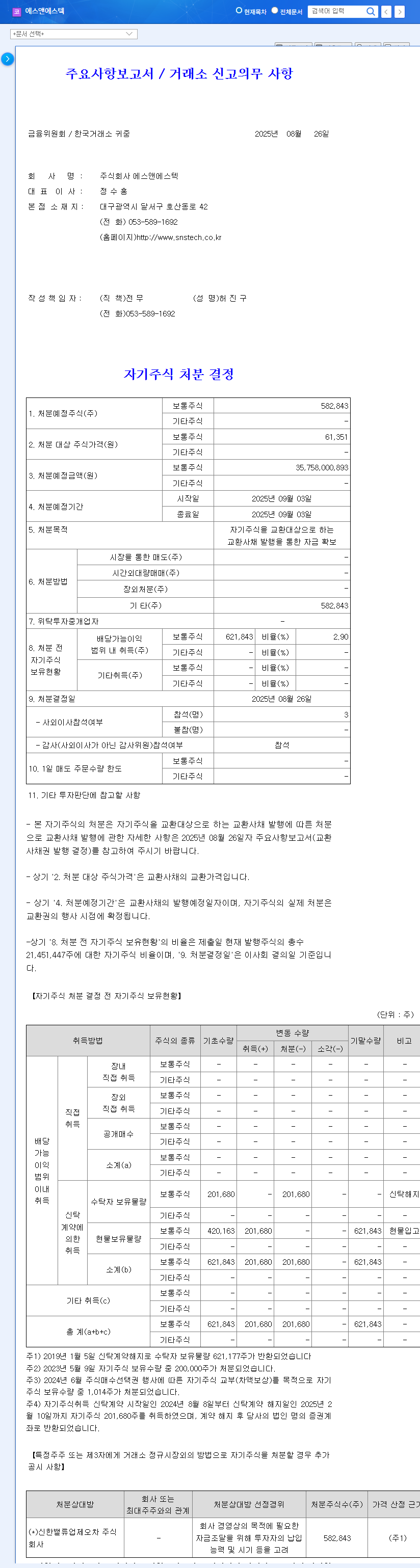

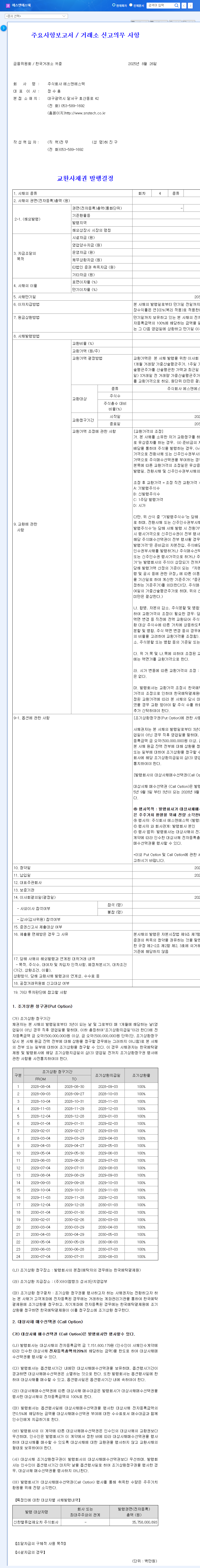

On August 26, 2025, S&S Tech announced the disposal of 582,843 treasury shares, equivalent to 35.8 billion won. The purpose is to secure funds through the issuance of convertible bonds.

2. Why Dispose of Treasury Stock?

S&S Tech is actively investing in future growth engines, including the development of EUV blank masks and pellicle technology, and the construction of a new plant in Yongin. This treasury stock disposal is analyzed as a way to secure funds for these investments and enhance financial flexibility.

3. What’s the Impact?

- Positive Aspects:

- Securing financial flexibility and funding for future growth engines

- Potential for long-term corporate and shareholder value enhancement through new business investments and technology development

- Considerations:

- Potential for short-term stock dilution depending on the conversion conditions and timing of convertible bonds

- Need for transparent disclosure of how the secured funds will be used

4. What Should Investors Do?

Investment Opinion: Maintain Buy

S&S Tech showed robust earnings growth in the first half of 2025 and possesses excellent competitiveness in the blank mask market. While this treasury stock disposal may cause short-term stock volatility, it can be interpreted as a strategic move for long-term growth.

- Buying Timing: Consider a gradual purchase strategy upon positive earnings announcements or new technology development achievements.

- Risk Management: Continuously monitor exchange rate fluctuations, macroeconomic uncertainties, and potential intensification of competition.

Frequently Asked Questions

How does the treasury stock disposal affect the stock price?

In the short term, there is a possibility of stock dilution due to the increase in the number of shares. However, in the long term, securing funds for future growth drivers can positively influence stock prices.

What is the outlook for S&S Tech?

With the growth of the semiconductor and display industries, S&S Tech maintains a positive outlook as a leading EUV blank mask technology company.

What should I be aware of when investing?

Investors should continuously monitor the specific terms and conversion timing of convertible bonds, exchange rate fluctuations, and macroeconomic uncertainties.