KNW Q3 2025 Earnings: Navigating Mounting Losses

This comprehensive KNW Co., Ltd. earnings analysis delves into the recently announced preliminary Q3 2025 results, revealing a company at a critical crossroads. With persistent losses and an increasing financial burden, investors are cautiously evaluating whether KNW’s strategic investments in high-growth sectors like semiconductor materials can offset its current financial instability. This report dissects the numbers, explores the root causes, and provides a clear KNW stock outlook to help you make informed investment decisions.

Breaking Down the Q3 2025 Financial Performance

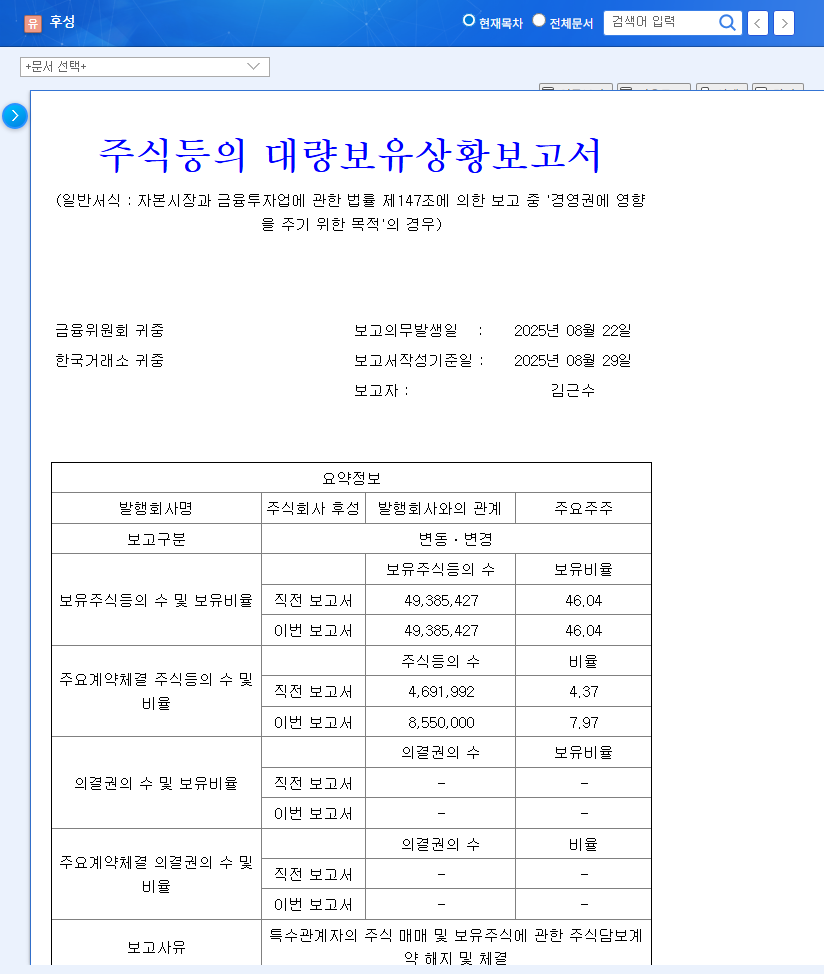

KNW’s preliminary earnings for Q3 2025 paint a challenging picture. The company reported sales of KRW 19.9 billion, an operating loss of KRW 0.5 billion, and a net loss of KRW 0.9 billion. These figures, consistent with the losses from the previous quarter, confirm that the downward profitability trend that started in 2023 is not yet reversing. This data is based on the company’s official filing (Official Disclosure).

The first half (H1) of 2025 already showed widening deficits compared to the prior year, with an operating loss of KRW 1.6 billion on sales of KRW 39.7 billion. While significant investments in future growth are evident from the -KRW 37.5 billion investing cash flow, the negative operating cash flow of -KRW 0.6 billion raises serious questions about the company’s core ability to generate cash from its primary business activities.

The continuation of operating and net losses into Q3 2025 underscores a fundamental profitability issue that strategic investments have yet to resolve. This persistent burn rate is a primary concern for the current KNW stock outlook.

Core Business Segments: A Double-Edged Sword

A detailed KNW financial analysis requires looking at its individual segments. While diversified, each carries its own set of opportunities and risks that contribute to the company’s volatile performance.

Semiconductor Materials: The High-Stakes Growth Engine

Constituting nearly 62% of sales, this is KNW’s most critical division. Its strength lies in being Korea’s sole producer of SF6 special gas and its strategic investments in anhydrous hydrogen fluoride (AHF) facilities. These materials are vital for chip manufacturing. However, this heavy reliance makes KNW extremely vulnerable to the notoriously cyclical semiconductor industry and global supply chain disruptions. A downturn in chip demand directly impacts KNW’s top and bottom lines.

Automotive & Electronic Parts: Stable but Vulnerable

The automotive parts and electronic components segments provide a more stable revenue base, accounting for the remaining share. The growth of EVs and advanced technologies like 5G and AI presents significant opportunities. However, these markets are fiercely competitive, and performance is tied to the health of the broader automotive and consumer electronics industries, which are currently facing macroeconomic pressures.

Decoding KNW’s Financial Health & Risk Factors

The KRW 50 Billion Convertible Bond Burden

A major red flag in the KNW financial analysis is the recent issuance of KRW 50 billion in convertible bonds. While this secures capital for investment, it introduces two major risks: future stock dilution for existing shareholders when bonds are converted to equity, and a heavier interest expense burden that will further erode net profits. For more details, see our guide to analyzing convertible bond risks.

Macroeconomic Headwinds and Currency Exposure

KNW is highly exposed to external economic forces. Global inflation, rising interest rates, and geopolitical instability can disrupt supply chains and dampen demand. Furthermore, the company’s significant exposure to USD and EUR exchange rate fluctuations is a key risk. A 10% swing in currency can materially impact net profit, yet the company has not implemented an aggressive hedging strategy, leaving its earnings vulnerable to volatility.

Investor Action Plan & Final Recommendation

Given the persistent profitability issues and rising financial risks highlighted in this KNW Co., Ltd. earnings analysis, the company’s fundamentals are currently assessed as negative. Short-term downward pressure on the stock price is highly likely to continue until tangible performance improvements are seen.

Investors should adopt a cautious, observant stance rather than initiating new positions. Key factors to monitor closely include:

- •Profitability Turnaround: Any concrete evidence of margin improvement or a reduction in operating losses in the upcoming quarters.

- •Financial Management: Clear strategies to manage debt, control interest expenses, and mitigate the dilutive effect of convertible bonds.

- •Semiconductor Segment Performance: Signs that the investments in SF6 and AHF are translating into market share gains and profitable revenue.

- •Risk Mitigation: Implementation of a robust currency hedging strategy to protect earnings from exchange rate volatility.

Until these areas show significant improvement, a wait-and-see approach is the most prudent course of action for investors considering KNW Co., Ltd.