What Happened? Analyzing Hancom’s Special Relationship Share Transfer

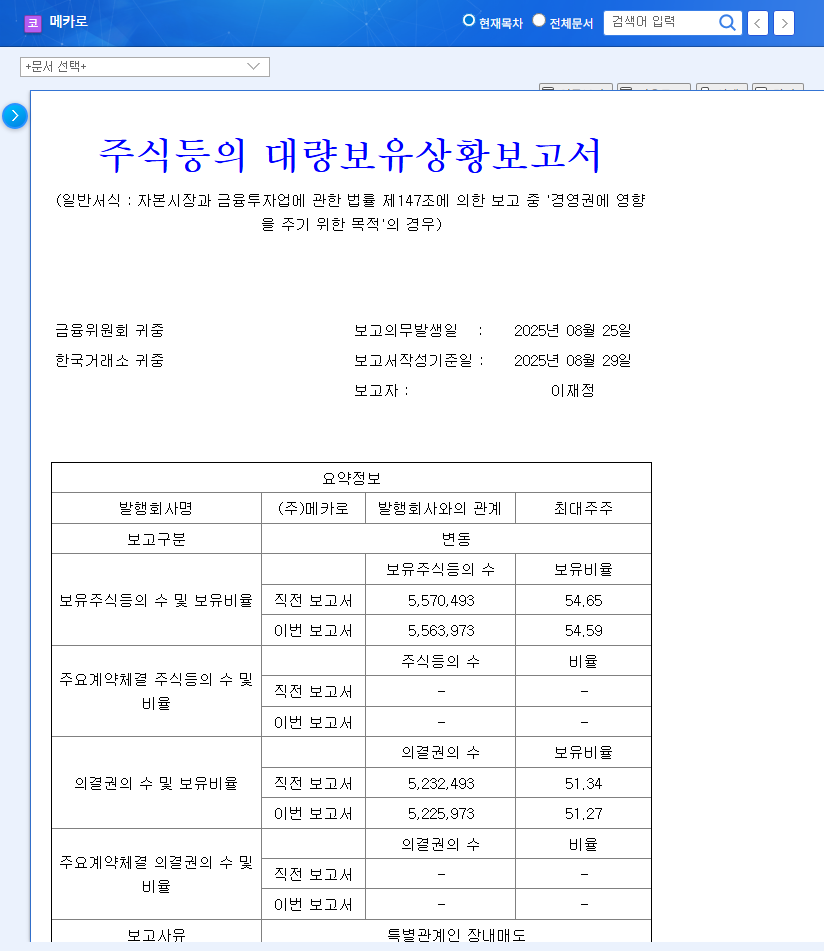

A share transfer occurred between Hancom With and the Republic of Korea through over-the-counter trading, but Hancom With’s total stake (35.76%) remains unchanged. The key transaction was Kim Yeon-soo’s over-the-counter sale of 5,535 shares to Datoes Co., Ltd.

Why Does This Matter? Understanding the Context and Hidden Meanings

As this transaction occurred between special relationships, an immediate management change seems unlikely. However, with Hancom With’s stated objective of influencing management rights, it suggests the possibility of future changes in governance. The inclusion of “Republic of Korea” as a special relationship may also imply potential government involvement.

So, What’s Next? Analyzing the Potential Impact

While the short-term impact on stock prices is expected to be limited, the recent decline in consolidated earnings reported in the semi-annual report could negatively affect investor sentiment. On the other hand, the growth of the core software business and the expansion of new AI/cloud businesses are positive factors. Standalone performance remains solid, and the maintained stake also contributes positively to management stability.

What Should Investors Do? An Action Plan

- Monitor consolidated earnings improvements: Recovery in manufacturing and other sectors, growth in the software sector, and securing profitability in new businesses are key.

- Monitor AI/cloud business performance: Closely analyze actual revenue and profit contributions.

- Track macroeconomic changes: Continuously monitor the impact of fluctuations in interest rates, exchange rates, and oil prices.

- Analyze major shareholder strategies: Pay attention to Hancom With’s management strategies and changes in governance structure.

Frequently Asked Questions (FAQ)

Will Hancom’s management change due to this share transfer?

This share transfer was between special relationships and there is no change in overall stake percentage, so an immediate management change is not expected. However, the possibility of future changes in management strategy should be considered.

What is Hancom’s investment outlook?

The growth potential of AI and cloud businesses is positive, but the decline in consolidated earnings and macroeconomic uncertainty are risk factors. Continuous monitoring of core business performance and changes in macroeconomic indicators is necessary.

What does it mean that “Republic of Korea” is included as a special relationship?

This suggests the possibility of government agency or public sector participation in the shares, and implies that it may be affected by government policies or support in the future.