Kiwoom SPAC No. 8 and Zison, What Changes?

Kiwoom SPAC No. 8, through the merger with Zison, has completed its role as a SPAC and transitioned into a company operating Zison’s wireless security solution business. This is a significant turning point, providing Zison with a springboard for growth through KOSDAQ listing and funding.

Why is the Merger Important?

The influx of approximately 11.5 billion won is expected to greatly contribute to Zison’s R&D, material procurement, and operating funds. In particular, it is expected to gain momentum in entering new businesses, such as vehicle and accommodation security systems, providing an opportunity to preempt the wireless security solution market, a key technology in the 5G, IoT, and AI era.

Expectations and Concerns After the Merger

- Positive Aspects: Increased corporate awareness and credibility due to KOSDAQ listing, easier access to funding, expected improvement in financial structure.

- Potential Risks: Need to resolve continuous operating losses and accumulated deficit, uncertainties in the macroeconomic environment such as high interest rates and exchange rate volatility, and the possibility of intensified competition.

What Should Investors Do?

While the merger with Zison presents an opportunity to realize its growth potential, it also presents challenges to overcome. Investors should continuously monitor the following:

- Financial Performance (Sales, operating profit, and deficit resolution trend)

- Performance and market response of new businesses

- Securing R&D and technological competitiveness

- Changes in macroeconomic indicators

- Changes in major shareholder’s stake and management activities

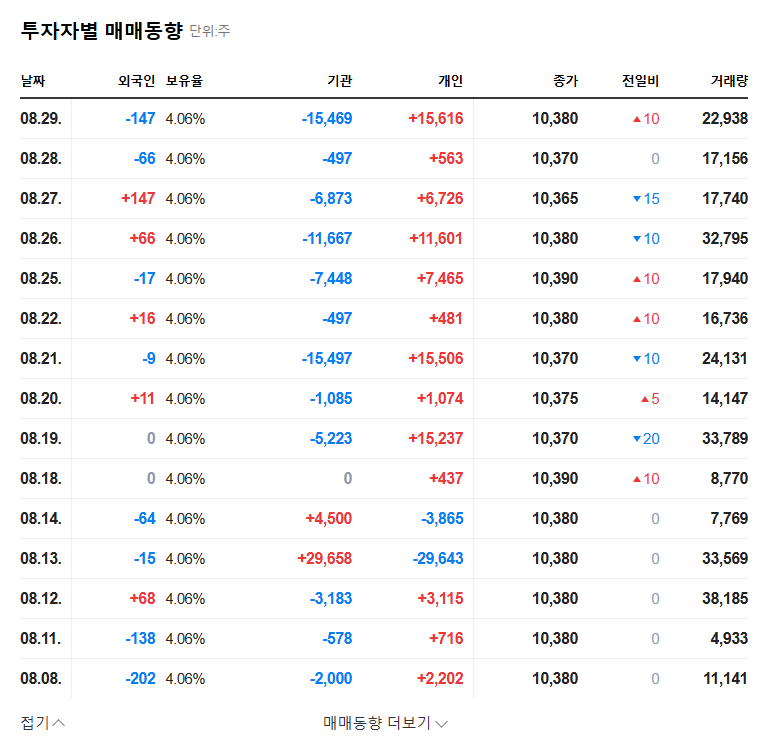

- Stock price movements and investor trends

We encourage you to make prudent and wise investment decisions through continuous monitoring and analysis.

FAQ

What is Zison’s main business?

Zison develops and provides wireless security solutions closely related to 4th industrial revolution technologies such as 5G, IoT, and AI.

What are the benefits of the merger for Zison?

Listing on KOSDAQ will facilitate funding and increase corporate awareness. Also, securing approximately 11.5 billion won in funding will accelerate R&D and business expansion.

What should I be aware of when investing in Zison?

Past accumulated deficits and current low profitability are major risk factors. In addition, uncertainties in the macroeconomic environment and the possibility of increased competition should be considered.