The recent WOOYANG HC shareholding change has sent ripples through the investment community. A significant disclosure revealed that major shareholder Solbrain Holdings has reduced its stake, raising critical questions about the company’s future stock performance and overall valuation. For current and prospective investors, understanding the nuances of this development is paramount.

This comprehensive analysis will unpack the details of the share disposal, explore the potential motivations behind it, and outline the short-term and long-term implications for WOOYANG HC stock. We will provide a clear, actionable framework to help you navigate this uncertainty and make well-informed investment decisions.

Unpacking the WOOYANG HC Shareholding Change

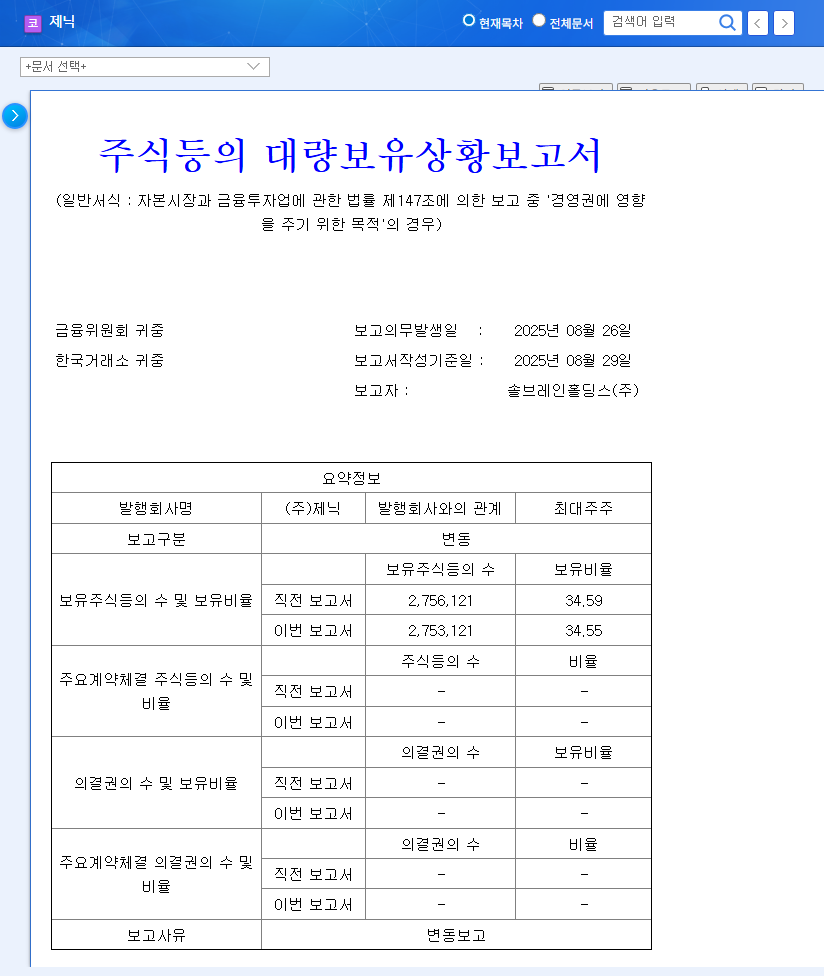

On October 16, 2025, WOOYANG HC CO.,LTD. filed a mandatory ‘Report on Large Shareholding Status,’ officially documenting the shift in ownership. This report is a crucial piece of information for all WOOYANG HC investors. The key takeaways from the disclosure, which can be viewed in the Official Disclosure (Source: DART), are as follows:

- •Primary Shareholder: Solbrain Holdings, whose stated purpose for holding shares is ‘management influence.’

- •Stake Reduction: Solbrain Holdings’ ownership decreased from a formidable 76.46% to 73.95%, marking a reduction of 2.51 percentage points.

- •Reason Cited: The official reason provided was ‘simple disposal.’

- •Executing Parties: The sales were executed through multiple on-market transactions by associated financial entities, namely Now IB Capital Co., Ltd. and the Now Turnaround Growth Ladder Fund 1 Private Equity Fund.

Why Did Solbrain Holdings Reduce Its Stake?

The term ‘simple disposal’ can be vague. To perform a thorough WOOYANG HC analysis, we must look beyond the surface. The motivation likely stems from the objectives of the financial institutions involved rather than a fundamental shift in Solbrain’s core management strategy.

A Financial Move, Not a Governance Crisis

Entities like Now IB Capital are investment firms. Their primary goal is to generate returns for their limited partners. A ‘simple disposal’ often translates to one of the following scenarios:

- •Profit-Taking: The fund may have reached its target return on its investment in WOOYANG HC and is now liquidating a portion to lock in gains.

- •Portfolio Rebalancing: The fund might be adjusting its overall portfolio allocation, reducing exposure to certain sectors or assets to manage risk.

- •Fund Lifecycle: Private equity funds have a finite lifespan and may be required to return capital to investors, necessitating the sale of assets.

Crucially, with an ownership stake still above 70%, Solbrain Holdings’ control over the company’s management remains firmly intact. This disposal is unlikely to be a prelude to a hostile takeover or a sign of internal management conflict.

While the sale creates short-term market pressure, the key for long-term investors is to determine if this is a temporary supply/demand issue or a signal of changing fundamentals within WOOYANG HC.

Event Impact Assessment: What’s Next for WOOYANG HC Stock?

Short-Term Outlook: Navigating Headwinds

The immediate market reaction to a major shareholder selling shares is often negative. The news can create a stock ‘overhang’—a perception that more shares are available for sale, which can suppress the price. Investor sentiment may turn cautious, leading to downward pressure on WOOYANG HC stock. Traders should watch for increased volume and potential tests of key technical support levels.

Medium- to Long-Term Outlook: Fundamentals Take Center Stage

Over time, the impact of this share disposal will fade, and the company’s intrinsic value will become the primary driver of its stock price. If WOOYANG HC continues to deliver strong revenue growth, healthy profit margins, and a positive business outlook, this event will likely be seen as a minor footnote. Conversely, if the company’s fundamentals are weak, this sale could be interpreted as sophisticated investors exiting before a downturn. Therefore, a deep dive into the company’s financial health is more critical than ever. For more on this, see our guide to fundamental analysis.

Actionable Strategy for WOOYANG HC Investors

In light of the WOOYANG HC shareholding change, investors should adopt a proactive, research-focused approach.

- •Scrutinize Financials: Obtain the latest quarterly and annual reports. Look for trends in revenue, net income, and cash flow. Is the company growing? Is it profitable? How does its debt level look?

- •Monitor Future Filings: Keep a close eye on DART for any further reports on shareholding changes from Solbrain Holdings. A continued pattern of selling would be a more significant red flag.

- •Seek Expert Opinions: Review recent analyst reports from brokerage firms. Outlets like Bloomberg or Reuters often consolidate analyst ratings and price targets, which can provide a sense of market consensus.

- •Assess the Competitive Landscape: Is this a company-specific issue, or is the entire industry facing headwinds? Understanding the broader context is crucial for a complete WOOYANG HC analysis.

Frequently Asked Questions (FAQ)

What was the core of the WOOYANG HC shareholding change?

The core event was the disposal of a 2.51% stake in WOOYANG HC by its largest shareholder, Solbrain Holdings. This reduced their total ownership from 76.46% to 73.95%. The sale was executed by affiliated financial investment firms for the stated reason of ‘simple disposal’.

Is WOOYANG HC’s management control at risk?

No, there is no immediate threat to management control. Solbrain Holdings retains a commanding majority stake of over 70%. The sale was conducted by financial investors, not as part of a strategic shift by the parent company. However, investors should monitor for any further sales, as a sustained trend could eventually raise governance concerns.

How will this share disposal affect WOOYANG HC stock?

In the short term, it’s likely to exert downward pressure on the stock price due to negative sentiment and the potential for more supply hitting the market. The long-term impact will depend entirely on the company’s underlying financial performance and business fundamentals.

What is the best course of action for investors now?

The best action is to conduct thorough due diligence. Focus on securing additional information like financial statements, analyst reports, and company IR materials. Base your final investment decision on a comprehensive fundamental analysis of WOOYANG HC’s intrinsic value, rather than on the short-term market noise created by this shareholding change.