1. What Happened?

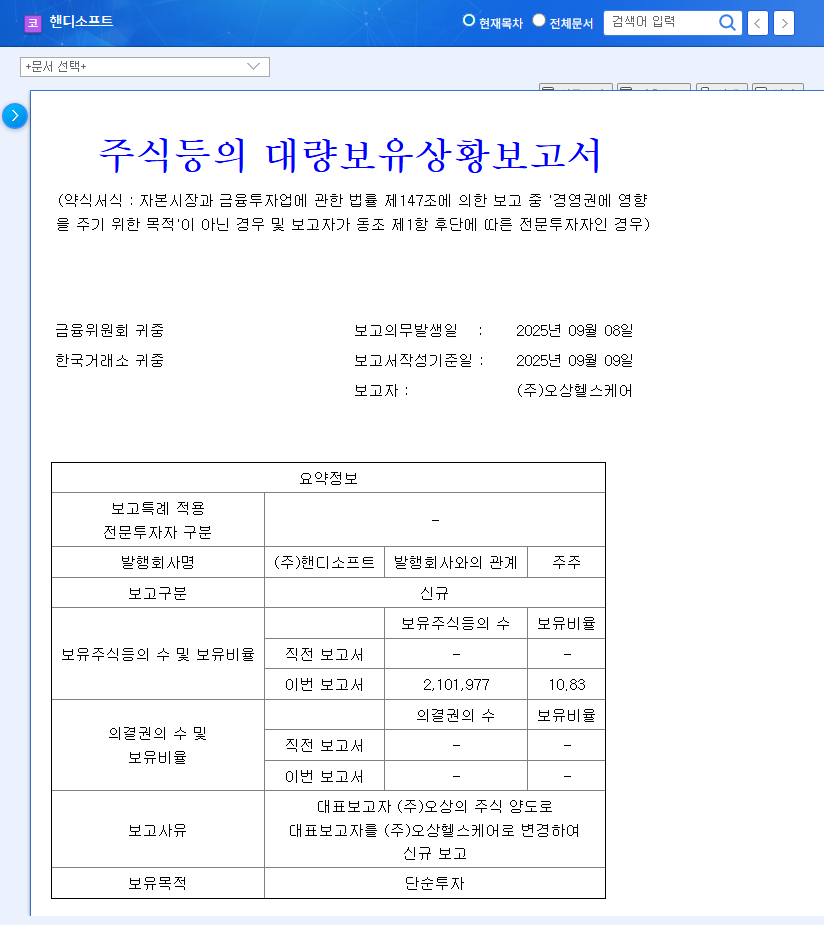

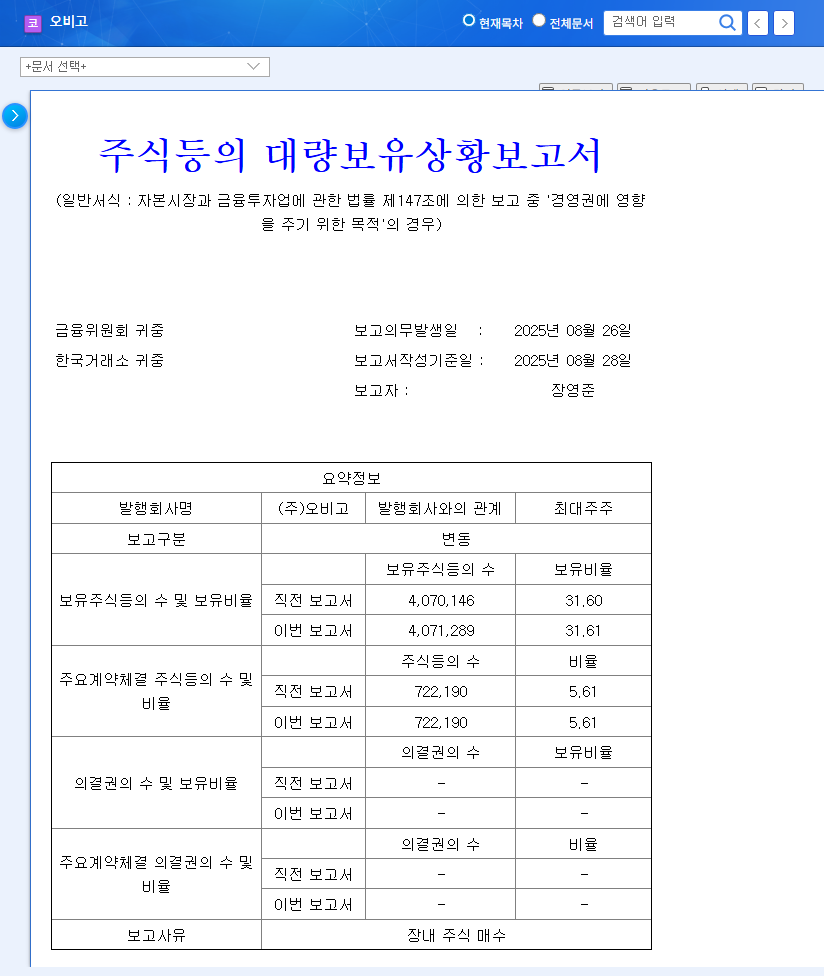

On September 10, 2025, Handysoft disclosed a change in its majority shareholder from Osang to Osang Healthcare. This signifies a shift in management control and potentially a new strategic direction for the company.

2. Why Does It Matter?

A change in majority ownership can significantly impact a company’s strategic direction, investment priorities, and financial structure. Handysoft currently faces challenges, including operating losses in its cloud business and impairment losses related to subsidiaries. The new management’s strategy and execution will be critical to Handysoft’s future.

3. What’s Next?

- Positive Scenario: If Osang Healthcare invests strategically, restructures operations effectively, and strengthens Handysoft’s AI and cloud initiatives, the company’s value could increase.

- Negative Scenario: Increased management uncertainty, abrupt changes in existing business strategies, or failure to improve profitability could negatively impact the stock price.

Macroeconomic factors, such as global economic slowdown, rising interest rates, and exchange rate volatility, could also affect Handysoft’s business environment.

4. What Should Investors Do?

- Monitor the New Management’s Strategy: Closely observe Osang Healthcare’s vision, business plan, and investment priorities.

- Track Profitability Improvements: Pay close attention to Handysoft’s efforts to address operating losses in its cloud business and resolve subsidiary-related issues.

- Analyze Macroeconomic Impacts: Continuously assess the potential impact of interest rates, exchange rates, and other macroeconomic factors on Handysoft.

- Be Mindful of Volatility: Avoid emotional reactions to short-term stock price fluctuations and base investment decisions on objective information related to the company’s fundamentals.

FAQ

What is Osang Healthcare?

Osang Healthcare is … (Company information)

What are Handysoft’s main businesses?

Handysoft’s core business is software, including groupware and collaboration solutions. They are also investing in AI and cloud technologies.

How will the change in majority shareholder affect the stock price?

A change in majority ownership can significantly impact a company’s management strategy and financial structure, which can, in turn, affect its stock price. The impact can be positive or negative depending on the new shareholder’s management capabilities and business strategy.

Should I invest in Handysoft?

Investment decisions should be based on your own individual assessment. Consider the information provided in this article along with other investment research and analysis before making a decision.