TLB Investor Relations: Key Takeaways

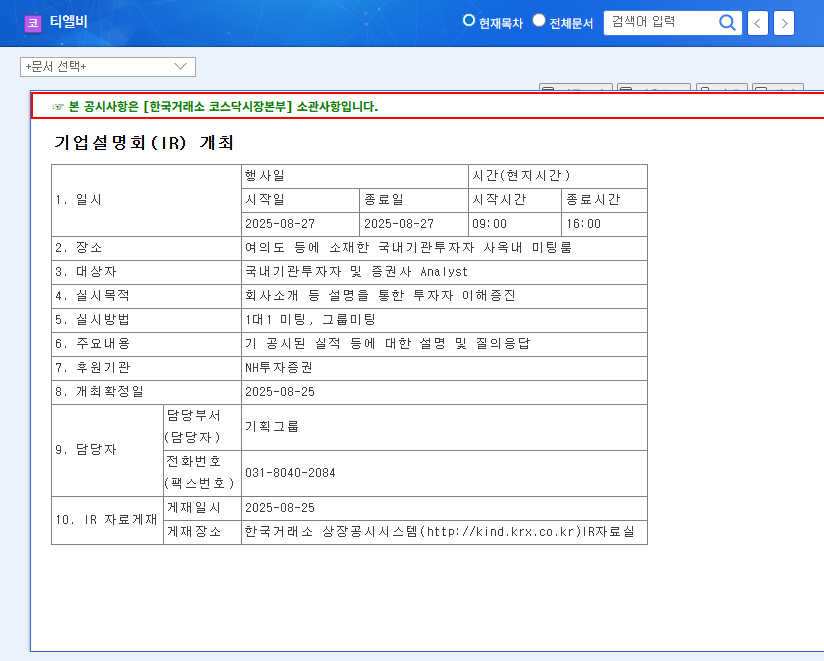

TLB will hold an investor relations meeting on August 27, 2025, to announce its first-half earnings and share its future business strategies. The main topics of this IR can be summarized into three points:

- 1. Explanation of poor performance and presentation of improvement measures

- 2. Sharing the development status and commercialization strategy of next-generation technologies (CXL, SOCAMM)

- 3. Announcement of the operational efficiency and return on investment plan for the Vietnam production base

Key Points for Investors to Focus On

Investors are expecting answers to the following key questions at this IR:

- What are the root causes of the decline in profitability and the solutions?

- What are the specific plans to restore financial soundness?

- What stage is the development of next-generation technologies at, and how will market competitiveness be secured?

- Is the Vietnam plant operating as expected, and when will the investment effect become visible?

- What are the risk management strategies for exchange rate volatility and the high interest rate environment?

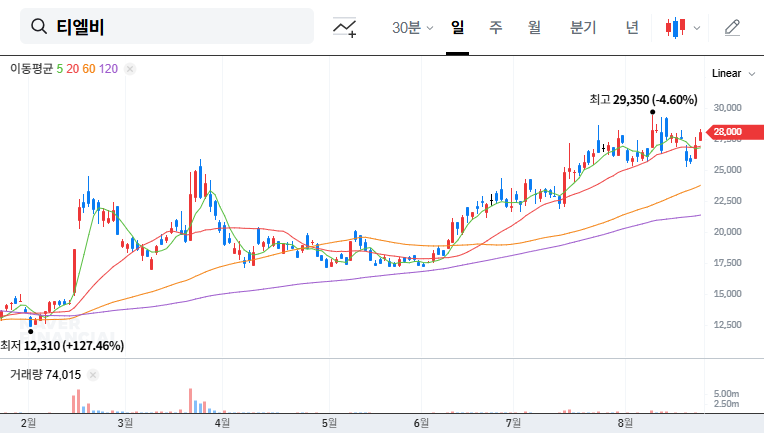

Investment Strategies Based on IR Outcomes

Investment strategies after the IR meeting are suggested as follows:

- Short-term: Make investment decisions after analyzing the IR content and market reaction. A conservative approach is recommended.

- Mid- to long-term: Continuous monitoring of fundamental improvement trends, securing competitive advantage, and ability to respond to macroeconomic environment changes.

Frequently Asked Questions

What is TLB’s main business?

TLB’s main business is the manufacturing and sale of memory semiconductors.

What are the key topics of this investor relations meeting?

The main topics are the announcement of first-half earnings and the sharing of future business strategies, especially measures to improve profitability, the development status of next-generation technologies, and operational plans for the Vietnam production base.

What should investors pay attention to?

They should carefully examine the concreteness of the analysis of the causes of the decline in performance and improvement plans, the market competitiveness of next-generation technologies, the investment effect of the Vietnam plant, and risk management strategies.