1. PEMTRON IR: What Happened?

PEMTRON held an IR session on September 10, 2025, to enhance investor understanding and boost corporate value. The session covered the company’s general status, main business activities, followed by a Q&A.

2. PEMTRON: Opportunities and Risks

Positive Factors:

- Expanding market share and stable revenue generation in the SMT inspection equipment market

- High growth potential in semiconductor and secondary battery inspection equipment markets

- Strengthening competitiveness through AI technology integration

- Active R&D investments

Concerns:

- Significant net loss and deteriorating profitability

- High debt ratio and concerns about financial stability

- Potential stock dilution due to convertible bond issuance

- Increase in accounts receivable and inventory assets

3. PEMTRON’s Future Post-IR

Positive Scenario: If the IR successfully addresses investor concerns and convinces them of the growth potential, it can create upward momentum for the stock price. Presenting a concrete roadmap for financial improvement and new growth drivers is crucial.

Negative Scenario: If the company fails to adequately answer key questions or presents unrealistic plans, it may increase market distrust, leading to a decline in stock price.

4. Action Plan for Investors

Carefully analyze the IR materials and management responses to assess the likelihood of profitability improvement and plans for securing financial stability. This stock may be suitable for investors who are not swayed by short-term price fluctuations and have confidence in PEMTRON’s mid-to-long-term growth potential.

Frequently Asked Questions (FAQ)

What is PEMTRON’s main business?

PEMTRON develops and manufactures SMT (Surface Mount Technology) inspection equipment, semiconductor inspection equipment, and secondary battery inspection equipment. It holds the top domestic market share in SMT inspection equipment.

Why has PEMTRON’s recent performance been poor?

The company recorded a large net loss in the first half of 2025 due to macroeconomic factors such as the global economic slowdown, interest rate hikes, and increased investment in R&D.

Should I invest in PEMTRON?

PEMTRON is a company with both growth potential and risks. Before making an investment decision, carefully analyze the IR materials and consider your investment preferences.

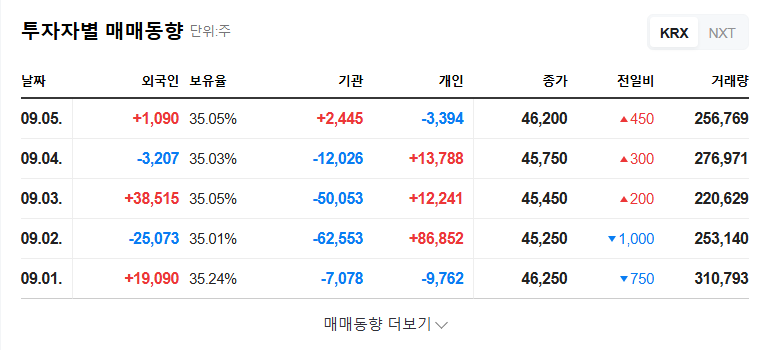

What is the outlook for PEMTRON’s stock price?

Significant price volatility is expected due to various factors such as future performance improvements and changes in market conditions.