An important development for Obigo Inc. stock (KOSDAQ: 352910) has caught the attention of the market. A recent disclosure revealed a major shareholder has increased their stake, signaling a clear intent to influence management. This move, while seemingly small, provides a crucial signal for anyone conducting an Obigo investment analysis. For investors, it’s essential to look beyond the headline and understand the deeper implications for this innovative smart car software company.

This comprehensive analysis will explore the significance of this major shareholder stake increase, evaluate Obigo’s current financial health and market position, and provide a strategic outlook for potential and current investors. We will break down the fundamental strengths and challenges facing Obigo to help you make an informed decision.

The Shareholder Event: A Signal of Confidence

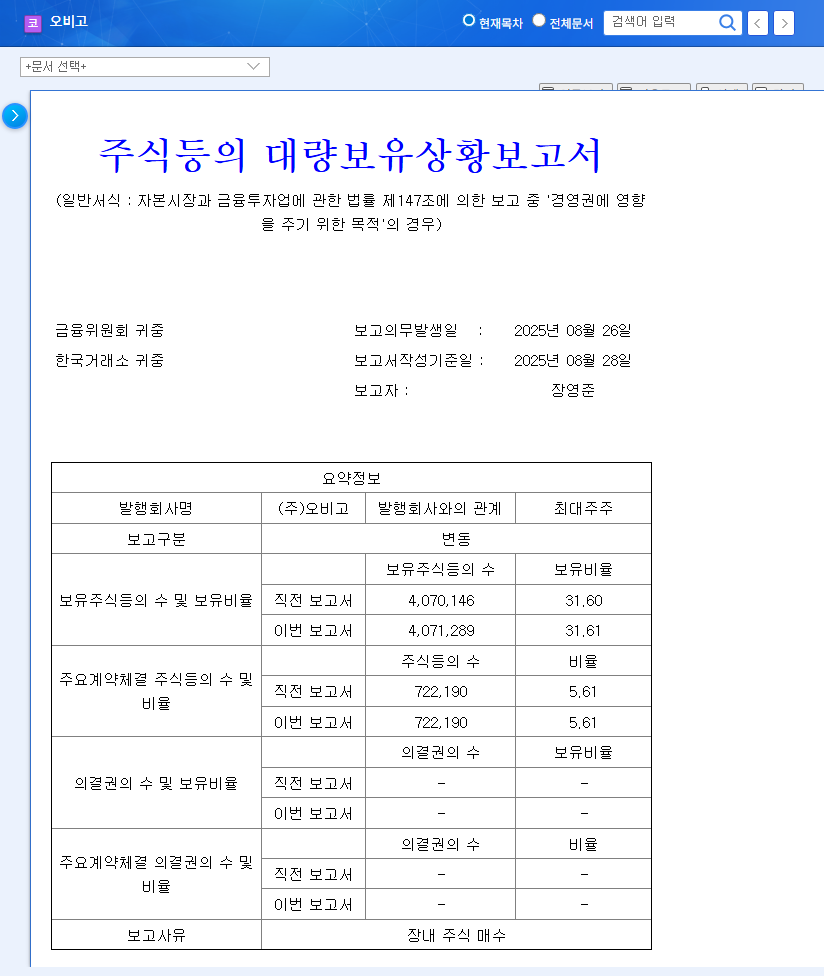

On October 28, 2025, Jang Young-joon, a major shareholder of Obigo Inc., announced a purchase of additional shares, increasing his ownership from 31.62% to 31.63%. The stated purpose, according to the Official Disclosure (DART), was to influence management. While the 0.01% increase may seem negligible, its public declaration is a strategic move. In the world of corporate governance, this is a powerful signal. It demonstrates the shareholder’s unwavering belief in the company’s long-term vision and serves to bolster management stability against external pressures.

This action is less about the percentage and more about the message: a key stakeholder is doubling down on Obigo’s future, which can significantly boost market sentiment and perceived stability.

Understanding Obigo Inc. and its Market Position

Pioneering the Smart Car Software Ecosystem

Obigo Inc. is not just another tech company; it’s a critical player at the heart of the automotive revolution. The company specializes in developing foundational smart car software platforms. Think of it as the operating system for your car’s infotainment, navigation, and connectivity services. Their focus on expanding services based on Android Automotive OS (AAOS) places them at the forefront of a major industry shift. As cars become more like smartphones on wheels, the demand for robust, secure, and feature-rich software platforms like Obigo’s is set to explode. They are also innovating in high-growth areas like AI-driven mobility and subscription-based services, positioning themselves for future revenue streams.

A Look at the Financials and Projections

A thorough Obigo investment analysis must consider its financial trajectory. The company successfully achieved a turnaround in 2023, a significant milestone. However, forecasts suggest a temporary dip in 2024, with potential revenue stagnation and a shift to an operating loss. This is often typical for growth-focused tech companies investing heavily in R&D and market expansion. The key takeaway for investors is the strong projection for a rebound in 2025, with expectations of both revenue and profit improvements. The stability of its sales pipeline and resolution of past financial uncertainties are positive indicators that support this long-term growth narrative.

- •2023 Performance: Successfully achieved a financial turnaround, demonstrating core business viability.

- •2024 Outlook: Expected investment phase, potentially leading to a temporary slowdown in reported profits.

- •2025 Projections: Anticipated return to growth in both revenue and profitability.

Investment Thesis: What This Means for You

Short-Term vs. Long-Term Impact on Obigo Inc. Stock

In the short term, the news of the major shareholder stake increase is likely to improve investor sentiment and could provide positive momentum for the 352910 stock price. However, seasoned investors know that long-term value is built on fundamentals, not headlines. The real story will be told by Obigo’s ability to execute its business plan. The stabilized management, reinforced by shareholder confidence, creates a more favorable environment for achieving long-term goals, such as securing new automotive partnerships and successfully launching new AI and subscription services. This move could also enhance the company’s credibility in future fundraising or M&A activities, which is an often-overlooked benefit.

Strategic Action Plan for Investors

While this event is a net positive, a prudent investment strategy requires ongoing diligence. We recommend focusing on the following key performance indicators:

- •Quarterly Financial Reports: Monitor revenue growth and profit margins closely to see if the 2025 recovery is on track. Read our hypothetical guide on How to Analyze Tech Company Earnings Reports for more tips.

- •New Contract Wins: Watch for announcements of new partnerships with major automakers, as this is a primary driver of future revenue.

- •Competitive Landscape: Keep an eye on competitors in the smart car software space. According to sources like Gartner’s latest mobility report, this is a rapidly evolving market.

- •Shareholder Activity: Continue to track filings for any further significant changes in the major shareholder’s position.

In conclusion, the major shareholder’s increased stake in Obigo Inc. is a strong vote of confidence. For investors, this should be seen as a positive signal that complements a broader investment thesis based on the company’s intrinsic value and its pivotal role in the future of the automotive industry. A long-term perspective focused on fundamental business performance will be key to navigating your investment in Obigo Inc. stock.