1. What Happened at SM Vecell?

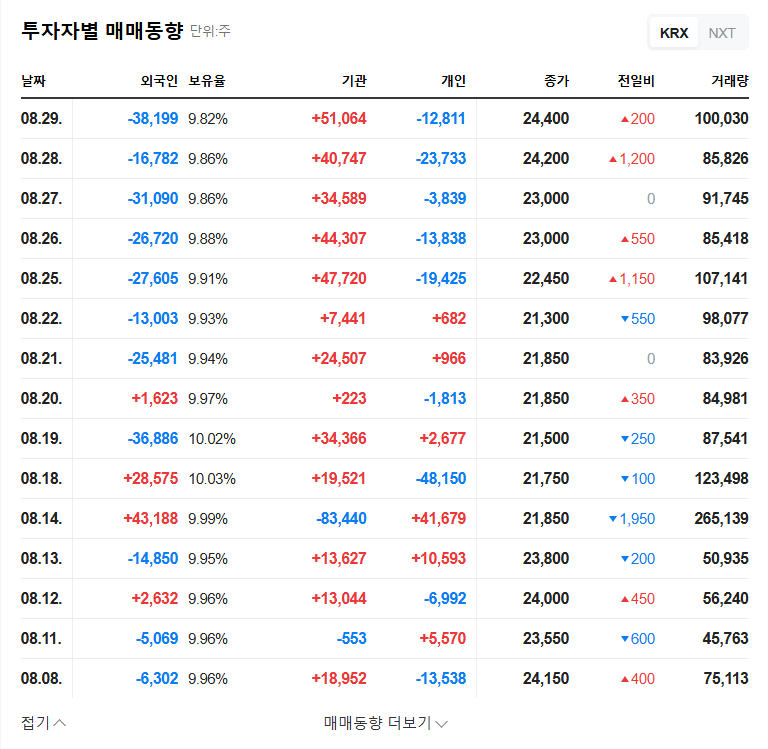

On September 5, 2025, SM Vecell’s major shareholder, SM High Plus Co., Ltd., increased its stake from 87.54% to 87.55% through open market purchases. This follows a series of stake acquisitions over the past month.

2. Why the Increased Stake?

The official purpose is ‘management influence.’ The company’s return to profitability and capital increase in the 2025 semi-annual report likely played a role. However, declining sales and low operating rates in some business segments are concerning. The stake increase could be an attempt to address these concerns and project a positive image to the market.

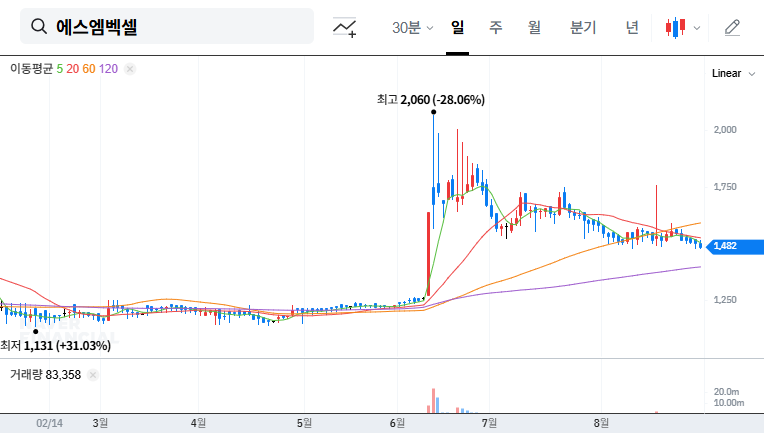

3. What Does This Mean for the Stock Price?

While the stake increase is positive, its impact is likely limited. A short-term surge in stock price is unlikely. The stock’s performance will likely continue along the trajectory established after the release of the 2025 semi-annual report. The key factor is fundamental improvement. Addressing declining sales, performance of new businesses (such as defense ampule batteries), and the major shareholder’s future actions will determine the stock’s direction.

4. What Should Investors Do?

- Analyze declining sales: Carefully examine the reasons for the decline in the auto parts business and its potential for recovery.

- Evaluate new business growth: Assess the actual performance and future growth potential of new ventures, such as defense ampule batteries.

- Monitor major shareholder actions: Observe whether the major shareholder continues to purchase shares and actively participates in management.

Avoid being swayed by short-term market reactions and make informed investment decisions based on continuous monitoring of the company’s fundamental improvements.

FAQ

Is the stake increase by SM Vecell’s major shareholder a good sign?

While it can be interpreted positively, the impact may be limited without fundamental improvement. A thorough analysis of the company’s performance and outlook is necessary.

What is the outlook for SM Vecell’s stock price?

No significant short-term fluctuations are expected, but the long-term price will depend on fundamental improvements.

What should investors consider when investing in SM Vecell?

Carefully analyze the reasons for declining sales, new business growth potential, and major shareholder actions before making investment decisions.