1. The SK Siltron Divestiture: What Happened?

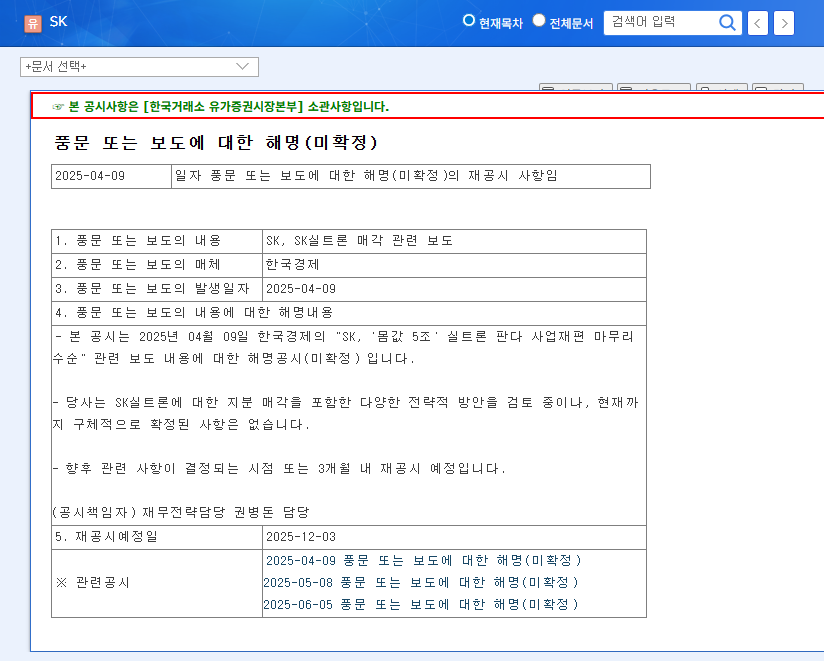

On April 9, 2025, news of a potential SK Siltron divestiture surfaced. SK released a statement clarifying that while they are exploring various strategic options, including a sale, nothing has been finalized. This leaves the situation uncertain, with a sale still a possibility.

2. Why Consider a Divestiture?

SK is likely considering the sale to restructure its business and improve its financial position. The proceeds could be used to reduce debt and invest in new growth engines.

3. Impact of the Divestiture

- Positive Impact: Successful sale could strengthen financial health and boost corporate value.

- Negative Impact: Failure to sell or a lower-than-expected sale price could lead to a stock decline and concerns about hampered growth potential.

- Uncertainty: Unconfirmed sale details make investment decisions challenging.

4. Market Trend Analysis

As of August 2025, market conditions, including exchange rates, commodity prices, and interest rates, have a low direct correlation with the SK Siltron divestiture but could act as macroeconomic variables.

5. SK Stock Performance

SK’s stock price has been volatile since 2020. Considering past stock fluctuations following similar news, this divestiture rumor could also impact the stock price in the short term.

6. Investment Strategies

- Monitor SK announcements, related news, and SK Siltron’s business performance.

- Keep an eye on the divestiture progress (potential buyers, expected sale price, etc.).

- Re-evaluate SK’s fundamentals based on the divestiture outcome.

- Analyze market sentiment.

In conclusion, the potential SK Siltron divestiture is a significant event for SK. Given the high level of uncertainty, careful investment decisions based on further information are crucial.

Is the SK Siltron divestiture confirmed?

No, the divestiture is not yet confirmed. SK stated that they are exploring various strategic options, including a sale.

How will the SK Siltron divestiture affect SK’s stock price?

A successful sale could improve SK’s financial position and increase its corporate value, potentially boosting the stock price. However, a failed sale or a lower-than-expected price could lead to a decline.

What should investors consider?

Investors should closely monitor SK announcements, related news, SK Siltron’s business performance, and the progress of the potential divestiture. Careful investment decisions based on further information and market sentiment analysis are recommended.

Leave a Reply