Recent market buzz suggests SK Securities is considering a major strategic shift by divesting subsidiaries, including NBH Capital. This move could significantly reshape the company’s financial structure and future direction. For investors, this moment presents both opportunities and risks. This article breaks down the divestment plan, analyzes its potential impact, and provides a clear action plan for navigating the path ahead.

The Core Issue: SK Securities’ Divestment Strategy

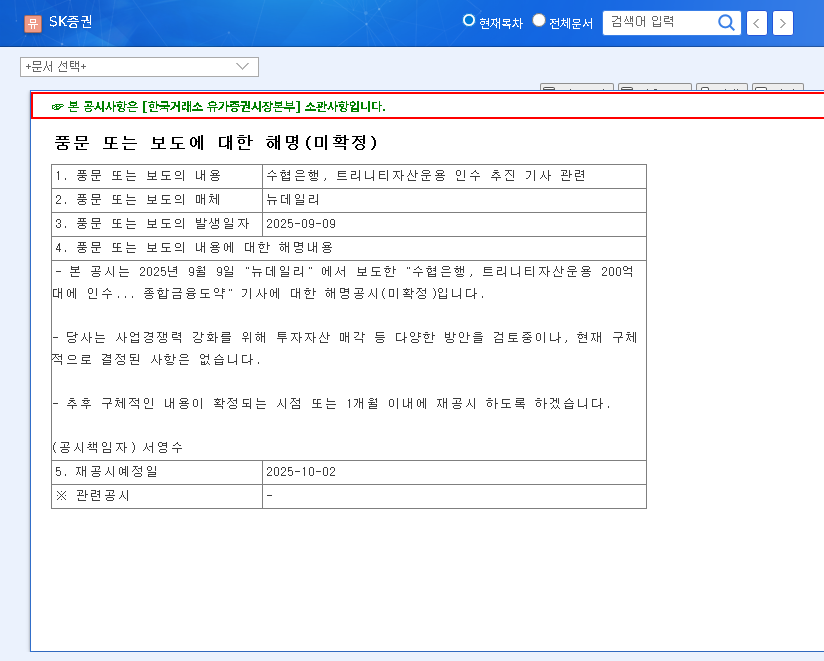

On September 25, 2025, reports emerged detailing SK Securities’ potential sale of its subsidiary, NBH Capital. While the company has officially stated it is “reviewing various options to enhance corporate value and competitiveness,” this news has sparked widespread speculation about its long-term strategy. The primary goal appears to be streamlining operations to focus on and reinvest in core, high-growth business areas like Investment Banking (IB) and asset management.

Weighing the Outcomes: Potential Benefits vs. Risks

A successful divestment could be a game-changer, but the process is not without its uncertainties. Investors must carefully consider both sides of the coin.

Potential Upsides

- ✔Improved Financial Structure: Securing capital through the sale can significantly strengthen the company’s balance sheet.

- ✔Strategic Reinvestment: Funds can be channeled into core profit centers like Investment Banking and asset management, fueling future growth.

- ✔Enhanced Efficiency: A leaner corporate structure allows for more agile management and focused operations.

Potential Downsides & Risks

- ✖Execution Risk: The sale process could face delays, unfavorable terms, or even fail to materialize, creating market uncertainty.

- ✖Negative Market Reaction: If the market perceives the sale as a sign of weakness, it could negatively impact the stock price in the short term.

- ✖Future Divestments: This move could signal further sales of non-core assets, increasing short-term volatility.

“While SK Securities returned to profitability in the first half of 2025, investors should remain watchful of persistent losses from its savings bank subsidiary and potential volatility in its proprietary trading segment.”

Strategic Action Plan for Investors

Navigating this period requires a proactive and informed approach. Here are three key steps for investors to take:

- Monitor Closely: Stay updated on all official announcements regarding the divestment’s progress, terms, and the company’s revised business plans. The details will be crucial.

- Conduct Fundamental Analysis: Look beyond the headlines. Re-evaluate the company’s core financial health, profitability metrics, and the long-term sustainability of its primary business segments.

- Consider the Macro Environment: Factor in broader economic trends, such as interest rate fluctuations and overall stock market sentiment, which will influence the investment’s outcome.

Conclusion: A Cautious but Strategic Outlook

SK Securities’ potential divestment of NBH Capital is a significant strategic pivot that could unlock substantial value. However, the associated risks and uncertainties cannot be ignored. A successful investment in SK Securities during this transitional period hinges on careful due diligence and continuous monitoring. By staying informed and analytical, investors can better position themselves to capitalize on potential upsides while mitigating risks.

Frequently Asked Questions (FAQ)

What is the main purpose of SK Securities’ subsidiary divestment?

SK Securities is pursuing this strategy to strengthen its overall business competitiveness and improve its financial structure. The plan aims to streamline operations by focusing capital and resources on core, high-growth business areas.

How could this divestment impact SK Securities’ stock price?

A successful sale could positively impact the stock price due to an improved balance sheet and increased investment in core businesses. Conversely, a failed sale, poor terms, or a negative market reaction could lead to a short-term decline in the stock price.

What key factors should investors watch closely?

Investors should monitor the divestment progress, specific sale terms, and the company’s future business plans. It is also crucial to analyze SK Securities’ fundamental financial health and consider macroeconomic factors like interest rates and market trends.