1. Decoding the ₩92.7B After-Hours Block Trade

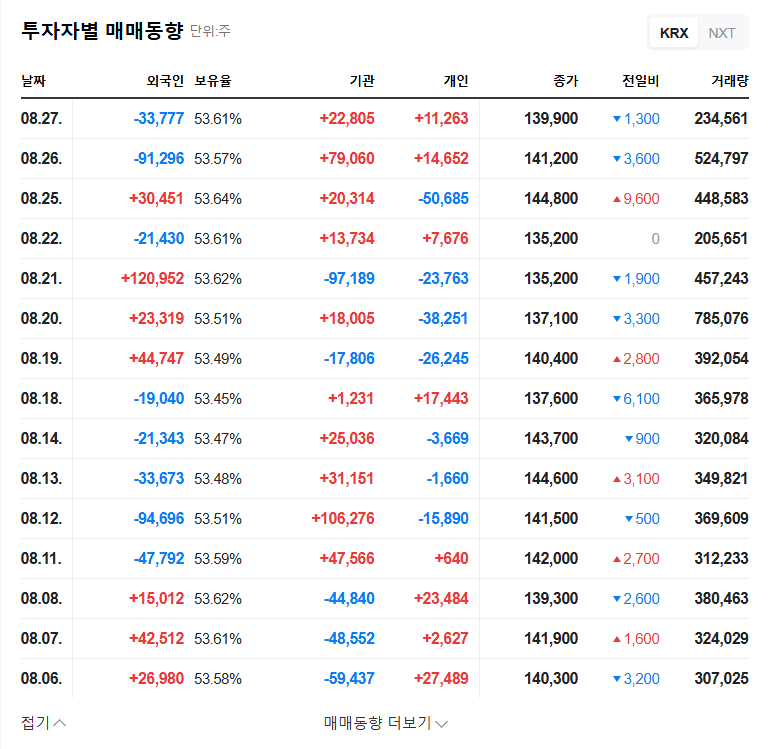

After the market closed on September 24, 2025, a substantial after-hours block trade of 259,607 SK Hynix shares, amounting to approximately ₩92.7 billion, was executed. Notably, foreign investors were the primary buyers in this transaction, despite significant net selling by foreign investors during regular trading hours.

2. SK Hynix’s Strengths: A Look at its Solid Fundamentals

SK Hynix demonstrated robust fundamentals by achieving record-high quarterly revenue and operating profit in its 2025 semi-annual report. The explosive growth of the AI market fueled a surge in demand for HBM (High Bandwidth Memory), and DRAM and NAND shipments also exceeded market expectations.

- Key Strengths:

- Leadership in the HBM Market

- Diversified Portfolio

- Solid Financial Structure

- Proactive Shareholder Return

- Strengthened ESG Management

- Potential Risk Factors:

- Economic Volatility

- Intensifying Competition

- Exchange Rate Fluctuations

3. Market Landscape and Future Outlook

The macroeconomic environment, including the downward trend in US interest rates and the continued weakness of the Korean Won, presents both opportunities and challenges for SK Hynix. Volatility in international oil and gold prices, as well as the potential slowdown in global logistics demand, are factors that warrant close monitoring. While the growth of the AI semiconductor market provides positive momentum, macroeconomic uncertainties and potential fluctuations in the semiconductor industry pose risks.

4. Action Plan for Investors

For investors considering SK Hynix, we recommend the following action plan:

- Monitor AI semiconductor market trends and changes in HBM demand.

- Analyze the impact of exchange rate and interest rate fluctuations on SK Hynix’s performance.

- Keep a close eye on competitor activities and technological developments.

Frequently Asked Questions (FAQ)

Is the after-hours block trade a positive signal for SK Hynix’s stock price?

While the block trade itself doesn’t guarantee a specific stock price direction, the observed buying activity by foreign investors can be interpreted as a positive sign. However, investment decisions should be made based on a comprehensive consideration of various factors, including fundamentals and market conditions.

What is the outlook for SK Hynix’s stock price?

Key variables influencing SK Hynix’s stock price include the continued growth of the AI semiconductor market, changes in macroeconomic indicators, and competitor activities. Currently, the company’s solid fundamentals and growth prospects suggest a stable stock price trend, but short-term volatility cannot be ruled out.

What should investors be aware of when investing in SK Hynix?

The semiconductor industry is susceptible to economic fluctuations and technological competition, requiring a cautious approach to investment. Investors should closely monitor changes in macroeconomic indicators and competitors’ technological developments.