What Happened?

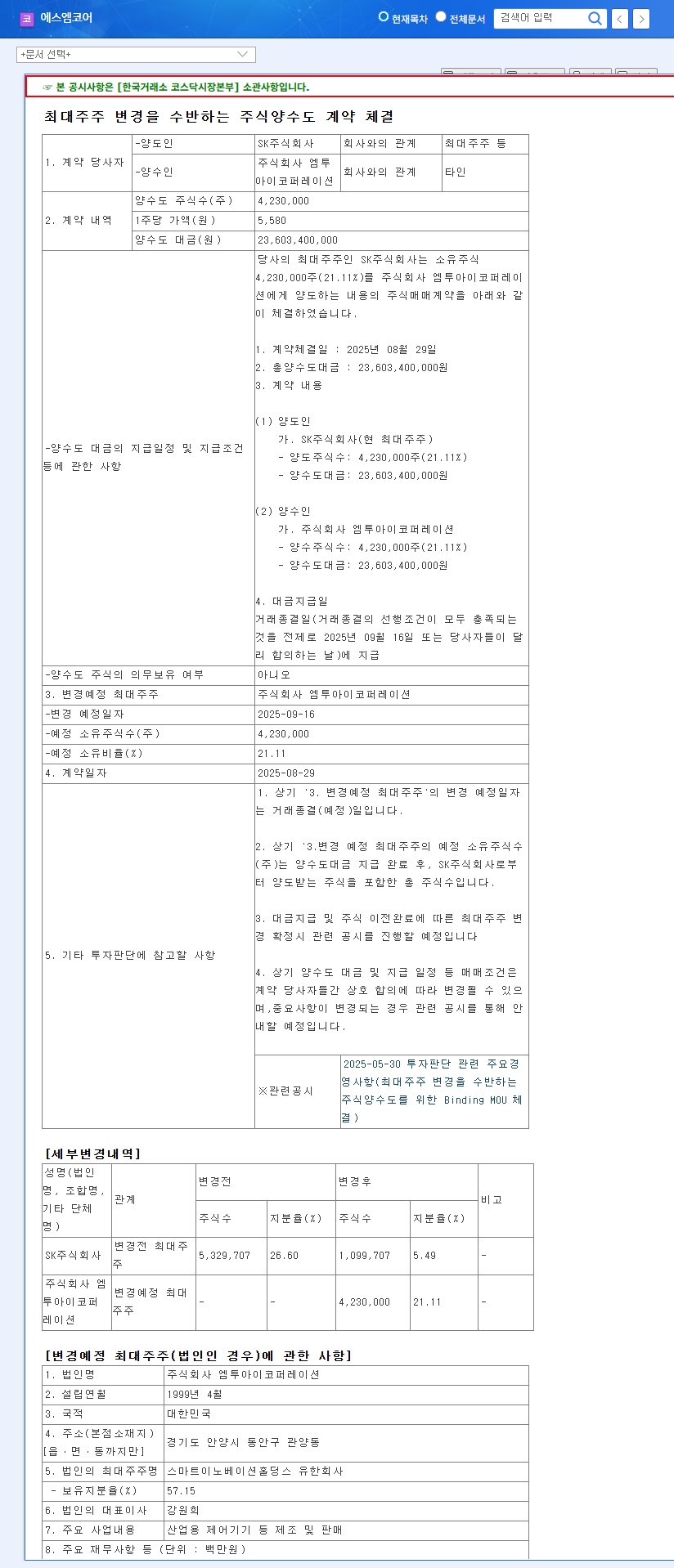

SK Corporation sold its 21.11% stake in SMCore to M2i Corporation for 23.6 billion KRW. The transaction is expected to close on September 16, 2025.

Why the Sale?

SK likely divested its stake as part of its portfolio restructuring strategy. M2i Corporation, specializing in industrial control devices, is expected to create synergy with SMCore’s logistics automation systems business.

Impact on SMCore

Potential Positives:

- • Enhanced competitiveness in smart factory solutions and new business opportunities

- • Improved management transparency and efficiency under new leadership

Potential Negatives:

- • Uncertainty and short-term stock price volatility due to the change in management

- • Time lag before synergy effects materialize

- • Financial health of the new majority shareholder and SMCore’s debt management

What Should Investors Do?

A ‘wait-and-see’ or ‘cautious’ approach is recommended. Investors should monitor M2i Corporation’s business plans, synergy strategies, and financial soundness before making investment decisions. External factors such as fluctuations in the Indian Rupee exchange rate should also be considered.

Frequently Asked Questions

What is M2i Corporation?

M2i Corporation manufactures and sells industrial control devices. They are expected to generate synergy with SMCore.

How will this sale affect SMCore’s stock price?

Short-term volatility is expected due to uncertainty, but the long-term impact could be positive. The realization of synergy effects will be a key factor.

What are the key investment considerations?

Investors should carefully evaluate the new majority shareholder’s management capabilities and business plans, the feasibility of synergy effects, and SMCore’s financial health. External factors like currency fluctuations should also be monitored.